What is a token?

In crypto, a token is a digital asset created on an existing blockchain, usually Ethereum. Tokens differ from native cryptocurrencies like Bitcoin or Ether, as they are created using smart contracts on existing blockchains rather than being the blockchain’s built-in currency.

They may represent value, rights, or access, such as digital goods, real estate, or governance voting.

Created by smart contracts, tokens power decentralized apps and enable trading, control, and innovation in Web3 ecosystems.

What are the types of tokens?

Token classification and regulatory treatment vary by jurisdiction. This content is provided for informational purposes and does not constitute legal or investment advice.

Here are the types of crypto tokens, each serving a distinct role in the crypto economy:

- Utility tokens provide access to products, services, or features within a specific blockchain project or decentralized application (dApp). They often function as “fuel” or keys for using a platform.

Examples: BAT, GLM, FIL - Security tokens are digital representations of ownership in real-world assets like stocks, bonds, or real estate. These tokens are subject to jurisdiction-specific securities laws and may not be offered or traded without appropriate regulatory authorization.

Examples: Props, BCAP, INX - Stablecoins are tokens pegged to stable assets like fiat currencies or commodities to minimize price volatility. They are widely used for trading, remittances, and as a store of value in crypto.

Examples: USDC, DAI, XRP - Non-Fungible Tokens (NFTs) are unique digital tokens that represent individual assets such as art, music, collectibles, or virtual real estate. Each NFT is distinct and cannot be exchanged on a one-to-one basis.

Examples: Bitcoin Ordinal, CryptoKitty, Quantum - Governance tokens grant holders voting rights on protocol upgrades, treasury management, or other key decisions within decentralized projects.

Examples: MakerDAO, Compound - DeFi tokens can be used within decentralized finance platforms for purposes like staking, lending, borrowing, or yield farming. They can often overlap with governance tokens, but focused on financial services.

Examples: LINK, XLM, DOT - Asset-backed tokens represent fractional ownership of physical or intangible assets such as gold, real estate, or intellectual property, enabling easier trading and liquidity of traditionally illiquid assets.

Examples: PAXG, PAX - Wrapped tokens stand for cryptocurrencies “wrapped” into tokens compatible with different blockchains (e.g., Wrapped Bitcoin on Ethereum). It enables cross-chain interoperability and access to various DeFi ecosystems.

Examples: wBTC, WETH, bLuna - Meme coins represent tokens created mostly for fun or community-driven hype. Their value is often driven by social media and cultural trends rather than fundamentals.

Examples: DOGE, SHIB, PEPE - Liquidity Provider (LP) tokens are issued to users who provide assets to decentralized liquidity pools. LP tokens represent your proportional share and can be used to claim rewards or withdraw your stake.

Examples: Sushi, Uniswap, PancakeSwap - Liquid Staking Tokens (LSTs) are received in exchange for staking native tokens. These tokens represent your staked assets and can be used elsewhere in DeFi, providing liquidity while still earning staking rewards.

Examples: stETH, rETH - Liquid Restaking Tokens (LRTs) are a newer innovation where staked LSTs are further “restaked” to earn additional yields, which serves to increase capital efficiency in emerging protocols.

Examples: WEETH, LBTC, RSETH

History of crypto tokens

The concept of crypto tokens emerged in 2012 with the launch of Mastercoin, a protocol built on Bitcoin and proposed by J.R. Willet. It was the first known example of a token-based project built on top of the Bitcoin blockchain. Mastercoin introduced the Initial Coin Offering (ICO) model that allowed developers to raise funds by issuing digital tokens.

Between 2012 and 2016, token-based fundraising slowly gained traction. In 2017, the ICO boom reached its peak. Hundreds of blockchain projects issued tokens to raise capital. The market grew rapidly, attracting both legitimate teams and fraudulent schemes. Token hype fueled massive speculation. It led to sharp price increases and global attention.

By 2018, the ICO bubble collapsed, which gave rise to Initial Exchange Offerings (IEOs), where crypto exchanges managed token sales. IEOs aimed to reduce risks by offering limited project vetting.

Why are tokens important?

Tokens represent digital ownership and enable fast, peer-to-peer value transfers without intermediaries. They can store rights, grant access, and power activity across blockchain networks.

In Web3 ecosystems, tokens serve as the foundation for decentralized applications, managing payments, rewards, and governance. They shape how users interact, contribute, and benefit from these platforms.

For businesses, tokens unlock new models for funding, collaboration, and engagement. Integrated with smart contracts, they automate trust and reduce transaction friction.

Tokens also support emerging economic structures. For example, decentralized autonomous organizations (DAOs) use tokens for collective decision-making and control.

How tokens work

Most tokens follow set standards, such as ERC-20 or ERC-721 on Ethereum, which define how they behave across applications.

Tokens use cryptographic methods like public-private key pairs and hashing to ensure security. Every token transaction is recorded on a decentralized ledger.

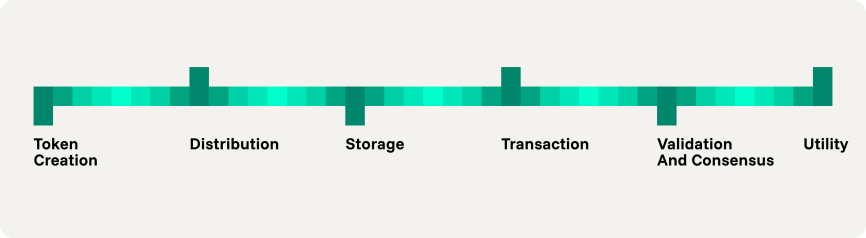

Here is how tokens usually function:

- Creation. Developers mint tokens by deploying smart contracts that define supply, rules, and functions.

- Distribution. Tokens can be released through Initial Coin Offerings (ICOs), airdrops, or network participation rewards.

- Storage. Users hold tokens in digital wallets (software-based or physical hardware devices).

- Transaction. When a token is sent, the network checks that the sender has sufficient balance and that the transfer is valid.

- Validation and consensus. Nodes verify the transaction, and it is included in a block through the blockchain consensus mechanism (e.g., Proof of Stake).

- Utility. Tokens interact with smart contracts to enable trading, staking, voting, access rights, and more.

Crypto tokens vs. cryptocurrencies

Crypto tokens and cryptocurrencies are often confused, but they serve different roles in the blockchain ecosystem. A cryptocurrency is a native digital asset of its own blockchain. It powers crypto transactions, secures the network, and often acts as a store of value. Bitcoin, for example, operates on the Bitcoin blockchain. Ethereum does the same on its own network.

A crypto token, by contrast, does not have its own blockchain. It is built on top of another blockchain, typically Ethereum, using smart contracts. Tokens can represent anything from utility access to digital assets or rights. They enable applications, platforms, and protocols to function without issuing a new blockchain.

Here is a Crypto tokens vs. cryptocurrencies comparison:

| Feature | Cryptocurrency | Crypto token |

|---|---|---|

| Blockchain | Has its own | Built on an existing blockchain |

| Purpose | Currency and payment | Access, governance, rewards |

| Creation | Through mining and staking | Via smart contracts |

| Network control | Decentralized | Can be centralized and decentralized |

| Price influence | Market demand and supply | Can include pegging, minting, and rules |

| Examples | BTC, LTC, ETH | UNI, LINK, USDC |