How Crypto Payment Gateways work

What are Crypto payment gateways?

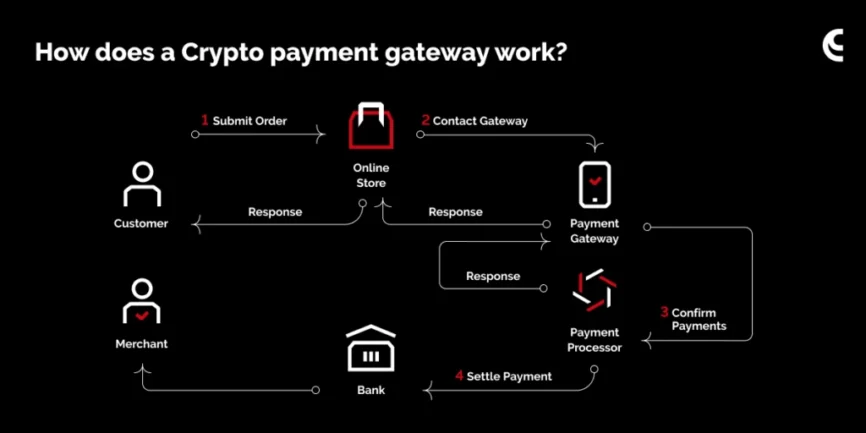

Crypto payment gateways are services that allow merchants to accept cryptocurrency as a method of payment. This could be on an e-commerce platform, a website, a mobile app or even offline store.

The gateway’s role here is to process and transfer the crypto payments, depending on the needs of the merchant, be it a ‘hands-on approach’ to crypto or a ‘hands-off’. As a result, a business is able to accept payment in a variety of different cryptocurrencies, from the popular ones such as Bitcon and Ethereum, to the more niche, such as Dogecoin or the NEO token.

A payment gateway is responsible for reading and transferring payment information to ensure two things. Firstly, that funds are available on the customer’s end, and secondly, that the merchant gets paid for whatever goods or services they are providing.

How Does a Crypto Gateway Work?

As the cryptocurrency gateway with 10+ years of experience, 800+ clients, and a monthly transaction volume of over €1 billion, here at CryptoProcessing.com we strive to provide the smoothest onboarding experience for our clients. If you choose us as your company’s crypto gateway, the procedure will look as follows:

Step 1. We Create a Personalised Offer

First, we figure out exactly what your firm needs in terms of digital asset payments. After becoming familiar with the specificity of your business model, we will send you the personalised commercial offer, as well as necessary information on the API documentation.

CryptoProcessing.com offers a variety of payment options, allowing you to choose the most suitable one:

- Channel — a simple deposit in cryptocurrency not tied to a specific fiat amount. Your customers top up their balances for any amount in crypto at any time, while we convert it into fiat and credit their balances on-the-fly. Most suitable for i-Gaming.

- Invoice — a payment in cryptocurrency tied to a specific fiat amount which needs to be settled in a short time. Most suitable for e-Commerce.

- Payment link — a crypto deposit similar to an invoice, which does not require an immediate settlement. Most suitable for e-Commerce.

Step 2. We Take Care of the Legal Side

CryptoProcessing.com is an EU-licensed crypto services provider. To ensure the legality of the procedure and stay compliant with the European AML policies, all clients have to pass KYB. This also allows us to provide the transparent and secure crypto payment experience, as well as protect our clients from being involved in fraudulent transactions.

Step 3. We Integrate via API

The next step is the implementation of CryptoProcessing.com’s gateway into your business. This is achieved via API integration, that only requires one tech person from your side. Our clients don’t need any background in crypto to start accepting it as payment, as we take care of all technical aspects. During the onboarding, our dedicated managers will guide you through each aspect of the system and answer any questions that might pop up.

Step 4. We Provide Constant Support

CryptoProcessing doesn’t just stop at the integration. Instead, we provide full technical support and regular software updates to ensure everything runs smoothly in terms of payment processing.

Moreover, we provide marketing assistance, allowing our clients to expand their businesses and gain crypto users as a new traffic channel. In a nutshell, we are interested in mutually beneficial cooperation and growth rather than simply selling the service.

As a point of reference, CryptoProcessing.com supports over 20 of the most popular digital currencies. Moreover, a service offers a high degree of customizability – options such as invoicing, payment links, e-commerce plugins, and plug-and-play makes the solution a stellar one for anyone seeking a tailored approach.

The Potential of Cryptocurrency Payments for Businesses

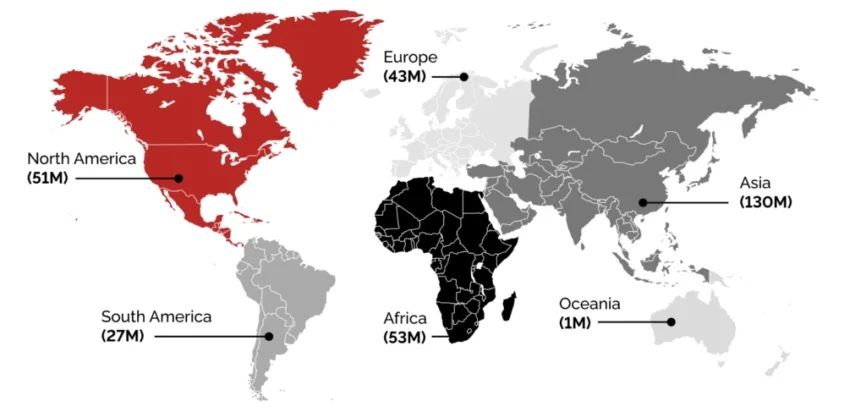

Despite 2025 being highly unstable and hectic for financial markets in general, crypto mass adoption continues to gain momentum. Currently, there are more than 320 million crypto owners globally, who can become your business’s potential clients.

According to the Skynova survey, 32% of small business owners and top executives currently accept crypto as payment. The main reasons for integrating digital asset gateway include its potential as the currency of the future, ability to reach a younger audience and scale to the new regions. When it comes to the factors that drove the adoption in the business sector, respondents named the desire to keep pace with the industry and competitors, as well as satisfy customer’s demand.

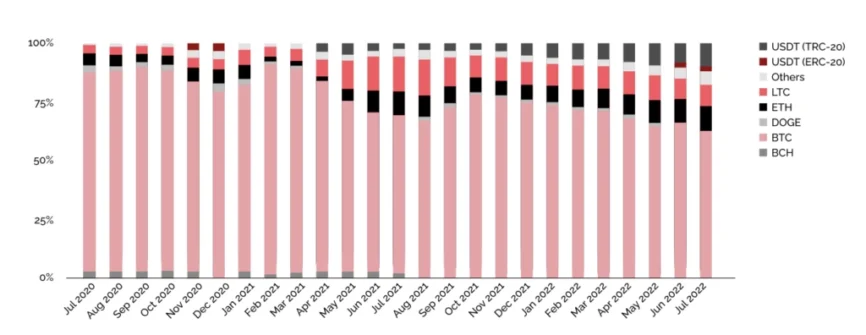

Bitcoin remains the most used digital currency in the payment industry, but the popularity of altcoins such as Ethereum, Tether, and Litecoin has been growing steadily. Check out the chart to see which currencies CryptoProcessing.com’s merchants prefer.

What is even more remarkable, the payment sector has not been perceptibly impacted by the negative news sentiment and the protracted bear cycle. Take a look at the numbers below: CryptoProcessing.com has managed not only to stay afloat amid the rising inflation and recession risks, but also double in volumes compared to last year.

| Q3 2021 | Q3 2022 | |

|---|---|---|

| Transactional volume | €1,449,363,888 | €2,905,876,864 |

| Number of transaction | 2,482,751 | 4,810,283 |

All things considered, the potential of crypto as the payment medium in the business sector is undeniable, which encourages more companies of different sizes and across various industries to integrate digital assets.

Why Might a Business Need a Cryptocurrency Payment Gateway?

1. Crypto Payments are Borderless

Digital assets are global and instant medium of payment. In traditional finance, there are 180 currencies in circulation, each limited to the jurisdiction of mint. Great British Pounds may not be used in the United States without a conversion to US Dollars and vice versa. With cryptocurrencies, payment becomes universal, borderless and instant.

Moreover, international transfers can often take up to five working days and can be incredibly expensive on the customer’s side. This reduces their willingness to spend – hardly a good outcome for the merchant.

2. Crypto Helps Attract New Customers

Accepting cryptocurrencies can also be a great marketing tool. More and more companies are moving into the realm of Web3 and are attaining recognition for it as pioneers. At this very moment, there’s an opportunity for every business to trailblaze for their industry and snatch up the additional market demand pent up amongst the over 1 billion crypto users. With new partnership opportunities, an added niche to attract investment and unique strategies for market-entry, businesses can be scaled rapidly.

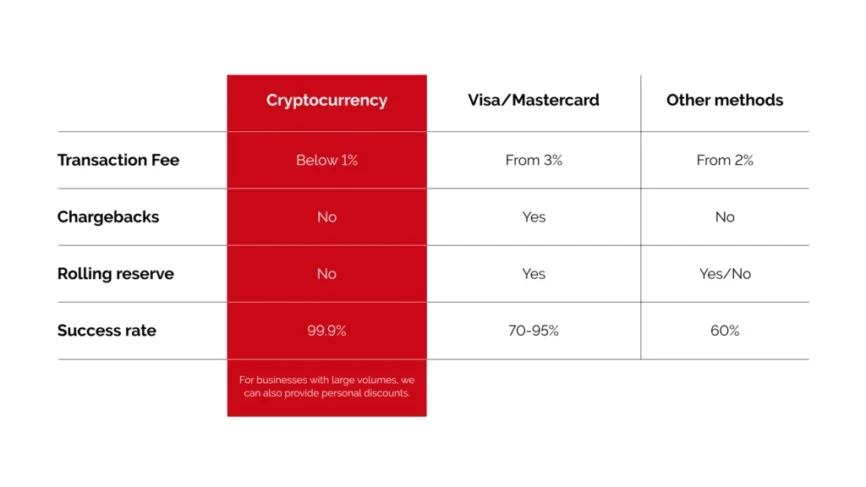

3. Crypto Reduces Processing Costs

Fees are a very important facet of the crypto advantage-ball, so to speak. Whereas the traditional payment processing companies can charge merchants up to 3.5% per transaction, companies such as CryptoProcessing.com guarantee a maximum fee of 1%, with discount schemes pushing that number even lower. In other words, it’s a fantastic cost-cutting opportunity for businesses.

4. Crypto is Chargeback-free

When it comes to the blockchain, there’s no centralised authority to verify the user. In this case, by default, chargebacks cannot be allowed and acceptance rates are on average incredibly high. That figure is 99% with CryptoProcessing.com.

This is a fantastic advantage for the merchant — not only does it stamp out any chance of chargeback fraud, but it also means that no rolling reserves are required. As a result, more capital will be available to the business.

How to Choose the Cryptocurrency Payment Gateway in 2025?

There are a number of advantages to selecting a crypto processing partner. However, as we’ve covered, crypto can be sticky stuff to manage. Therefore, the advantages are only to be reaped should the provider satisfy a number of criteria:

- Wide currencies selection. Although the crypto industry is usually associated with Bitcoin, there are many popular сoins that can even provide a better check-out experience.

Currently, CryptoProcessing.com supports transactions with over 20 top cryptocurrencies.

- Fiat conversions. If a business doesn’t want to keep crypto on its books, a payment processor should provide instant fiat conversion.

CryptoProcessing.com supports over 40 most popular fiat currencies, including USD and EUR. Moreover, we take all the volatility risks upon ourselves, protecting you from price spreads and slippages.

- Transaction monitoring. In other words, one needs to be sure that a provider conducts ongoing transaction monitoring to stamp out any possibility of money laundering, terrorist financing or other criminal activity.

At CryptoProcessing.com, we make use of the integrated blockchain risk-scoring system to detect suspicious activity.

- No setup fee. The fine print will often reveal hefty setup fees under the guise of ‘API integration fees’. The truth is, there is no need to pay more, when the largest players on the market don’t have any setup fees.

CryptoProcessing.com has neither set-up fee, nor foreign transaction fees or commercial spread.

- Convenient payment methods. SWIFT and SEPA are the two most widely used forms of cross-border transfers. If a crypto payment gateway doesn’t support either one of these, you should have questions relating to their scalability and ability to handle cross-border payments.

CryptoProcessing.com provides multiple fiat payment options, including bank transfers, SEPA, and SWIFT.

We are ready for Crypto. Are you?

If you need more help or have questions about how to add our service to your work, our team is ready to help you. You can ask for help by filling out the contact form, sending us an email at [email protected], or messaging us on Telegram. We’re here to help you.