FUD in crypto stands for Fear, Uncertainty, and Doubt and describes a tactic used to influence market behavior through the spread of negative or false information.

What is FUD in crypto?

FUD in crypto stands for Fear, Uncertainty, and Doubt. It’s a tactic used to manipulate market behavior by spreading misleading or negative information, often during volatile periods when emotions run high.

There are four types of FUD in crypto:

- Common FUD

Claims that a certain cryptocurrency has no value, is too volatile, or used only by criminals. These narratives ignore adoption growth, market maturity, and the real-world use of blockchain technology. - Technology FUD

Concerns about energy use, lost crypto wallets, and slow transaction speed of a cryptocurrency or a crypto platform. While these issues exist, ongoing innovation like renewable mining and second-layer networks continues to address them. - Regulatory FUD

Fear of government bans, legal restrictions, or sudden tax law changes. These shifts can cause panic selling but often lead to clearer frameworks and long-term growth. - Miscellaneous FUD

Warnings about celebrity manipulation, quantum computing threats, or internet outages. While some risks are real, many remain speculative and rarely affect daily market behavior.

Some FUD distorts facts for emotional impact. According to Kraken’s 2024 Crypto FOMO Survey, 81% of crypto owners said FUD has influenced their decisions. It’s a common tool for those looking to profit from price drops or disrupt market momentum, especially in competitive sectors like DeFi and new tokens.

Why is FUD common in the crypto market?

The crypto market is highly reactive to news, and its volatility, combined with limited regulation, creates an ideal environment for fear-driven strategies. It explains why FUD is so prevalent and spreads rapidly.

There are two main sources of FUD:

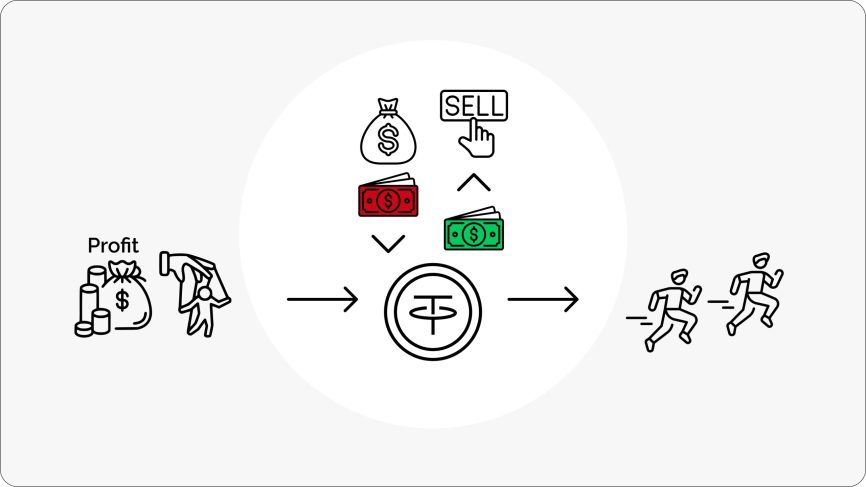

- Natural FUD This type originates from real developments. A weak market structure or an overhyped growth narrative can often lead to a correction. When legitimate concerns, like lawsuits, exchange failures, or regulatory issues, emerge, they fuel anxiety. A single negative headline can trigger a chain reaction.

- Artificial FUD Artificial FUD is typically calculated. Large players may propagate negative narratives via media, forums, or social media to lower prices. After causing a price drop, they can acquire assets at a discount. Once the damage is done, the asset may rise again, but under new ownership.

Three primary factors explain why FUD is so widespread:

- Market manipulation Big players may generate pressure to buy crypto at a lower price. Misleading reports or rumors can shake the market just before they act.

- Competition Rival projects often deploy FUD to harm one another, redirecting user trust and market attention.

- Regulation Government actions or new regulations can trigger panic, even before the final outcomes are clear.

How FUD impacts crypto owners’ behavior and market trends

FUD in crypto can trigger panic selling. As soon as negative news surfaces, traders often exit their positions to mitigate potential losses. Prices can react dramatically, even when the news lacks significant weight.

Here are the key effects of FUD:

- Panic leads to rapid exits and sharp price declines.

- Uncertainty amplifies market fluctuations.

- Fear can spread from one asset to the entire sector.

- Even strong crypto projects can lose support.

- Decision-making shifts from strategy to emotion.

How FUD spreads: media, social networks, and influential figures

FUD in crypto spreads rapidly across different platforms. It often starts with a single piece of content and grows into a widespread wave of fear and uncertainty.

- Some media and rumors

News stories, especially those lacking full context, can shift market sentiment. Headlines about cryptocurrency bans, lawsuits, or bankruptcies often trigger fear before the facts are verified.

Example: In late 2023, news about the SEC delaying its approval of spot Bitcoin ETFs created a negative backdrop, which held Bitcoin’s price down despite growing market demand. - Social networks

Crypto groups on Telegram, forums, and Twitter frequently spread unverified claims. These messages can target new projects, presales, or airdrops, shaping sentiment before any facts surface.

Example: Before Worldcoin’s launch, claims circulated on Twitter that it was connected to global surveillance, despite the lack of evidence. These rumors delayed early adoption and sowed doubt within crypto communities. - Influential figures

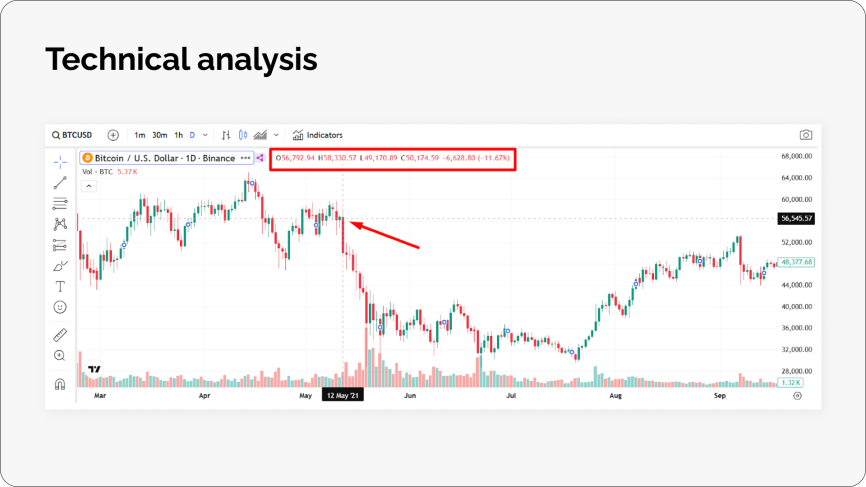

Well-known figures can influence the crypto market with a single statement. Whether CEOs, fund managers, or regulators, their words can shift sentiment instantly.

Example: In 2021, Elon Musk’s tweet that Tesla would stop accepting Bitcoin due to environmental concerns caused Bitcoin’s price to drop by over 10% within hours.

How to identify and handle FUD

Handling FUD in crypto requires calm analysis and strategic thinking. Here’s how it can be identified and dealt with effectively:

Identifying FUD

When headlines start flying, the tone and source often give away the intent. Wild exaggerations, dramatic language, and vague claims usually hint at something fishy. Legitimate platforms and analytical tools tend to stick to facts and avoid panic-inducing language.

Typical clues that FUD might be in play:

- Phrases like “crypto crash incoming” or “this coin is dead” tend to circulate when emotions are running high.

- Platforms like CoinMarketCap tend to offer data without drama.

- Sentiment tools like the Fear and Greed Index reflect how the crowd is feeling. Deep fear can signal capitulation, while extreme greed often precedes a cool-down.

- A story might break about a protocol being hacked, but a deeper look might reveal that the funds were recovered or that the exploit was exaggerated.

Handling FUD

When FUD in crypto hits, reactions can be intense. The market doesn’t always wait for facts. Panic selling, volatility spikes, and bearish sentiment usually follow. Despite the chaos, patterns tend to repeat.

How to handle FUD:

- A good option is not to panic. Crypto markets can drop dramatically, but history shows they often recover. It’s possible to close a position and make a pause.

- FUD can create buying opportunities, especially during market corrections. Keeping an eye out for moments when the market has overreacted to negative news is the right decision.