Cryptocurrency use in the United Kingdom has increased in recent years. The 2024 research conducted by the Financial Conduct Authority (FCA) found that 12% of UK adults owned cryptocurrency, a 2% increase compared to the previous year. This rise reflects the growing public adoption of digital financial instruments.

Despite growing interest in crypto assets, surveys held in 2023 reveal a limited understanding of the market. Citing volatility as a key factor, 31% of UK investors prefer to consult with a financial adviser rather than solely rely on cryptocurrencies to achieve their expected returns.

But what effect does this volatility have on the average UK crypto owner?

Let’s see a real-world example.

Duncan, a former primary school teacher, invested his life savings into cryptocurrency during the coronavirus pandemic. At the peak, his portfolio was worth over $300,000. However, market volatility left him with a mere £4,000 from an initial £40,000 investment. His experience highlights the extreme fluctuations typical of volatile assets. It’s a common experience in the volatile crypto market.

But, how is it that such assets exist? What determines their volatility? What is crypto volatility?

These questions will be answered below.

A brief history of volatility

“Volatility is a measure of how much trading prices fluctuate over time. High volatility signifies large, rapid price changes, while low volatility indicates minor, gradual changes.”

To understand what drives volatility in the cryptocurrency market, let’s have a look at the historical drivers in the traditional financial system. It will provide a foundation for understanding crypto volatility.

1920s – 1930s: The Great Depression

Triggered by speculative trading and excessive use of margin borrowing, leading to a sudden and severe loss of confidence. This panic and withdrawal of investments caused extreme market volatility.

1980s: Stock market crash of 1987

Black Monday was partly attributed to program trading and portfolio insurance strategies, which automated selling to prevent losses, exacerbating the decline as prices fell.

1990s: Tech bubble

The dot-com bubble’s volatility was driven by speculative investment in internet-based companies, many of which had unsustainable business models and excessive valuations.

2007–2008: Global financial crisis

The collapse of the subprime mortgage market in the United States resulted in extreme volatility across financial markets.

2010s–Present: high-frequency trading and algorithmic trading

The Flash Crash of 2010 highlighted the volatility caused by high-frequency and algorithmic trading.

2020: COVID-19 Pandemic

The pandemic-induced volatility was driven by uncertainty over the virus’s global economic impact, leading to rapid sell-offs in equities, commodities, and other asset classes.

The timeline shows that periods of speculation and overvaluation often precede market corrections. During these times, assets are priced well above their intrinsic value. It was evident during the dot-com bubble and just before the 2008 financial crisis. These overvaluations often lead to rapid market movements.

“Intrinsic value refers to the actual worth of an asset, in terms of tangible and intangible factors. This value may or may not be the same as the current market value.”

Leverage and margin trading amplify market volatility, as seen in the 1929 stock market crash, by forcing the liquidation of positions when prices move unfavorably.

External shocks like economic crises, geopolitical tensions, or pandemics increase uncertainty and prompt rapid portfolio adjustments, as observed during the 2008 crisis and the 2020 pandemic, thereby increasing volatility.

These episodes are often exacerbated by feedback loops and herd behavior, where investors’ collective actions can significantly escalate market movements. Indeed, with the influence of the media or market sentiment, FOMO certainly plays a role.

Volatility can spike during a liquidity shortage, resulting in sharper price changes as the markets struggle to stabilize.

Now that we understand the factors affecting Traditional Finance (TradFi) volatility, let’s move on.

What makes crypto so volatile?

The volatility in the cryptocurrency market can be understood by separating the factors into those that mirror traditional financial systems and those that represent new facets specific to the crypto asset space.

Factors mirroring traditional financial system volatility

Speculative trading: Both traditional markets and cryptocurrencies experience volatility driven by speculation, where investments are made based on expectations of future price movements rather than fundamental value.

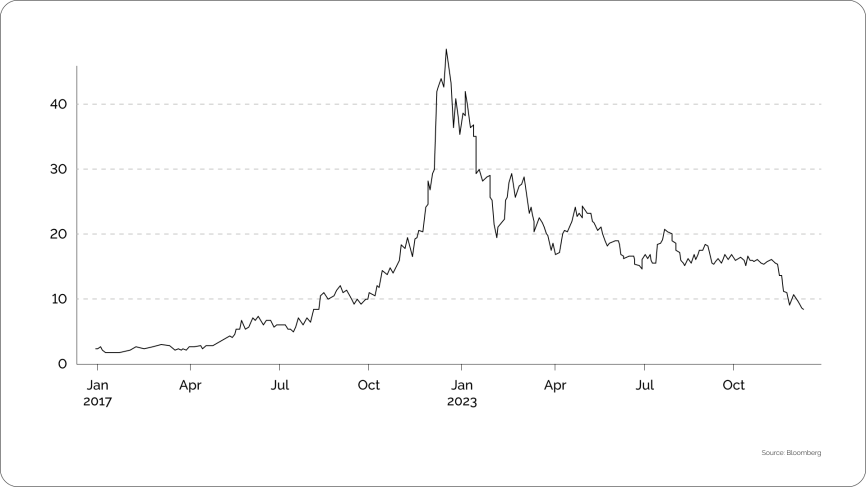

In 2017, Bitcoin’s price surged from around $1,000 to nearly $20,000, fueled by speculative trading from retail investors. While this rapid rise was followed by a significant price correction in 2018, with the price dropping to around $3,000, it serves as an example of the volatility that speculative trading can create. Despite this, Bitcoin has continued to exhibit high volatility, influenced by market interest, crisis events, and its attractiveness as a digital asset.

Bitcoin’s 2018 crash

Regulatory news and events: Similar to traditional markets, cryptocurrencies are highly sensitive to regulatory changes.

In 2021, China’s increased crackdown on cryptocurrency trading and mining led to significant price drops, with Bitcoin and Ethereum experiencing rapid declines in value as a result of market reactions to the news.

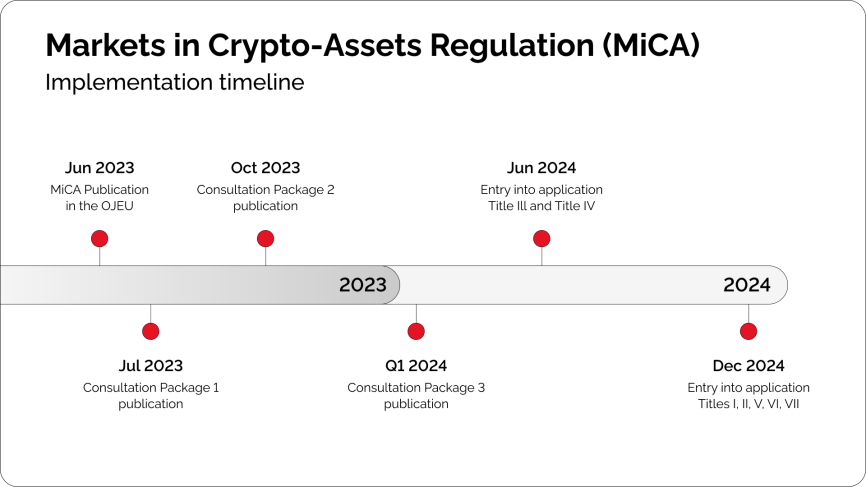

On the flip side, the MiCA regulation, that was set to take effect in 2023, was expected to foster innovation and expand cryptocurrency investment opportunities in the European market. It ensures consistent investor protection across all European Union member states and streamlines the licensing process for Crypto Asset Service Providers (CASPs), allowing them to operate throughout the EU.

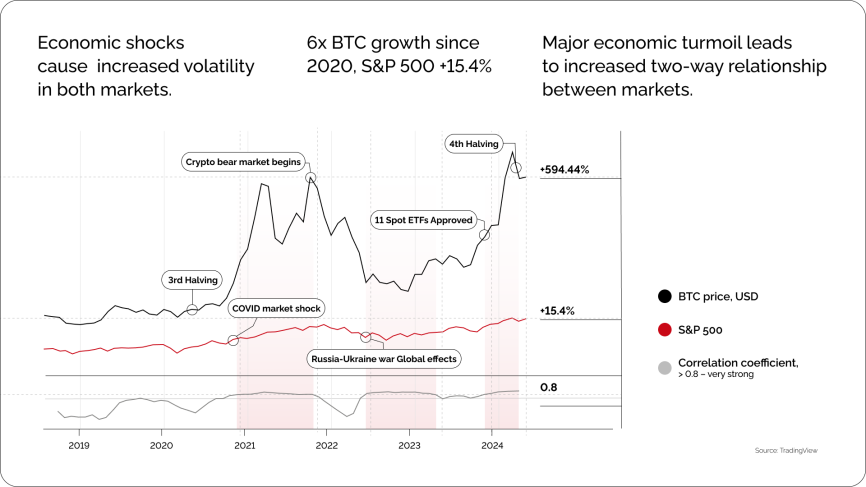

External shocks: A strong correlation, above 0.8 between Bitcoin price movements and the SP500 index during major global events such as the pandemic from December 2020 to November 2021, the aftermath of the Russian invasion of Ukraine from July 2022 to May 2023, and from December 2023 to the present day.

Increased Bitcoin price volatility is also observed around announcements from the European Central Bank (ECB) and the Federal Open Market Committee (FOMC), particularly during press conferences.

External shocks notably impact Bitcoin markets, with significant differences in volatility on announcement versus non-announcement days.

Liquidity: Many cryptocurrencies suffer from low liquidity, leading to greater price volatility in response to market movements.

Cryptocurrencies with smaller market capitalizations tend to be more volatile due to lower liquidity. Prices can be significantly influenced by a single tweet or social media post, as buy and sell orders have a larger impact on the market price.

Media influence and public sentiment: Markets are influenced by media and public sentiment, where news stories and social media can rapidly affect investor behavior and lead to price fluctuations.

The price of Dogecoin has been notably influenced by tweets from influential figures like Elon Musk. His mentions of Dogecoin on Twitter have led to quick, significant price movements.

New facets of volatility specific to cryptocurrencies

Technological changes and developments: The pace and impact of technological innovation in blockchain and cryptocurrency significantly influence prices.

Ethereum’s transaction from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism, known as Ethereum 2.0, affects its scalability, security, and environmental impact. Announcements about the upgrade can cause fluctuations in Ethereum’s price as the market reacts to the anticipated improvements and their potential impact on Ethereum’s adoption and utility.

Security concerns: The impact of security breaches, such as exchange hacks in the cryptocurrency space, can have an immediate and pronounced effect on market volatility.

In 2014, Mt. Gox, one of the largest Bitcoin exchanges at the time, filed for bankruptcy after losing 850,000 Bitcoins to hackers. This event caused a sharp drop in Bitcoin’s price and shook market confidence, demonstrating how security breaches can trigger severe market volatility in the crypto environment.

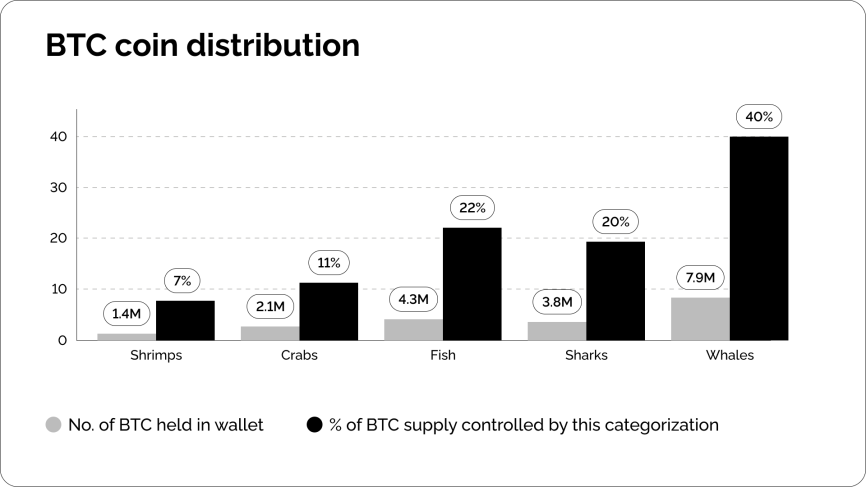

Concentration of ownership: The cryptocurrency market often has a large portion of its total supply controlled by a few entities. When these “whales” make large transactions, it amplifies volatility, a situation less common in mature traditional markets.

Bitcoin wealth is highly concentrated among large holders. Whales (1,000–5,000 BTC) and humpbacks (over 5,000 BTC) control 40% of the supply. Notable holders include Tim Draper and MicroStrategy’s Michael J. Saylor, whose company holds over 129,000 BTC.

Dolphins (100–500 BTC) and sharks (500–1,000 BTC) hold 20%, fish (50–100 BTC) and octopuses (10–50 BTC) have 22%, and crabs (1–10 BTC) account for 11%. The smallest holders, shrimp (less than 1 BTC), control 7% of the supply.

Intrinsic value perception: Cryptocurrency valuations rely mainly on perception and consensus, unlike traditional assets with physical backing and cash flows. It contributes to their volatility. Coins also vary in collateralization methods, which further affect their price stability.

The Initial Coin Offering (ICO) craze of 2017 saw many new cryptocurrencies and NFT collections enter the market. The prices of such assets are often based more on speculation and perception than on fundamental value.

Many of these projects were unstable, causing large price swings as individuals rushed to buy the new tokens, only for prices to drop sharply when the project’s weaknesses became clear.

Overall, cryptocurrencies are volatile. Much more so than many traditional assets.

Is crypto volatility an eternal problem?

The intense volatility in the cryptocurrency market is a defining characteristic now, but it is not permanent. Several factors are contributing to the evolution of the market towards greater stability over time.

- Stablecoins, digital currencies pegged to stable assets like fiat currencies or commodities, aim to reduce volatility in the crypto market. Recent data on crypto transaction volumes show significant month-over-month growth in stablecoin usage compared to more volatile coins. Indeed, we could predict a market where stablecoins and CBDCs (Central Bank Digital Currencies) become the go-to in crypto, with volatility comparable to traditional financial markets.

- Cryptocurrency regulations become more established worldwide. Also applied in the US, the Travel Rule requires financial institutions to share customer information for transactions above a certain amount to prevent illicit activities. Europe, while adhering to the Travel Rule, has its strict rules, with 5AMLD requiring exchanges to perform customer due diligence and register with authorities, and the ESMA clarifies crypto asset guidelines. In Asia, regulations differ: China bans ICOs and exchanges, while Japan has a licensing system for exchanges. Regulatory efforts, like MiCA, often take years to implement.

- The crypto market is on a path toward maturity, underscored by an anticipated growth rate of 8.62% from 2024 to 2028 and an increasing presence of institutional investors. This transition is supported by a focus on improving market efficiency, liquidity, and stability, with ongoing research aimed at understanding and quantifying these aspects of maturity.

- Technological developments, such as the Ethereum 2.0 Merge, play a crucial role in stabilizing and advancing the market. This transformation is profoundly significant, slashing the blockchain’s energy consumption by an astonishing 99%, thereby ushering in a new era of environmental sustainability for Ethereum. Moreover, the shift to PoS plays a vital role in bolstering security and mitigating the risks associated with over-centralization.

These factors highlight that the cryptocurrency market has become less volatile and more reliable.

Wrapping up

Volatility is not exclusive to cryptocurrency. It’s common in any free market, driven by factors like speculation, external shocks, and liquidity shortages.

However, as the market matures, such extreme price swings become less frequent. The adoption of stablecoins, clearer regulatory frameworks, and technological advancements help stabilize the market.

For crypto holders, the future remains promising, especially for those who focus on long-term growth instead of short-term gains.