Annual Percentage Rate (APR) is a simple-interest-based estimate of yearly returns on digital assets, commonly used in DeFi to measure earnings from staking, lending, and liquidity provision.

What is the Annual Percentage Rate (APR)?

In crypto, the Annual Percentage Rate (APR) refers to the projected yearly return on digital assets, typically calculated using simple interest (excluding compound interest). It represents a flat percentage of earnings over 12 months. APR is widely used in decentralized finance (DeFi) to measure yield from staking, lending, and liquidity provision.

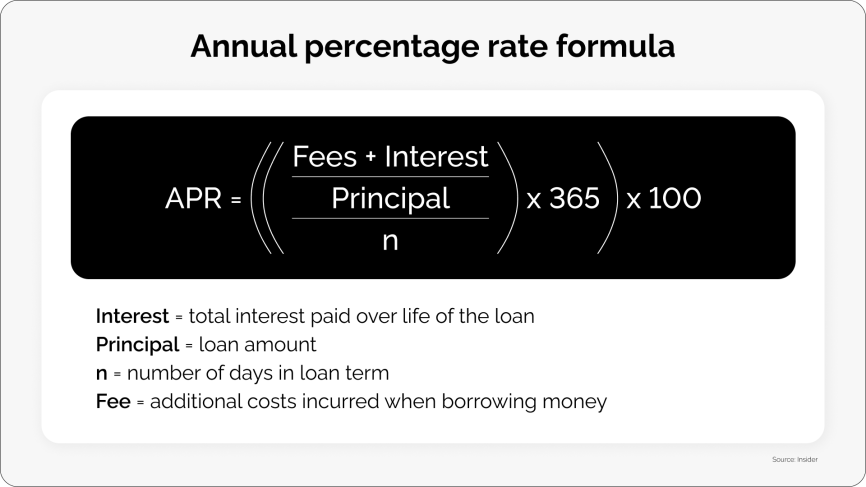

How is APR in crypto calculated?

APR in crypto calculates projected returns using simple interest.

For example, with a 10% APR on $100, the return after one year is $10. If held for six months, the return is $5.

However, the APR rate may fluctuate based on factors such as platform policies, market conditions, or the value of the underlying asset. Therefore, while the APR may be set as a projected fixed rate, it may not remain constant due to external variables.

Key advantages of APR in crypto:

- It’s simple to calculate and compare. No compounding makes it easier to directly compare yields across platforms.

- It provides transparent annual profit over 12 months. The APR is typically expressed as an annual return, giving a clear idea of the expected yield over the year.

Weak sides of APR:

- There is no benefit from reinvested rewards. APR does not factor in the compounding of rewards, unlike APY.

- It has variable rates in DeFi. While APR is often shown as fixed, it can fluctuate based on changes in market conditions or platform policies.

Why is APR important in crypto finance?

APR defines the fixed annual return or borrowing cost in DeFi. It provides a clear, standardized way to compare yields or interest rates across protocols.

Key reasons APR matters in crypto:

- Offers consistent benchmarks for staking and lending

- Supports capital allocation with defined returns

- Helps evaluate DeFi products with predictable yield

- Reflects a platform’s reward strategy

- Maintains clarity by avoiding compounding complexities

- Builds user confidence through transparent terms

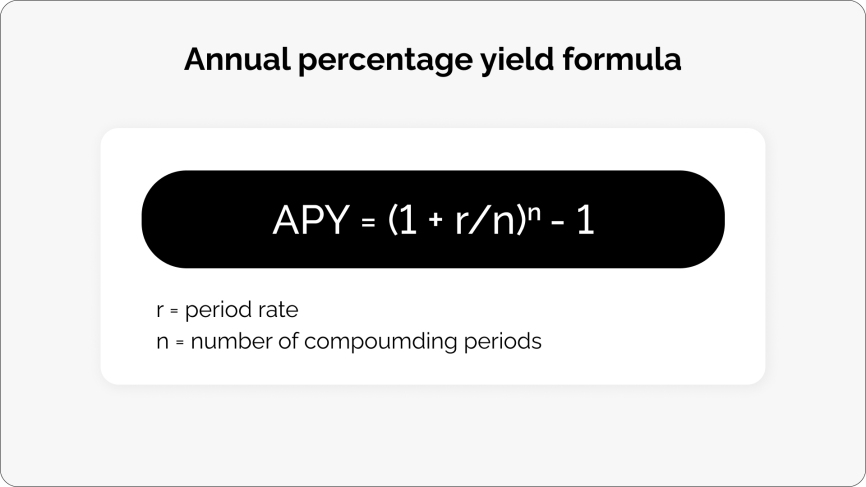

What is the difference between APR and APY?

APR and APY both measure returns in crypto, but they differ in how rewards are calculated.

APR shows the fixed annual return without compounding. APY includes compound interest and accounts for rewards added back into the balance.

Key differences between APR and APY in crypto are presented in the following table:

| Feature | APR | APY |

|---|---|---|

| Calculation | Based on simple interest only | Includes compound interest |

| Complexity | Easier to understand and compare | Varies with payout frequency and reinvestment |

| Use cases | Used for fixed-term lending, staking, and DeFi protocols | Common in auto-compounding DeFi protocols |

| Yield accuracy | Provides a basic estimate | Shows actual earnings over time |

| Clarity | Prioritizes simplicity | Delivers more detailed insight |

APR is often used to evaluate fixed-rate products. APY fits dynamic environments with frequent reinvestment.

Where is APR used in crypto?

APR appears across key areas of decentralized finance. It defines the annual rate applied to earnings or borrowing in token-based systems.

Main use cases:

- Lending platforms

Shows annual returns for lenders and borrowing costs for users accessing liquidity. - Borrowing and margin trading

Quantifies the cost of leveraged positions. Directly affects risk and profitability. - DeFi protocols

Used in staking, yield farming, and liquidity mining. Represents fixed-rate rewards. - Liquidity pools

Measures base returns earned by providing assets to decentralized crypto exchanges.

What is the role of APR in DeFi?

APR plays a central role in DeFi and adjusts based on token supply, user demand, and governance rules. These changes affect reward structures and liquidity flow. Typical APR rates in DeFi range from 3% to 7% but may be higher.

A higher APR can increase participation and token adoption. However, it may also raise risk levels, especially in new or untested protocols.

Key roles of APR in DeFi:

- Sets standard yield benchmarks

- Encourages liquidity through incentives

- Reflects tokenomics and reward strategy

- Adapts to governance or market shifts

- Supports platform comparisons in real-time

High APR rates often signal higher risk. These risks may include smart contract bugs, volatile assets, or imbalanced liquidity pools.

What are the factors affecting APR in crypto?

APR in crypto varies based on platform conditions and market dynamics. Understanding these variables helps assess potential returns and risks.

Key factors influencing APR:

- Collateral type

Widely accepted assets like BTC or ETH lead to lower APRs. Less liquid or volatile tokens increase the rate. - Market volatility

Sharp price swings raise risk, leading platforms to increase APR. - Loan-to-value (LTV) ratio

Higher LTV means more risk for the lender. It often results in higher APR. - Platform-specific terms

Each platform uses its own logic to set APR, including internal token incentives or risk models. - Supply and demand

When demand for a token rises or supply shrinks, APR tends to increase. Low demand can drive it down.

Future trends in crypto APR

APR in crypto is evolving with changes in technology, market structure, and regulation. These shifts continue to reshape how fixed returns are structured across DeFi.

Emerging trends in crypto APR profit include:

- Blockchain upgrades

Faster protocols and Layer-2 networks reduce transaction costs. It supports better APR offers from efficient platforms. - Smart contract automation

Automated systems lower costs and enable real-time updates to yield models, making APR more attractive for crypto owners. - AI-driven rate models

Artificial intelligence may help platforms adjust APR dynamically using live market data. - Flexible yield structures

APR models may shift to hybrid formats, mixing APR and APY based on user activity. - Tighter regulations

Stronger compliance may bring stability, reduce risk, and attract more users. - Tax and legal clarity

Defined tax rules may impact how users choose platforms or assets offering APR.

APR in crypto is moving toward flexibility, automation, and compliance. Platforms that adapt quickly can lead to delivering consistent, transparent returns.