What is the crypto exchange rate?

The crypto exchange rate shows the value of one cryptocurrency in relation to another asset. This asset can be a national currency like USD/EUR or another cryptocurrency like ETH or SOL. For example, the BTC/USD exchange rate tells you how much one Bitcoin is worth in US dollars.

Crypto exchange rates are not fixed. They shift based on activity in the market. When demand rises or supply drops, the exchange rate often moves up. When interest fades or more coins enter circulation, it can move down.

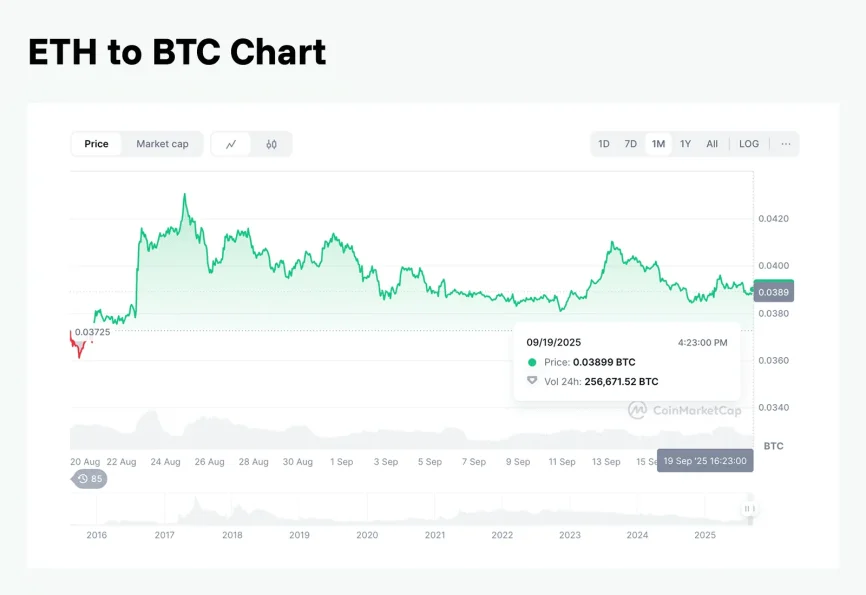

Each exchange rate is shown as a trading pair. For instance, ETH/BTC shows how many Bitcoins you need to buy one Ether, or the other way around. These pairs form the basis of most crypto trading.

What is the difference between the exchange rate and the price of cryptocurrencies?

People often confuse “price” and “exchange rate”, but they refer to different things.

The exchange rate stands for the ratio between two currencies. It tells you how much of one asset you can get in return for another. For example, if the ETH/BTC exchange rate is 0.031, one Ether costs 0.031 Bitcoin.

Price shows the cost of one unit of a cryptocurrency in terms of a fiat currency or another digital asset. For example, if Bitcoin is priced at $112,000, it means one Bitcoin is worth $112,000 at that time.

How are crypto exchange rates calculated?

Exchange rates come from the open market. They depend on how many people want to buy or sell a coin at a certain time.

If more people want to buy than sell, the rate moves up. If more people want to sell than buy, the rate can drop. These movements happen in real-time and are visible across trading platforms.

What are the factors that may affect crypto exchange rates?

Several forces influence how crypto exchange rates move:

- Market demand and supply. When more people want a coin and the supply is limited, the rate can increase. If fewer people are buying, or supply grows, the rate may drop.

- Investor sentiment. Market mood matters. If the sentiment is positive, buying activity can push exchange rates up. Fear or uncertainty can push them down.

- Regulatory developments. News related to government policies, court decisions, or tax rules can move the market. Clarity can drive interest. Restrictions can slow trading.

- Market liquidity. A liquid market allows trades with minimal price changes. Low liquidity can cause sharp moves, even on small trades.

- Market trends. Adoption of blockchain, changes in infrastructure, or global events can shift trading patterns. These trends often influence demand and pricing.

What are the risks associated with crypto exchange rates?

Crypto exchange rates can move fast. It can open up potential returns, but also expose users to risk. Some of the main risks include:

- Volatility. Crypto rates often change within minutes or hours. This movement can cause both profits and losses in a short time.

- Regulatory risks. New laws or changes to existing rules can affect prices and exchange rates. Companies must stay updated on the laws in the areas they serve.

- Security risks. The platforms used to trade and store crypto can be targets for cyberattacks. Choosing reputable service providers that meet recognized security standards and securing digital assets is critical.

- Market manipulation. Some markets can be influenced by large trades or coordinated activity. This can cause artificial price swings, especially in low-volume coins.

Why are crypto exchange rates important for businesses?

Businesses that use or accept cryptocurrency need to track exchange rates. These rates affect how they value assets, convert payments, and calculate future income. For example, if a company accepts TRX as a payment on the website, it’s necessary to monitor the TRX/USD rate in real time to help achieve accurate conversion at the moment of the transaction. Any delay can result in receiving more or less than expected due to market fluctuations.

In platforms that accept crypto, price changes can impact how much users spend or receive. This makes it important for businesses to use accurate rates and update them regularly.

Exchange rates can also affect long-term planning. For companies dealing with global payments or holding crypto as reserves, understanding exchange movements can support budgeting and forecasting, though exchange rate volatility can still affect outcomes.

Accepting crypto is subject to legal and regulatory requirements that vary by jurisdiction. Always seek legal counsel and verify local compliance obligations before implementing a crypto payment option on your website or conducting any other crypto-related activity.

Summary

A crypto exchange rate shows how much one cryptocurrency is worth when traded for another asset. Rates can be shown as pairs, like BTC/USD or ETH/BTC.

- Exchange rates often undergo changes.

- Factors like investor sentiment, regulations, liquidity, and global events can influence rates.

- Businesses accepting crypto should track rates in real time to avoid losses from sudden changes.

- Legal and regulatory rules vary by location. In this regard, compliance checks are essential before accepting crypto payments.