Accept Tether (USDT) Payments as a Business

In the ever-evolving landscape of decentralized digital finance, Tether ($USDT) has emerged as the key player, offering a blend of cryptocurrency’s innovation with the stability of traditional fiat currencies.

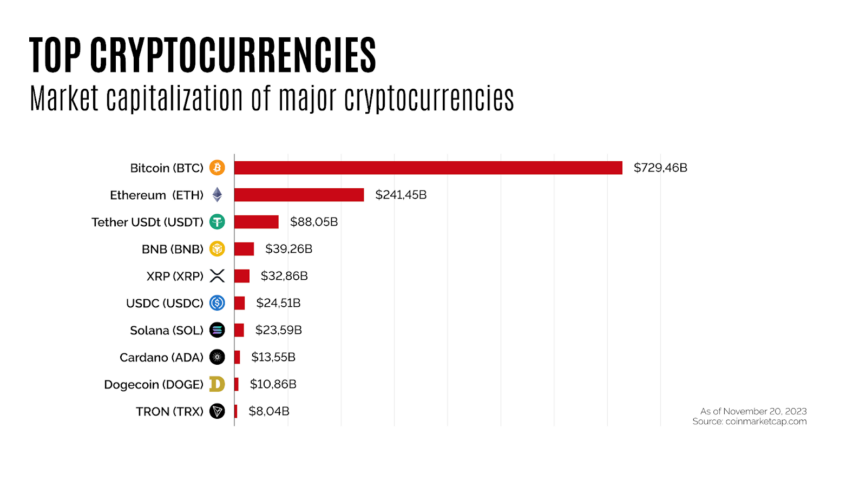

Tether payment, which operates on both ERC20 and TRC20 protocols, is the third largest cryptocurrency in the world in terms of overall market cap, valued at $89 billion. It also happens to be the most trusted and most commonly used stablecoin in circulation.

Since digital token, Tether’s value is pegged 1-to-1 to the US dollar, it gives users and organizations much-needed security that they constantly desire with cryptocurrency.

What is USDT Payment Method?

Tether, commonly known as USDT or $USDT, was created in 2014 to bridge the gap between fiat currencies and cryptocurrencies, offering stability, transparency, and minimal transaction charges.

It was designed to combine the unrestricted nature of cryptocurrencies with the stable value of traditional currencies.

As a tether payment gateway, it presents an array of compelling advantages for businesses, making it a standout choice in the various digital wallet and payment landscape.

Advantages of Tether Payment Gateway for Business

Although the goal of most stablecoins is the same as Tether’s, there are, however, a few factors of USDT that separate it from the rest.

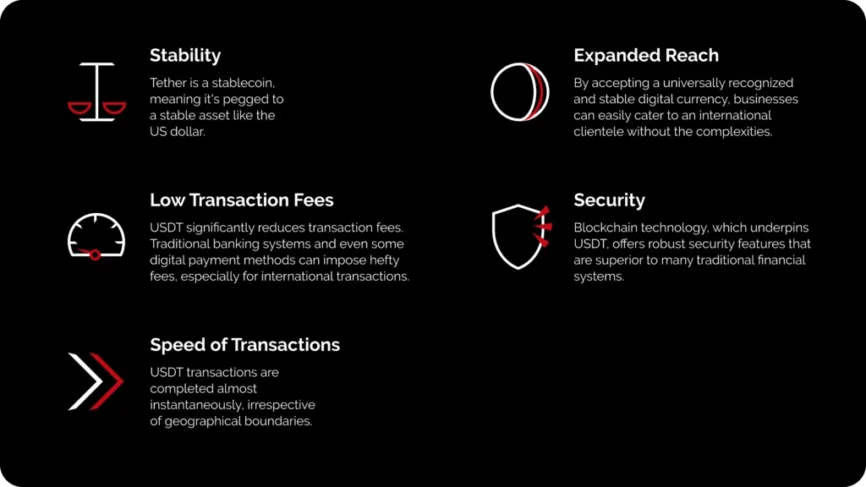

USDT Stability

One of the primary benefits of USDT is its stability. Unlike other cryptocurrencies, Tether is a stablecoin, meaning it’s pegged to a stable asset like the US dollar.

This linkage curbs the market volatility so often associated with cryptocurrencies, providing businesses and their customers with the assurance of stability in their transactions.

Reduced Transaction Fees with USDT Tether Payment

Moreover, USDT significantly reduces transaction fees. Traditional banking systems and even some digital payment methods can impose hefty fees, especially for international transactions.

USDT circumvents these costs, offering a more economical alternative for businesses. This cost-effectiveness is particularly beneficial for small and medium-sized enterprises operating on tighter budgets.

Speed of Transactions with USDT Tether Payment method

Another key advantage of using USDT is the speed of transactions. International transfers in the traditional banking system can take several days to process.

In contrast, USDT transactions are completed almost instantaneously, irrespective of geographical boundaries.

This expediency not only enhances cash flow management for businesses but also improves customer satisfaction by providing quick and efficient payment solutions.

Expanded Reach with USDT Tether Payments

Furthermore, USDT continues to open doors to the global market.

By accepting a universally recognized and stable digital currency, businesses can easily cater to an international clientele without the complexities and costs associated with currency conversion and cross-border transactions.

Enhanced Security with USDT Tether Payments

And lastly, using a tether payment gateway like USDT also enhances security. Blockchain technology, which underpins USDT, offers robust security features that are superior to many traditional financial systems.

This added layer of security is crucial in an era where digital transactions are increasingly susceptible to fraud and cyber-attacks.

Blockchain Leveraged Security

Blockchain technology provides an added layer of security that is often lacking in traditional payment systems such as:

- Decentralization. Unlike traditional payment systems that rely on a central authority, blockchain operates on a decentralized network, reducing the risk of centralized data breaches and single points of failure.

- Immutable Records. Once a transaction is recorded on the blockchain, it cannot be altered or deleted. This immutability ensures the integrity and transparency of transaction histories, preventing fraud and unauthorized alterations.

- Encryption and Privacy. Blockchain technology employs advanced cryptographic techniques to secure data. This encryption ensures that sensitive financial information remains confidential and protected from unauthorized access.

- Transparency and Traceability. Every transaction on the blockchain is transparent and traceable. This level of visibility helps in monitoring and auditing transactions, making it easier to detect and prevent fraudulent activities.

- Consensus Mechanisms. Blockchain utilizes consensus mechanisms like Proof of Work or Proof of Stake to validate transactions.

Two examples of these mechanisms include Bitcoin (Proof of Work) and Ethereum (Proof of Stake).

These mechanisms ensure that all network participants agree on the validity of transactions, thereby preventing unauthorized transactions and double-spending.

As you can see blockchain technology not only safeguards against fraud but also ensures the integrity and confidentiality of each transaction.

Reliability and Experience

The efficiency in transaction processing is vital for businesses that rely on swift payment settlements to maintain their cash flow and operational efficiency.

Instead of waiting weeks for your cash to settle and collect, with cryptocurrency, your funds are immediately available.

PRO-TIP: According to a recent report by Deloitte, 75% of retailers plan to accept cryptocurrency within the next two years.

And instead of spending hundreds of thousands, or even millions of dollars to try and implement their platform, many of them will partner with crypto processing platforms to handle everything for them.