Offering crypto payments unlocks benefits like lower fees, no chargebacks, borderless payments, and access to global markets. These advantages grow as more customers adopt it.

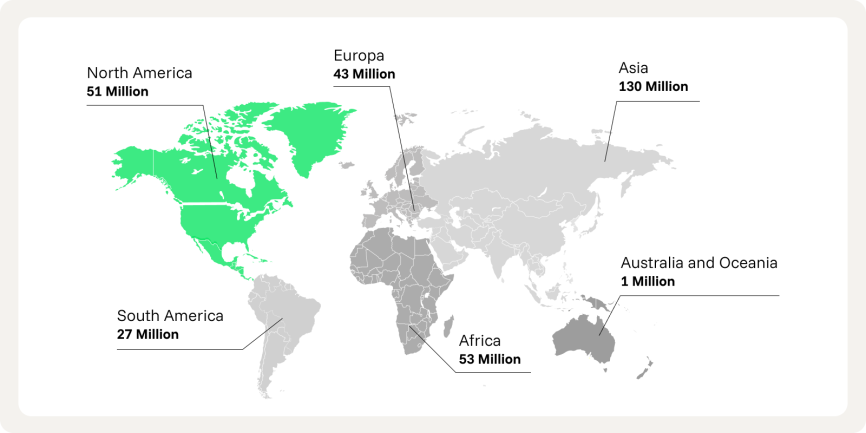

Attracting crypto-paying customers can boost your business performance. The number of digital asset owners surpassed 650 million by the end of 2024 – all potential clients for your company.

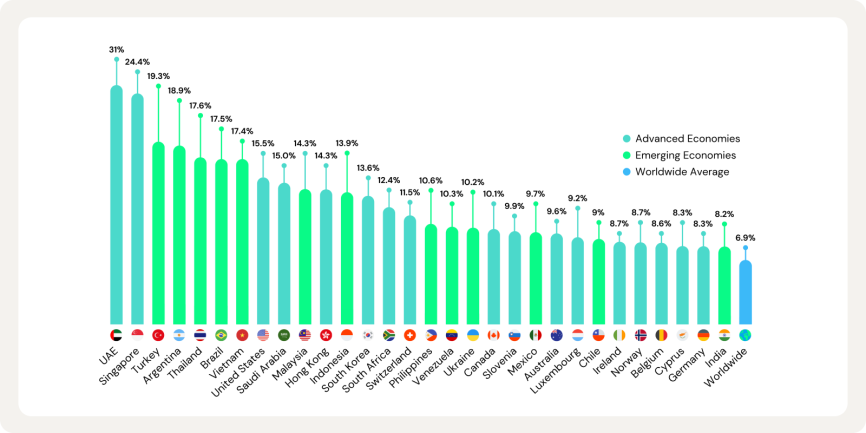

Encouraging crypto newcomers is crucial, especially as adoption grows. Thus, businesses should act quickly to gain a competitive advantage before it gets “too crowded”.

So how can merchants onboard more customers to crypto and get its full benefits? To answer this question, we’ll outline firstly the reasons why users are afraid of paying with crypto, and secondly, the steps one can take to combat these fears.

Why customers hesitate to use crypto

Technical intimidation

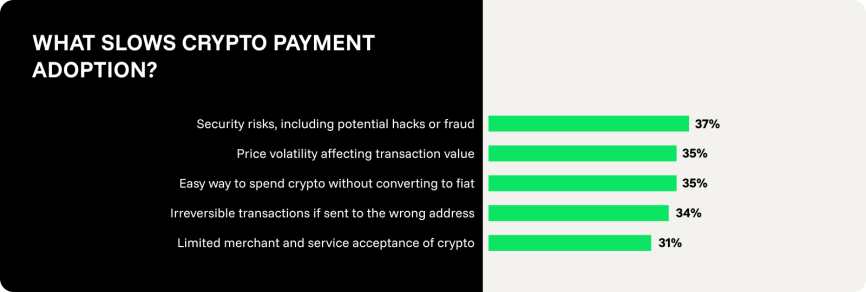

For many first-time users, blockchain feels overwhelming – full of complex code, technical jargon, and high-risk actions. Without a clear understanding of how it works, users are afraid of making mistakes that could result in lost funds or security breaches. For example, sending crypto to the wrong wallet address can mean permanent loss, which deters users from even trying.

Price volatility

Crypto’s reputation for wild price swings adds another layer of hesitation. After Bitcoin’s 60% drop from its 2021 peak, public confidence took a hit. While stablecoins like USDC offer more consistency, they’re not yet widely adopted for payments. The market’s instability paired with the perceived risks around newer, algorithmic stablecoins makes many users cautious.

Negative perception

Despite growing adoption by governments and businesses, cryptocurrency still faces a negative public perception, often linked to illicit activities like money laundering or dark web transactions. However, this perception is changing. According to Checkout.com’s 2022 ‘demystifying crypto report’, fewer than 5% of Europeans use crypto for dark web purchases. As blockchain technology matures and more people use crypto for legitimate purposes, the association with criminal activities is fading.

Countries like El Salvador have adopted Bitcoin as legal tender, and more are expected to follow suit, signaling the growing legitimacy of cryptocurrencies. As more users become familiar with blockchain through everyday use cases – such as receiving crypto payments for freelance work or engaging in play-to-earn gaming – the stigma surrounding crypto is likely to diminish. Still, educating your customers about the positive uses of cryptocurrency is essential to overcoming this barrier.

Onboarding challenges

One of the key obstacles to crypto adoption is the complexity of setting up wallets and understanding how to use them. Non-custodial wallets often require users to install browser extensions, manage cross-chain bridges, and securely store their mnemonic keys. It can be too difficult for beginners, especially without proper guidance.

Additionally, lengthy KYC (Know Your Customer) processes at centralized exchanges like Binance can deter users. Simplifying the onboarding process with easy-to-understand tutorials and offering easy wallet integrations can significantly reduce drop-off rates and help more customers transition to using crypto.

Addressing crypto fear: key barriers and solutions

When fear manifests in the ‘fiat’ world, one might argue that inoculation is the best way to go. By removing obstacles, encouraging more exposure, and providing better education, we can reduce fear and increase understanding.

A similar approach may be applied to cryptocurrencies, but it must be done correctly. Since digital goods, especially uncollateralized ones, lack intrinsic value, the push to adopt crypto as a payment method could be seen as an attempt to foster demand for one’s investment. In other words, it seems like you’re advertising a pyramid scheme to your clients.

How to tackle the intimidation factor

The idea that blockchain is a complex, inaccessible system is a misconception. Mobile banking, used daily by everyone from fishermen to day traders, relies on similar authentication technologies. As a result, even a Binance newcomer will find these concepts familiar.

Three things can be done, first and foremost, to tackle crypto intimidation:

- User-friendly interface. Clients should be guided through the onboarding journey with a simple interface, only displaying the necessary features. Perhaps a ‘Paying with Crypto’ FAQ would be a wonderful addition to your website as a merchant.

- Special offers. The user should be attracted to crypto as a payment method – discounts or special benefits might be available for those paying with crypto. You might consider developing Loyalty and Affiliate programs.

- Educational content. Lastly, the appropriate materials should be in place to guide the user to a crypto wallet, where they will be able to quickly and easily access all the necessary information regarding the service. You can also provide educational content to help guide users through the crypto world.

How to tackle the volatility concern

There are thousands of cryptocurrencies on the market that could, in theory, be used for payments. However, not all of these currencies are going to be around forever. Thus, it’s important to offer your customers more stable currencies on the market, in addition to the big names. CryptoProcessing.com supports 40 top digital currencies, including stablecoins such as USDC to mitigate the volatility concern.

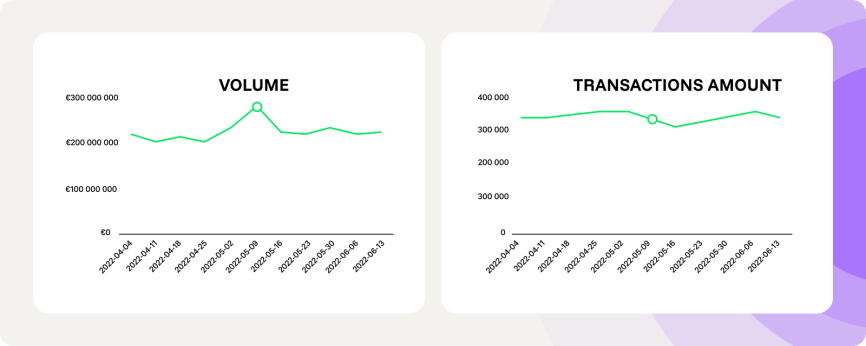

Furthermore, despite the massive price fluctuations and the industry losing over 2 trillion in its cap compared to all-time highs, the payment sector remains mostly unaffected. Our internal analytics show that even during Terra Luna collapse in 2022, the number of transactions and volume were not impacted.

You should also inform your customers that crypto processors like CryptoProcessing.com take on volatility risks, ensuring a fixed purchase price to avoid slippage. In addition, it’s important to educate your audience on the real reasons behind the Terra Luna collapse to help strengthen confidence in algorithmic stablecoins.

It may be worth drawing attention to the natural volatility inherent in many currencies. For example, how the volatility of the Turkish Lira can impact holding this currency as a long-term investment, and whether crypto assets can, in today’s economic climate, where inflation is soaring. This may all be done via a Medium channel or an on-site blog.

“The biggest mistake merchants make is thinking their customers have to be crypto experts to start using it. In reality, all they need is a smooth experience and a reason to try – the rest takes care of itself.”

How to mitigate the forces of mistrust

Mistrust is a key fear to overcome. It involves the demonstration of crypto benefits as a payment method, which can be difficult for those who are unfamiliar with it, much like the challenge in the Allegory of the Cave.

The best way to improve trust is by selecting a reputable crypto processing provider. For example, CryptoProcessing.com is the firm market leader with zero instances of client fund loss. We’re an Estonia-licensed crypto services provider with an in-built transaction monitoring system, having been audited by two separate independent bodies.

Clarifying that an experienced third party handles transactions helps ease client concerns. Education is key to overcoming market mistrust, as it highlights the global benefits of blockchain, the drawbacks of centralization, and the freedom of low-fee, cross-border transactions. Put yourself in the client’s shoes, and consider using social media platforms like Twitter, Medium, or YouTube to communicate these points.

How to combat the drop-off rate

A high drop-off rate shows that crypto onboarding isn’t effective, often due to intimidation from warning signs or the complexity of the KYC process. This is a key metric to tackle as you’re losing would-be crypto customers at the most crucial stage.

The remedy is to simplify the onboarding process. As the merchant, you aren’t always directly responsible for this, which is why it’s important to integrate a reliable and efficient crypto processing provider.

If you haven’t yet integrated crypto payments for your business, feel free to book a meeting with our sales team to discuss how CryptoProcessing.com could benefit your unique case. We’ll assign you a personal manager to guide you through the entire process. Moreover, we offer a range of different payment options to satisfy every conceivable merchant or client need.

Summary

Onboarding customers to crypto requires addressing intimidation, volatility concerns, negative perceptions, mistrust, and complex setup processes.

Merchants that simplify access, provide education, and partner with trusted processors can convert hesitant users into active payers.

Offering stable payment options, clear guides, and incentives helps remove common barriers. Besides, meeting compliance requirements adds a significant level of trust to the provider.

- Over 650 million digital asset owners by the end of 2024 represent a growing potential client base for businesses.

- Stablecoins such as USDC can help reduce volatility risks while still offering fast, borderless transactions.

- Offering limited-time promotions may encourage some first-time users to explore crypto payments, especially when combined with educational resources.

- Clear, user-focused onboarding interfaces and FAQs reduce errors and build user confidence.

- No cases of client fund loss in combination with third-party audits, as achieved by providers like CryptoProcessing.com, can increase trust and adoption.

Merchants that streamline onboarding and promote transparency may align more effectively with growing consumer interest in alternative payment methods.

Attract new customers globally

with crypto payments integration