USCD and USDT are the largest stablecoins (cryptocurrencies), the value of which is tied to fiat currency (in most cases, the U.S. dollar).

Among stablecoins, Tether (USDT) and USD Coin (USDC) are the most prominent. As of January 6, 2025, USDT holds a market capitalization exceeding $137 billion, ranking it third among all cryptocurrencies. In contrast, USDC has a market cap of approximately $43.9 billion, placing it sixth.

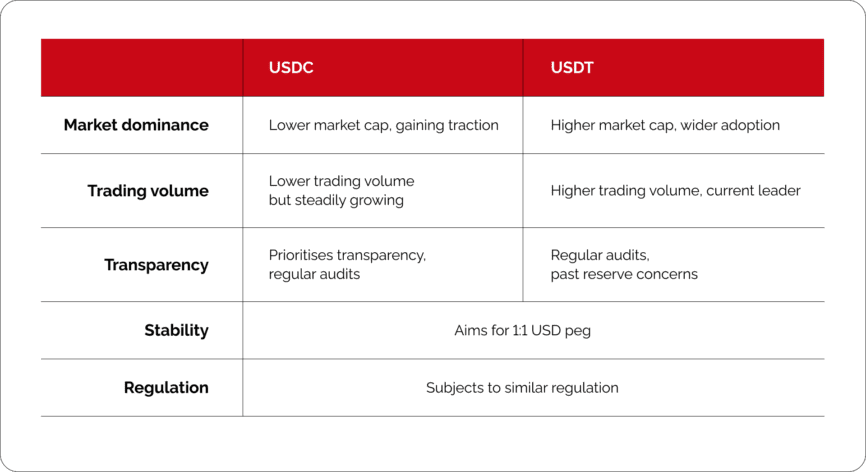

While both USDT and USDC aim to maintain stability by pegging their value to the U.S. dollar, they differ in transparency and adoption: USDC is praised for regular audits and public trust, while USDT, despite scrutiny over its reserves, dominates in liquidity and exchange acceptance.

What is USDT in crypto?

United States Dollar Tether (USDT) was launched in 2014 by Tether Limited. It was one of the first stablecoins introduced to the cryptocurrency market, designed to provide traders with a stable digital asset that could maintain a value equivalent to the U.S. dollar.

Launched: July 2014

Type: Fiat-collateralized stablecoin

Pegged currency/asset: U.S. Dollar

Market cap/rank: Approximately $137.4 billion; ranked #3 among cryptocurrencies

24-hour trading volume: Approximately $101.5 billion

Primary blockchains: USDT operates on multiple blockchain platforms, including Ethereum (ERC-20), Tron (TRC-20), Omni (Bitcoin), Binance Smart Chain (BEP-20), Algorand, EOS, OMG Network, and Solana.

Exchanges present on: USDT is widely available on numerous cryptocurrency exchanges, including major platforms such as Binance, Bitfinex, Kraken, and many others.

What is USDC in crypto

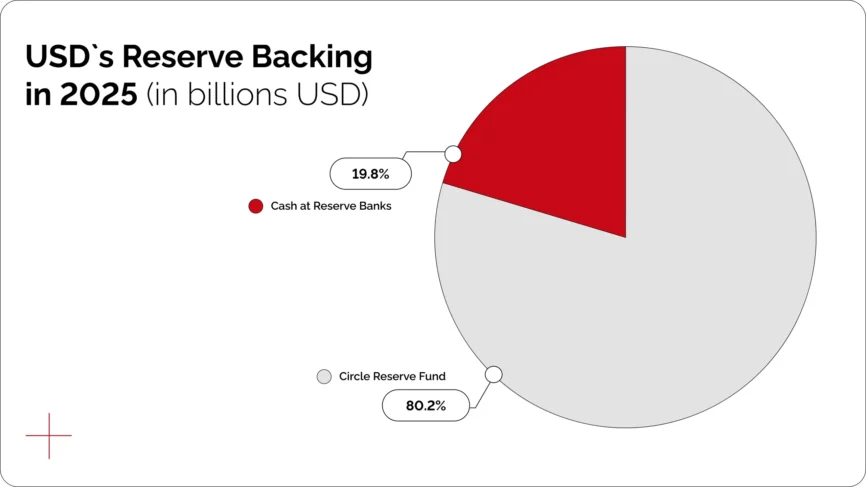

Much like USDT, USD Coin (USDC) is a stablecoin designed to maintain a 1:1 peg with the U.S. dollar. USDC’s reserves are fully backed by highly liquid assets, primarily short-term U.S. Treasury securities and cash deposits.

Launched: September 2018

Type: Fiat-collateralized stablecoin

Pegged currency/asset: U.S. Dollar

Market Cap/Rank: Approximately $45.7 billion; ranked #8 among cryptocurrencies

24-hour trading volume: Approximately $6.5 billion

Primary blockchains: USDC operates on multiple blockchain platforms, including Ethereum (ERC-20), Solana, Algorand, Tron, Avalanche, Stellar, and others.

Exchanges present on: USDC is widely available on numerous cryptocurrency exchanges, including major platforms such as Coinbase, Binance, Kraken, and many others.

Why are USDC and USDT so popular?

USDC and USDT solve real problems in the cryptocurrency space:

1. Protecting value during market volatility

USDT provides a solution for traders during market dips. For instance, a Bitcoin trader facing a 10% market drop can convert BTC into USDT, safeguarding their funds from further losses without withdrawing into fiat currency or exiting the crypto ecosystem.

This ability to quickly “park” value is a key reason for USDT’s dominance as a trading pair on exchanges.

2. Regulatory compliance and transparency

USDC stands out for its transparency and regulatory adherence, making it a preferred choice for businesses. For example, a tech company in Europe can use USDC to pay contractors in the U.S. or Asia.

With fully-backed reserves and compliance, businesses can trust that their payments are secure, fast, and cost-effective compared to traditional banking.

3. Stable investment and borrowing in DeFi

Both USDT and USDC play a crucial role in decentralized finance (DeFi). A user can lend their USDC on platforms like Aave or Compound to earn steady interest in a stable currency, avoiding market volatility.

For borrowers, USDC loans provide a stable source of funding without worrying about fluctuations in collateral value, unlike volatile assets such as Ethereum.

4. Efficient cross-border payments

USDT and USDC excel in cross-border transactions. For example, a worker in the U.S. can send money to family in the Philippines using USDT, completing the transfer in minutes and at a fraction of the cost of traditional remittance services like Western Union.

This is especially beneficial in regions with limited banking access, offering a fast, low-cost alternative for international payments.

Enhance your business. Our team is here

to ensure a smooth setup.

USDC vs USDT: similarities and difference

The choice between USDT and USDC ultimately depends on the user’s priorities. Traders requiring liquidity and exchange compatibility often prefer USDT, while those valuing transparency, compliance, and reliability lean towards USDC.

| USDT (Tether) | USDC (USD Coin) | |

|---|---|---|

| Market Capitalization | $137 billion | $43.9 billion |

| Circulating Supply | 137 billion | 43.9 billion |

| Blockchain Platforms | Ethereum, Tron, BNB Chain, and others | Ethereum, Solana, and others |

| Transparency | Faced scrutiny over reserve disclosures; improving transparency efforts | Regular audits; high transparency |

| egulatory Compliance | Faced regulatory scrutiny; enhancing compliance measures | Adheres to stringent regulatory standards |

| Use Cases | Predominantly used in trading for liquidity; widely accepted across exchanges | Preferred for business transactions; significant presence in DeFi applications |

How to choose between USDT and USDC

- USDT and USDC are the dominant stablecoins, sharing a common concept but differing in their approaches.

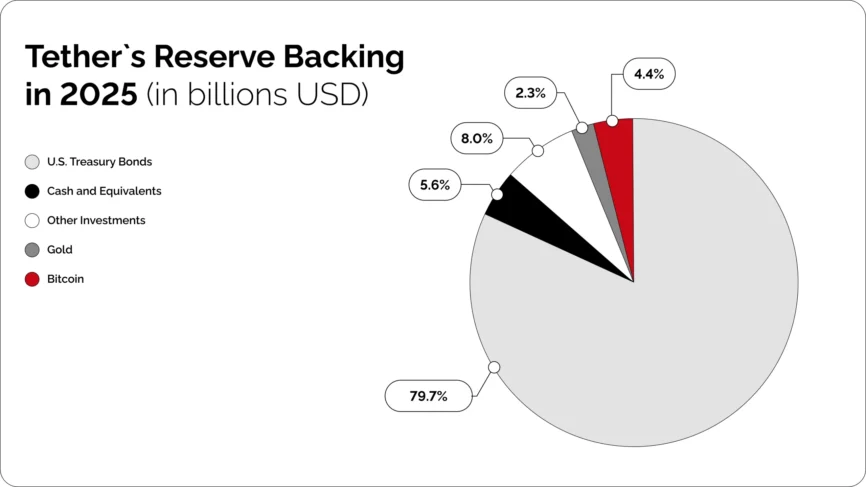

- USDT boasts wider adoption and deeper liquidity across crypto exchanges. It is supported on multiple blockchains, which enhances its flexibility. However, Tether, the company behind USDT, has faced controversies regarding the transparency of its backing assets, leading some users to seek alternatives.

- USDC, on the other hand, has prioritized transparency since its inception. It undergoes regular independent audits to verify its reserves, which has earned it a reputation for reliability and compliance.

When choosing between the two, there is no definitive answer. For frequent traders, USDT might be the preferred choice due to its broader market presence and greater liquidity. Conversely, for those prioritizing transparency and regulatory compliance, USDC may be a better fit, particularly for long-term holdings.

How to accept USDC and USDT as a business

Accepting cryptocurrencies can do wonders for businesses. Integrating stablecoin payment methods can:

- Open new revenue streams.

- Expand your customer base by attracting tech-savvy and international clients.

- Reduce transaction costs compared to traditional payment methods.

- Ensure faster payment processing times.

- Minimize currency conversion fees.

- Offer a secure and stable payment option in volatile markets.

At CryptoProcessing.com, we offer a comprehensive suite of services, including a corporate crypto wallet, to facilitate seamless cryptocurrency transactions for your business. With support for over 20 additional, more volatile cryptocurrencies, including Bitcoin, Ethereum, Litecoin, and others, we’re able to approach each client case individually.

To get started with us, follow these steps:

- Visit our website: Go to CryptoProcessing.com to explore our services.

- Contact us: Reach out through our contact form or via email to express your interest.

- Consultation: Our team will discuss your business requirements and provide tailored solutions.

- Onboarding:

- Agreement: Review and sign the cooperation agreement outlining our terms and services.

- Integration: Utilize our API and integration support to set up cryptocurrency payment options on your platform.

- Start accepting payments.

Businesses might also consider using an OTC (Over-the-Counter) payment solution for large trades to minimise slippage. If that’s the case, we’re here to help.

Both USDC and USDT offer stability: one is highly compliant, while the other is highly liquid. Businesses must therefore choose the right balance based on their priorities.

Summary

USDT and USDC remain the top stablecoins, each serving different user needs. USDT leads with a market cap of over $130 billion and high trading volume, favored for its liquidity and broad exchange presence. USDC, with more than $40 billion in market cap, is known for transparency and strong reserve backing. Both offer fast, affordable cross-border transfers and play important roles in decentralized finance. Each stablecoin presents distinct advantages, liquidity for USDT and regulatory transparency for USDC, allowing users to choose based on their priorities.

- USDT operates on platforms like Ethereum, Tron, and Binance Smart Chain, enhancing flexibility.

- USDC is widely used in business transactions and decentralized finance lending.

- Both stablecoins tend to maintain a 1:1 peg with the U.S. dollar and support cross-border payments.

- Integrating stablecoin payments can attract international and tech-savvy customers who seek modern payment options.

CryptoProcessing supports stablecoin integration in alignment with applicable industry standards and regulatory requirements.

USDC vs USDT FAQ

USDC is often considered more transparent due to regular audits, while USDT has higher liquidity and wider acceptance. The choice depends on your priorities: transparency or liquidity.

Both are stablecoins pegged to the U.S. dollar, but they differ in transparency, regulatory compliance, and market adoption. USDT has faced scrutiny over its reserve disclosures, whereas USDC is praised for its transparency.

On Binance, both serve as trading pairs, but USDT typically has higher trading volumes and liquidity. USDC may appeal to users prioritizing transparency and regulatory compliance.

USDC allows for faster, cheaper, and borderless transactions compared to traditional USD bank transfers, making it convenient for digital transactions.

USDC aims to maintain a 1:1 peg with the U.S. dollar, but minor fluctuations can occur due to market conditions. Generally, it stays very close to $1.

USDC is considered safe due to its full backing by reserves and regular audits, but it’s essential to stay informed about market and regulatory developments.

Enhance your business. Our team is here

to ensure a smooth setup.