Capitulation in crypto happens when holders panic-sell, leading to a sharp market decline and often signaling a potential bottom.

Definition of capitulation in financial and crypto markets

Capitulation is a key moment in the financial markets when individuals, under extreme pressure, abandon their positions. It marks the shift from hope to panic, as prolonged losses force them to sell at any price, accelerating the decline.

In crypto, capitulation might be even more extreme. It happens when digital asset holders sell in bulk during a downturn. After reaching $414 in October 2021, TSLA dropped sharply, hitting $101 by early 2023 – down over 75%. Panic selling intensified, but soon after, TSLA rebounded above $200, signaling a shift in momentum.

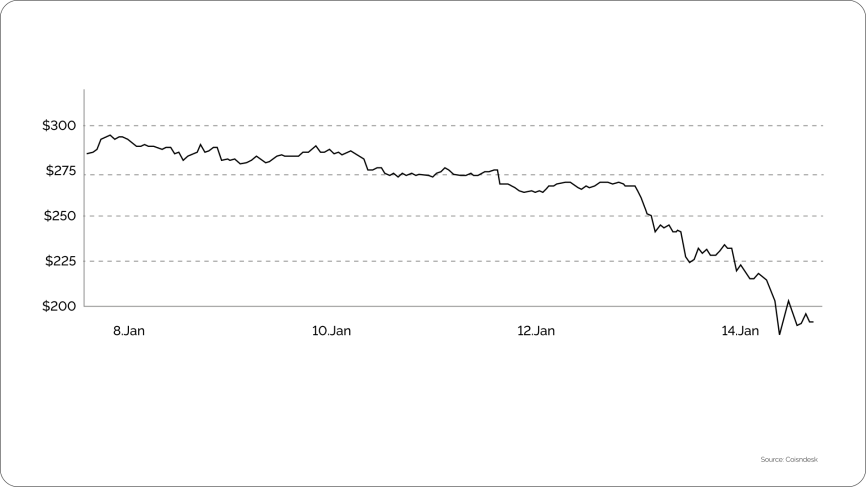

A key example is Bitcoin’s sharp decline in January 2015, when it dropped 50% in the first two weeks, including a 24% plunge on January 14 after Bitstamp announced a 19,000 BTC hack.

Capitulation is revealed when fear overtakes reason. Understanding it helps identify market bottoms and potential entry points in volatile markets like crypto.

Why capitulation is a crucial event in market cycles

Capitulation is neither good nor bad – it’s simply a turning point. Its impact depends on the market’s direction and crypto owners’ position. In crypto, capitulation marks peak selling pressure, as panic drives prices lower. This phase often resets market sentiment and sets the stage for potential recovery.

Capitulation can present profitable opportunities.

- Bullish capitulation Short-sellers close their positions, which pushes prices upward.

- Bearish capitulation Rapid declines may offer entry points for speculators who seek discounted assets.

Thus, understanding capitulation helps crypto holders act before the trend reverses, potentially positioning them for a profitable entry.

How capitulation affects traders, long-term holders, and market sentiment

Capitulation has a profound impact on all market participants. It alters behavior, shifts sentiment, and can determine the next phase of the cycle. Here’s how:

For traders:

- Extreme volatility creates rapid profit and loss opportunities.

- Price swings widen, increasing risks and rewards.

- Stop-loss orders trigger in clusters and cause sharp declines.

- Short-term strategies may fail due to unpredictable price movements.

- Experienced traders often find high-reward setups during the chaos.

For long-term holders:

- Panic-driven losses undermine long-term confidence.

- Many crypto owners exit at a loss to avoid further declines.

- Remaining holders may hesitate to re-enter due to fear of additional drops.

- Bearish capitulation presents entry points at lower valuations.

- Bullish capitulation forces short sellers to buy back and therefore push prices higher.

For market sentiment:

- Trust in the market erodes.

- Interest in crypto payment interest services slows as consumers lose confidence.

- Fear dominates headlines and trading platforms.

- Trading volumes decrease as confidence falters.

- Recovery takes time, as sentiment resets.

- Capitulation often marks the psychological bottom of a bear market.

How capitulation happens in crypto

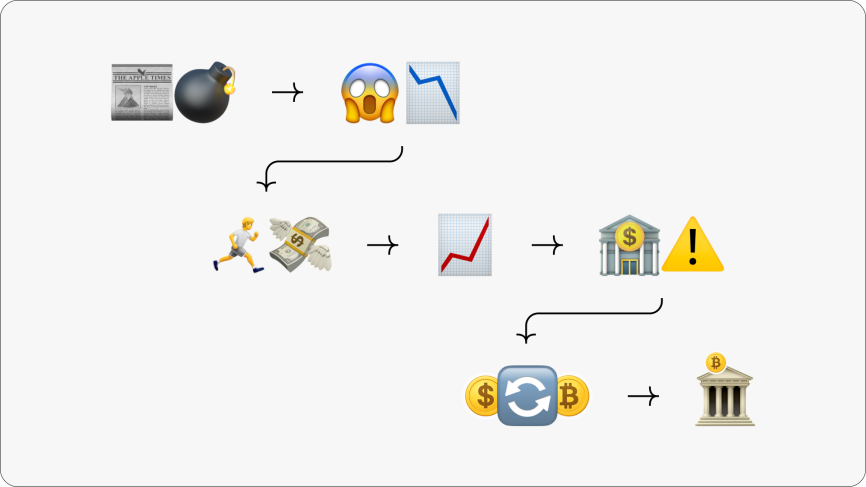

Capitulation in crypto occurs through a rapid, emotional sequence of events. It starts with a sharp price drop and ends with complete surrender. Each phase increases pressure, driving the market lower.

- Triggering event

A sudden external shock – regulatory crackdowns, major hacks, exchange insolvencies (e.g., FTX), or macroeconomic news (like rate hikes). Prices drop sometimes by 30% or more overnight. - Panic selling

Traders rush to sell and accelerate the decline. Liquidations rise sharply as fear overrides strategy. - Increase in volume

Trading volume rises. Large holders sell off, reducing order book depth and liquidity. - Extreme volatility

The market becomes highly unstable. Algorithms and stop-loss orders trigger in chains. - Oversold signals

Key indicators flash deep red (e.g. RSI often drops below 30 or lower) suggesting that the market may be oversold. Buyers hesitate, unsure where the bottom lies. - Exhaustion and stabilization

Sellers run out. Short positions start to cover, and “smart money” steps in. Prices flatten before potentially bouncing higher. - Aftershock and recovery

Despite weak sentiment and lower volume, those aware of capitulation may see it as a long-term opportunity, as prices stabilize and market sentiment resets.

Key signs and reasons for capitulation in the crypto market

Capitulation in crypto is characterized by panic-driven selling. Recognizing the signs and understanding the reasons can help with strategic decision-making.

Key signs of capitulation in crypto

- Sharp, fast price drops (often 20-30% or more in a single day).

- Surging trade volumes across exchanges.

- Massive liquidations of leveraged positions.

- Technical oversold signals on major timeframes.

- Spikes in volatility, with erratic price swings.

- Negative sentiment flooding social media platforms like Twitter or Reddit.

- Whale wallets reducing or moving large holdings.

- Quick V-shaped often reversals after intense sell-offs.

Main reasons behind crypto capitulation

- Extended bear markets with no relief rallies.

- Major exchange collapses or project failures.

- Sudden legal/regulatory crackdowns.

- Security breaches (large-scale hacks or theft).

- Global economic uncertainty or recession fears.

- A cascade of liquidations from overleveraged traders.

- Market manipulation by large holders (whales).

- Bad news amplifies existing fear.

Indicators of crypto market capitulation

Crypto market capitulation often shows up through a combination of technical signals and emotional extremes.

These indicators may predict upcoming capitulation:

- High trading volume

A major capitulation phase often sees high surges in daily trading volume. For example, during the March 2020 crash, Bitcoin’s daily volume spiked above $50 billion. - Extreme volatility

Intraday price drops of 10-30% are common. - Fear and Greed Index ranging from 0 to 24

The index often dips into extreme fear during capitulation. - Mass liquidations and long squeezes

When leveraged traders are forced out, liquidation volume can exceed $1 billion in hours. In May 2022, over $1.2 billion in crypto positions were liquidated, marking a major capitulation event. - Negative social sentiment and media panic

Bearish mentions flood platforms like Twitter and Reddit.