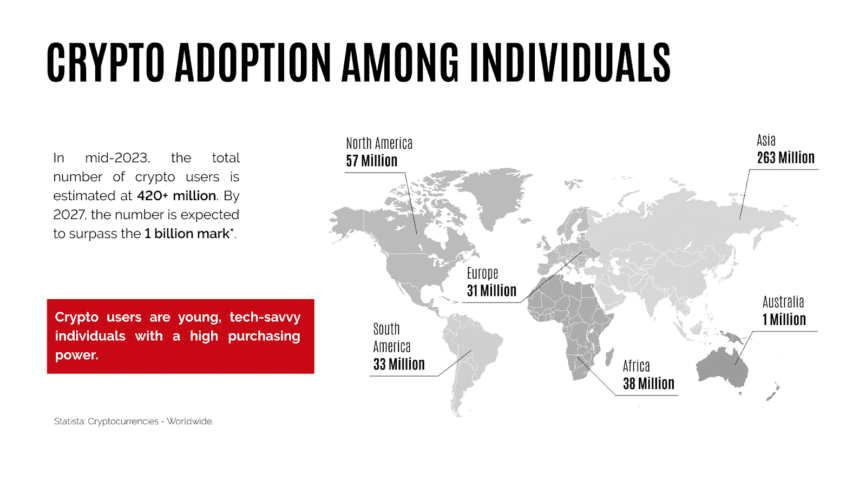

Accept Bitcoin and 20+ other cryptocurrencies, gain new customers, avoid the cost of high fees and chargebacks.

In today’s digital era, the way businesses transact is transforming, with cryptocurrencies such as Bitcoin at the forefront. Embracing the potential to accept Bitcoin payments on your website offers businesses the competitive edge they need.

As an increasing number of customers look for options to pay using Bitcoin, merchants must have an efficient Bitcoin payment system in place. The recent surge in BTC payments only goes to support the significance of this decentralised currency.

This article delves deep into why businesses should consider integrating a Bitcoin payment solution and how they can effortlessly add bitcoin payment to their website. With the right Bitcoin payment service provider, like the ones we’ll explore, companies can become a preferred bitcoin merchant for consumers worldwide.

Why businesses should accept Bitcoin payments

Beyond the myriad of advantages consumers enjoy from using cryptocurrencies like Bitcoin, merchants also reap significant benefits by incorporating them into their payment options. Let’s take a look at the main reasons why businesses should be accepting cryptocurrencies today.

1. Borderless transactions:

- Global reach. Bitcoin transcends geographical boundaries, offering a universal mode of transaction. This means businesses can cater to a global audience without the complexities and fees associated with foreign exchange and cross-border transactions.

- Surge in international transactions. According to a Deloitte survey conducted in the US, a staggering 77% of merchants witnessed a spike in international transactions post the integration of a crypto payment processor. This is a testament to Bitcoin’s ability to tap into a more expansive market.

2. Low costs:

- Competitive fees. Traditional payment methods, especially credit card processors like Visa, can charge hefty fees, sometimes as high as 3.5%. In contrast, BTC payment providers such as CryptoProcessing.com offer incredibly competitive rates, with fees lower than <1%.

- Increased profit margins. The reduction in transaction fees can substantially increase a business’s profit margins, especially for those with a high volume of transactions.

3. Unparalleled security:

- Immutable transactions. All Bitcoin transactions are encrypted and logged on the blockchain. This decentralised ledger technology ensures that transactions are transparent and secure, drastically minimising the risk of fraud.

- Personal data protection. Bitcoin transactions don’t require personal data to be disclosed, further safeguarding consumers from potential data breaches. However, please note that according to the AML/KYC framework centralised platforms usually require from their users documentation containing personal data in order to provide clients with their services.

But the centralised and reputable platforms, such as CryptoProcessing.com, must adhere to the data regulations like GDPR so you are sure your personal data is safe.

Enhanced security often leads to reduced rolling reserve requirements in numerous regions, allowing companies to enjoy increased liquidity that can further boost their profits.

4. No chargebacks:

Irreversible transactions. A significant pain point for many businesses, especially online retailers, is the issue of chargebacks. However, with Bitcoin, once a transaction has been confirmed, it is immutable, effectively reducing the risks and costs associated with chargebacks.

5. High transaction limits:

Ideal for premium transactions. Bitcoin is especially beneficial for businesses dealing with high-value items or services as it allows for larger transaction volumes without the constraints posed by traditional payment gateways.

6. Fast settlements:

Instantaneous processing. Bitcoin transactions, especially when compared to bank transfers, are processed swiftly, often within minutes. This ensures businesses have quicker access to their funds, improving cash flow.

7. Flexibility:

- Diverse conversion options. The dynamic nature of the crypto world means businesses can quickly convert Bitcoin into other digital assets, such as USDT or other stablecoins. This provides a hedge against the volatile nature of cryptocurrencies.

- Cold storage. For added security, businesses can send their funds to a cold wallet – an offline storage option, thereby safeguarding their assets from potential online threats

How to set up a Bitcoin payment gateway

Navigating the world of cryptocurrency adoption offers two primary paths. One approach is the DIY route, where businesses build their own crypto-centric platform. While this avenue offers total control, it’s labour-intensive, can be expensive, and might get complicated.

Alternatively, collaborating with established cryptocurrency gateway providers can revolutionise your crypto journey. CryptoProcessing by CoinsPaid enables businesses to seamlessly adopt cryptocurrency without the hassle of forming a dedicated unit.

Having been recognized as 2023’s Top Cryptocurrency Service by the EGR B2B Awards, CryptoProcessing positions businesses to seamlessly and legally handle cryptocurrency transactions. We offer multiple payment solutions tailored to diverse business models, spanning from invoicing and payment links to unique transaction avenues.

Moreover, businesses aren’t obligated to retain the cryptocurrency. CryptoProcessing promptly transforms digital currencies into traditional fiat, ready for banking transactions.

Moreover, we prioritise transparency. Hidden fees are nonexistent, and the initiation process is entirely free. Only transaction activities bear a charge.

Here’s a concise guide to integrating CryptoProcessing by CoinsPaid:

- Begin by placing a request on CryptoProcessing.com website.

- A swift email acknowledgment arrives in moments, proposing a consultation.

- An expert guides you through the service, answering all questions.

- Based on your business’s unique needs, CryptoProcessing.com formulates a personalised plan.

- Provide the necessary KYB documents to seal the partnership deal.

- A dedicated liaison aids you throughout the setup journey.

- Launch your ability to accept cryptocurrency payments.

Considering the varied demands of businesses, the integration methodology is flexible. Be it instant fiat conversion for those cautious about holding crypto, or the setting up of a crypto wallet for those that are looking to capitalise on the benefits of holding crypto.

| You Need | If |

|---|---|

| Crypto Business Wallet | Your business requires low-frequency payments processing in the form of invoices and links with no API integration. |

| Crypto Payment Gateway | Your business requires automated crypto processing for high-frequency payments via channels. |

“You don’t need to be a crypto expert to start accepting Bitcoin. The key is finding a partner who takes care of the complexity so your business can focus on growth.”

Configuring Bitcoin payment settings

The final step in setting up your Bitcoin payments integration is configuring the payment settings. The methods by which your customers pay will largely depend on your industry and can influence factors like conversion rates. Therefore, it’s crucial to grasp the basics early on.

CryptoProcessing’s crypto payment gateway offers a variety of payment methods to select from.

Let’s explore the primary types:

- Payment Channels: Business transactions, especially in areas like gaming, can get a bit intricate. In scenarios where transactions span anywhere from minutes to days, payment channels come into play. Think of it as keeping a tab at a bar; numerous transactions occur over time but only get recorded on the blockchain when the tab (or channel) is settled.

- Payment Links: A user-friendly option, payment links eliminate the need for website integration. Businesses can share these links, possibly via email. Upon accessing, users are led to a payment platform, often with a timer indicating the payment window.

- Invoices: Typically used in a B2B context, invoices serve as efficient tools for businesses to bill partners or clients. Nonetheless, individuals can also auto-generate these for tasks like freelancing. Distinct from payment links, invoices lack a time-sensitive component, instead, they have a legal due date.

We are ready to crypto. Are you?

Conclusion

In a world swiftly moving towards a decentralised and digital financial landscape, businesses must be proactive in their approach to accept BTC. Harnessing the power of Bitcoin payment processing solutions not only offers a global reach and cost-effective transactions but also fosters a level of trust and transparency in financial dealings.

As a leading BTC payment provider, CryptoProcessing.com ensures seamless Bitcoin payment processing for businesses of all sizes. As we venture into the future, those that receive bitcoin payments and have integrated Bitcoin payments their platforms are poised to lead in their industries.

As a business, now is the opportune moment to consider digital assets, making them integral to your financial strategy, ensuring your clientele has the ease to pay using Bitcoin whenever they choose.

bitcoin payments

Book a demo call with our sales team,

and we’ll walk you through the process!