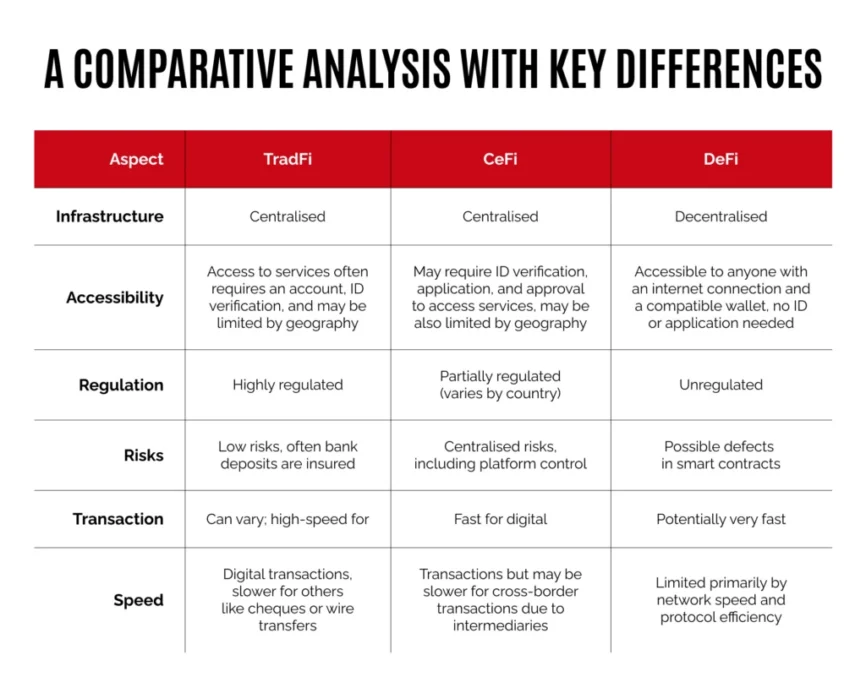

CeFi, DeFi, and TradFi are all distinct financial systems, each with unique approaches to handling transactions, assets, and trust.

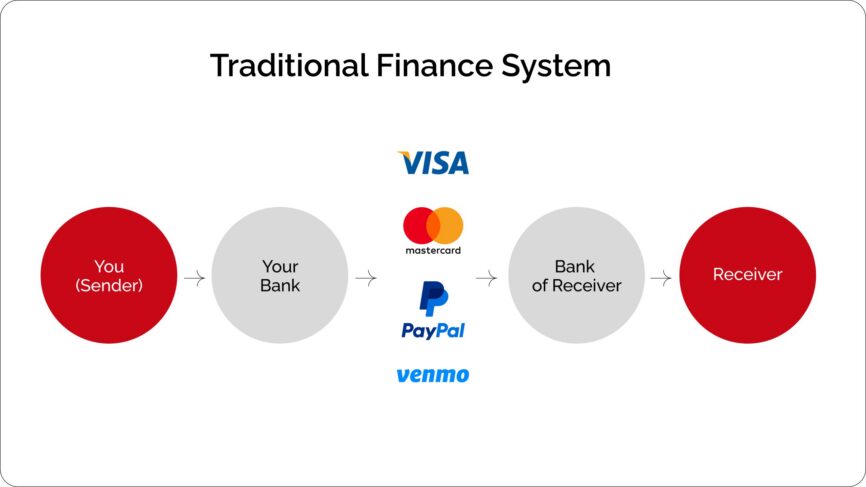

- Traditional finance (TradFi): This is the conventional financial system we’ve relied on for decades. It revolves around banks, governments, and other centralized institutions that manage fiat currencies, loans, and investments.

- Centralized finance (CeFi): Sitting between TradFi and DeFi, CeFi offers crypto-based financial services but still depends on centralized entities like exchanges or custodians.

- Decentralized finance (DeFi): DeFi is a blockchain-powered financial ecosystem that operates without intermediaries, enabling users to manage their finances directly through smart contracts.

Each of these systems serves different needs. Today, we’ll explore each in detail—from their definitions to their use cases, along with their pros and cons.

What is Traditional Finance (TradFi)?

Traditional Finance, often referred to as TradFi, is the established financial system that forms the backbone of global economies. It relies on centralized institutions such as banks, governments, and regulatory bodies to manage and facilitate transactions, lending, investments, and currency distribution. TradFi operates under strict regulatory frameworks, ensuring stability, security, and trust within its network.

For centuries, TradFi has dominated the financial landscape by providing services that cater to both individuals and businesses. It encompasses everything from personal banking and insurance to corporate lending and stock market investments. While TradFi ensures reliability and widespread adoption, it is often criticized for inefficiency, high costs, and limited accessibility for underbanked populations.

Key features:

- Centralized control through banks and financial institutions.

- Regulated by governments and financial authorities.

- Reliance on fiat currencies (USD, EUR, etc.).

- Physical and digital infrastructure for banking, payments, and investments.

- Standardized procedures like KYC (Know Your Customer) and AML (Anti-Money Laundering).

Examples of traditional financial instruments:

- Savings accounts: Secure storage for funds with interest rates determined by banks.

- Mortgages: Long-term loans for property purchases, secured by the asset itself.

- Stocks: Equity investments in publicly traded companies, allowing investors to share in profits.

- Bonds: Debt securities issued by governments or corporations to raise funds, typically offering fixed returns.

- Insurance policies: Contracts that provide financial protection against risks, such as health issues or accidents.

Use Cases:

- Retail banking: Everyday banking services for individuals, such as checking accounts and credit cards.

- Corporate finance: Facilitating business loans, mergers, and acquisitions.

- Real estate: Financing property purchases through mortgages or commercial loans.

- Wealth management: Investment services for individuals and institutions to grow capital.

- International trade: Currency exchange and financing for cross-border trade activities.

Strengths:

- Reliability: Trusted by billions of users globally due to strict regulations and historical stability.

- Wide acceptance: Accepted as the standard for trade and commerce in almost all industries.

- Risk management: Offers diverse tools like insurance and hedging to protect against financial uncertainties.

Limitations:

- Limited accessibility: Excludes billions of unbanked individuals due to infrastructure or regulatory barriers.

- High costs: Transaction fees, interest rates, and operational expenses make services expensive.

- Slow innovation: Often lagging behind modern technology, especially compared to blockchain solutions.

What is Centralized Finance (CeFi)?

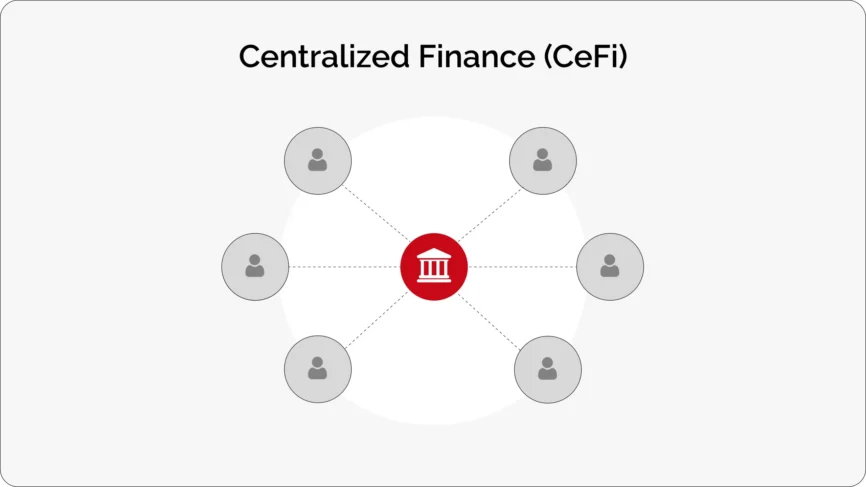

Centralized Finance, or CeFi, refers to financial services within the crypto space that operate under centralized entities, such as exchanges, custodians, or lending platforms.

Unlike DeFi, CeFi bridges the gap between traditional finance (TradFi) and blockchain technology by combining the efficiency of cryptocurrencies with the familiar structure of centralized oversight. Users entrust these institutions with managing their assets and transactions.

CeFi plays a critical role in the adoption of cryptocurrencies by offering user-friendly interfaces, customer support, and simplified processes for trading, lending, and borrowing digital assets. However, its reliance on centralized control also introduces risks, such as hacking and regulatory scrutiny.

Key features:

- Centralized oversight by entities like exchanges or custodians.

- Requires users to complete KYC (Know Your Customer) processes.

- Supports fiat-to-crypto conversions, making onboarding easier.

- Facilitates services like trading, lending, and staking under centralized platforms.

- Custodial control, where the platform holds users’ funds.

Examples of Centralized Finance services:

- Centralized Exchanges (CEXs): Platforms like Binance or Coinbase that enable users to buy, sell, and trade cryptocurrencies.

- Custodial wallets: Services that store users’ private keys and manage their crypto holdings securely.

- Crypto lending platforms: Platforms like BlockFi that allow users to earn interest on their crypto assets or borrow funds against them.

- Fiat on-ramps: Services that allow users to convert fiat currencies into cryptocurrencies, such as MoonPay or PayPal’s crypto services.

Use cases:

- Crypto trading: Facilitating the buying, selling, and exchange of cryptocurrencies on centralized platforms.

- Lending and borrowing: Offering loans or earning interest using crypto assets as collateral.

- Staking services: Enabling users to earn rewards by participating in blockchain networks through a centralized platform.

- Cross-border payments: Providing faster and cheaper alternatives for international transfers compared to TradFi.

- Asset management: Allowing investors to manage diverse crypto portfolios with ease.

Strengths:

- User-friendly: Simplifies crypto transactions with intuitive interfaces and customer support.

- Fiat integration: Makes it easier to convert traditional currencies into digital assets.

- Reliability: Provides structured and regulated services that are familiar to TradFi users.

Limitations:

- Centralized control: Requires users to trust the platform with their funds and data.

- Security risks: Centralized platforms are frequent targets for hacks and breaches.

- Regulatory challenges: Subject to government regulations, which may restrict certain services or jurisdictions.

What is Decentralized Finance (DeFi)?

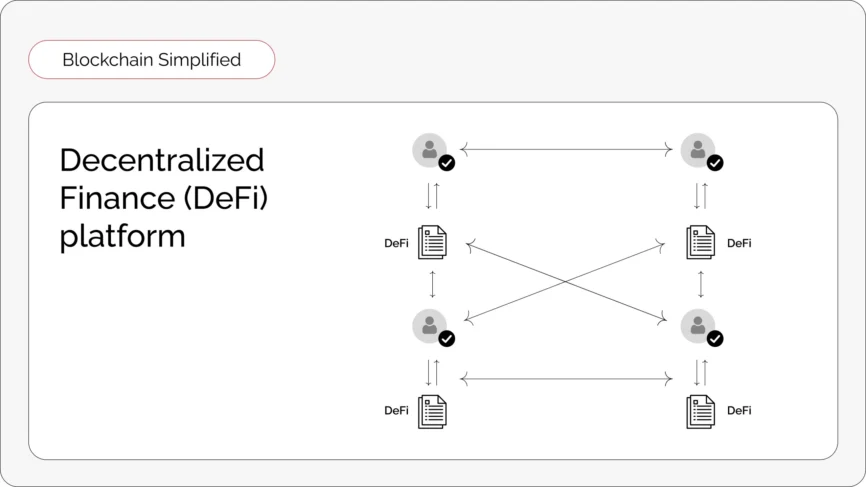

Decentralized Finance, or DeFi, is a blockchain-driven financial ecosystem that eliminates the need for intermediaries like banks or brokers.

By leveraging smart contracts—self-executing agreements coded directly onto blockchain networks—DeFi allows users to manage their finances directly in a secure and transparent environment. It enables a wide range of financial activities, including lending, borrowing, trading, and investing, all conducted peer-to-peer without centralized oversight.

Unlike traditional or centralized systems, DeFi operates globally, offering users complete control over their assets and transactions. Its trustless nature, built on open-source protocols, ensures transparency and decentralization, making financial services accessible to anyone with an internet connection. However, its unregulated structure also comes with risks, such as vulnerabilities in smart contracts and market volatility.

Key features:

- Operates on blockchain technology, primarily Ethereum, but expanding to others like Solana and Binance Smart Chain.

- Uses smart contracts to automate transactions without intermediaries.

- Provides global access, available to anyone with an internet connection.

- Non-custodial, meaning users retain full control over their funds.

- Transparent and open-source, allowing anyone to review the underlying code and processes.

Examples of DeFi instruments:

- Decentralized Exchanges (DEXs): Platforms like Uniswap or SushiSwap where users trade cryptocurrencies directly without intermediaries.

- Lending and borrowing protocols: Platforms like Aave and Compound let users lend their assets to earn interest or borrow against collateral.

- Yield farming: Strategies on protocols like Yearn Finance that maximize returns by moving funds across platforms offering the highest yields.

- Stablecoins: Cryptocurrencies like DAI that are pegged to fiat currencies for stability, often used in DeFi transactions.

- Tokenized assets: Digital representations of real-world assets (e.g., real estate, art) traded on DeFi platforms.

Use cases:

- Decentralized lending and borrowing: Individuals or businesses can access loans without credit checks, providing financial inclusion.

- Decentralized trading: Facilitates peer-to-peer asset exchanges without centralized oversight, ideal for cross-border transactions.

- Investment opportunities: Yield farming, liquidity provision, and staking for passive income.

- Insurance: Decentralized insurance protocols like Nexus Mutual offer coverage against risks in the crypto space.

- Supply chain finance: Tokenizing invoices or trade receivables for real-time, decentralized funding.

Strengths:

- Decentralized control: Users maintain full ownership and control of their assets without intermediaries.

- Global accessibility: Open to anyone with internet access, removing barriers faced in TradFi and CeFi.

- Transparency: Built on open-source protocols, ensuring all transactions are publicly visible and auditable.

Limitations:

- Smart contract risks: Bugs or vulnerabilities in code can lead to significant losses.

- Market volatility: High price fluctuations in cryptocurrencies can pose risks to users.

- Regulatory uncertainty: Operates in a largely unregulated space, making it vulnerable to future legal challenges.

CeFi vs DeFi vs TradFi – differences visualised

CEFI vs DEFI

| Aspect | CEFI | DEFI |

|---|---|---|

| Control and governance | Centralized control by institutions like exchanges or custodians, governed by a specific entity or group of stakeholders. |

Fully decentralized, relying on smart contracts and community governance through token-based voting or consensus mechanisms. |

| Interface | User-friendly and similar to traditional financial platforms, with customer support and onboarding assistance. |

Requires knowledge of blockchain tools (e.g., wallets, DEXs), with interfaces improving but still less intuitive for beginners. |

| Transaction speed | Fast for on-platform transactions but may experience delays for withdrawals or fiat conversions. |

Dependent on blockchain speed; some platforms (e.g., Solana, Polygon) offer near-instant transactions, while others (e.g., Ethereum) may face congestion. |

| Transaction cost | Typically higher fees (e.g., trading, withdrawal), with additional charges for convenience. |

Costs vary based on blockchain network fees (gas fees); generally lower but can spike during congestion. |

| Complexity of use | Easy to use, requiring minimal technical knowledge and offering a familiar user experience. |

Can be challenging for newcomers, requiring understanding of wallets, private keys, and smart contracts. |

| Liquidity | High liquidity due to centralized pooling of assets and institutional backing. |

Liquidity depends on user participation in liquidity pools, which can vary between platforms and tokens. |

| Regulatory requirements | Subject to government regulations, requiring KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance. |

Largely unregulated, allowing for anonymity and bypassing traditional compliance procedures. |

| Security | Centralized systems are frequent targets for hacks, and users must rely on platform security for custodial funds. |

Security depends on smart contract integrity, with non-custodial systems ensuring users retain control of their funds. |

DEFI vs TRADFI

| Aspect | DEFI | TRADFI |

|---|---|---|

| Control and governance | Fully decentralized, managed through smart contracts and community governance, offering users full autonomy over their assets. | Centralized and controlled by banks, governments, and regulatory authorities, with top-down decision-making. |

| Interface | Interfaces can be technical and less intuitive, requiring knowledge of blockchain wallets and protocols, though they are improving. | User-friendly and standardized, with accessible tools like bank apps, credit cards, and in-person branch support. |

| Transaction speed | Transactions are near-instant, limited only by blockchain speed and potential network congestion. | Often slow due to intermediary processes and limited by banking hours, especially for international transactions. |

| Transaction cost | Costs depend on blockchain gas fees, which are typically lower but can spike during congestion. | High fees for services like international transfers, card processing, and currency exchanges. |

| Complexity of use | Requires understanding of blockchain technology and self-management of private keys, making it complex for beginners. | Simple and accessible for most users, with in-person support available. |

| Liquidity | Liquidity depends on participation in decentralized liquidity pools, which vary by platform and asset popularity. | Extremely high liquidity due to centralized pooling and backing by governments and central banks. |

| Regulatory requirements | Largely unregulated, offering anonymity but facing potential regulatory challenges in the future. | Highly regulated with mandatory KYC/AML compliance and government oversight. |

| Security | Non-custodial; funds are controlled by users, but smart contract bugs or exploits pose significant risks. | Relies on centralized systems, which are generally secure but vulnerable to insider fraud or systemic failures. |

CEFI vs TRADFI

| Aspect | TradFi | CeFi |

|---|---|---|

| Control and governance | Centralized and controlled by banks, governments, and regulatory authorities, with top-down decision-making. | Centralized control by institutions like exchanges or custodians, governed by specific government authorities, but with a focus on digital assets. |

| Interface | User-friendly and standardized, with tools like bank apps, credit cards, and branch support. | Similar to TradFi, with user-friendly interfaces, customer support, and onboarding assistance tailored to digital assets. |

| Transaction speed | Can be slow due to intermediary processes, especially for international transactions, and limited by banking hours. | Faster than TradFi, particularly for on-platform digital transactions, but withdrawals and fiat conversions can experience delays. |

| Transaction cost | High fees for services like international transfers, currency exchanges, and bank loans. | Structured fees for trading, withdrawals, and fiat conversions, generally lower than TradFi but higher than DeFi. |

| Complexity of use | Simple and accessible for most users, with in-person and digital support available. | Easy to use, with interfaces similar to TradFi, but focused on digital asset management. |

| Liquidity | Extremely high liquidity due to centralized pooling and government or institutional backing. | High liquidity, supported by centralized pooling and institutional investors within the crypto space. |

| Regulatory requirements | Strict regulations, with mandatory KYC/AML compliance and oversight by governments. | Partially regulated, depending on the jurisdiction, with KYC/AML requirements often enforced. |

| Security | Relies on centralized systems, which are generally secure but vulnerable to insider fraud or systemic failures. | Centralized systems that are secure but frequent targets for hacks, with custodial models relying on the platform’s security. |

Summing up – the future of finance

While approximately 76% of the global population have at least one bank account within traditional finance (TradFi), only about 7.51% actively use Centralized Finance (CeFi) or Decentralized Finance (DeFi) platforms.

However, with DeFi projected to grow at an impressive compound annual growth rate (CAGR) of 46% until 2030, the financial systems users rely on today are likely to evolve significantly in the coming years.

Most businesses don’t care if it’s DeFi, CeFi, or TradFi – they just want it to work. Our job is to make crypto payments feel as smooth and reliable as the tools they already use, without all the learning curve.

At CryptoProcessing.com, we seamlessly bridge this transition. We cater to businesses looking to accept and hold cryptocurrencies through our secure business wallet, as well as those preferring to avoid handling crypto directly. For the latter, we offer instant fiat conversion, allowing businesses to enjoy the benefits of crypto transactions without exposure to volatility.

Our platform supports over 20 cryptocurrencies and more than 40 fiat currencies. By integrating our solutions, businesses can reduce transaction costs by up to 80%, expand globally, and access new markets through reliable and efficient cryptocurrency processing. With services like almost instant transactions, international coverage, and no rolling reserves, we ensure a 99% acceptance rate and zero chargebacks.

Have questions or are you ready to get started? We’re just a message away!