Digital money moved from debate to deployment. Central banks now test retail and wholesale CBDCs. Private issuers scale stablecoins into a quarter-trillion market. For a finance team, the question shifts from the realm of theory to cash flow, risk, and reach.

This guide explains what CBDCs and stablecoins mean for payments, treasury, and growth in 2025. It maps the difference between CBDC and cryptocurrency, tracks regulation across major markets, and gives a practical path to pilot and scale.

Understanding CBDCs and stablecoins

What is a CBDC?

It’s in the name – Central Bank Digital Currency, i.e, digital central bank money. Retail CBDCs target the public and businesses. Wholesale CBDCs serve interbank settlement. Design choices vary, but the core point holds: we’re talking about digital assets that are a direct liability of the central bank.

What is a stablecoin?

A stablecoin is a private token designed to hold a stable value. In the EU, MiCA defines two main types: asset-referenced tokens (ARTs) and e-money tokens (EMTs). EMTs reference a single fiat currency for payments. Algorithmic designs sit outside these categories.

Why the comparison matters now

- The ECB’s digital euro preparation phase focuses on privacy, offline use, and a rulebook for broad acceptance. A pilot could follow once the law is ready.

- The EU’s MiCA Titles III and IV have applied to stablecoins since June 30, 2024. ESMA and EBA have issued guidance and reporting standards.

- Singapore finalized a stablecoin regime with redemption at par and reserve rules. Hong Kong’s licensing for stablecoin issuers took effect on August 1, 2025.

- In the US, the GENIUS Act was introduced in July 2025, setting a federal framework for “payment stablecoins.” Implementation rolls out over the next 18 months or sooner if regulators finalize rules.

Fundamentals at a glance: CBDC vs Stablecoins

| Dimension | CBDC | Stablecoin |

| Issuer | Central bank | Private issuer under a regulatory regime such as MiCA, MAS, GENIUS, etc. |

| Liability | Public money, central-bank liability | Private money, issuer liability |

| Purpose | Public means of payment, governance goals | Payments, trading, on-chain settlement, yield variants |

| Backing | Sovereign backing and settlement in central-bank money | Reserves in cash, T-bills, or baskets per rules |

| Privacy | Depends on design and implementation | Varies by issuer and chain transparency |

| Tech base | Often permissioned DLT or conventional rails | Public or permissioned chains |

| Cross-border | Active pilots for blockchain interoperability and cross-border settlements | Active today across chains and custodians |

Bottom line:

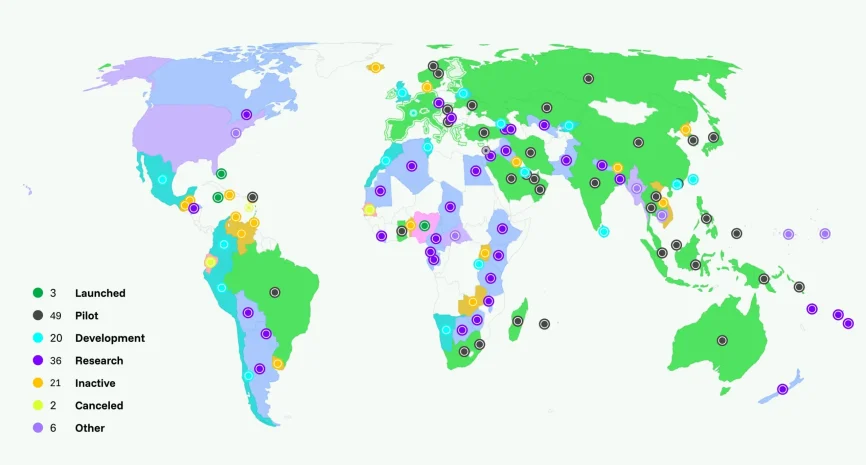

Stablecoins are typically tied to existing assets, are already well-established and readily available on the market. CBDCs are widely discussed by governments with varying degrees of implementation. According to the Atlantic Council, 137 countries are actively exploring CBDCs, with 49 in pilot stages as of July 2025.

Business use cases and implications

What businesses can do with stablecoins

1) Merchant crypto integration and checkout conversion

- Accepting stablecoins from global customers and settling on fiat or crypto is easy, especially if you use CryptoProcessing.

- Visa already pilots USDC settlement with acquirers, showing how stablecoins will soon plug into the card-network treasury as well.

- Pay 1.5% or less in processing fees while processing payments anywhere where crypto payments are legal.

2) Treasury management with digital currencies

- Hold and route stablecoin working capital for supplier payments across time zones.

- Use the crypto wallet for business for currency exchange, reporting, and audits.

- Use stablecoins as a bridge asset for remittances efficiency where bank rails are slow. In general, stablecoins are liquid in most jurisdictions, and Circle’s USDC is even MiCa-compliant in the EU.

What to expect from CBDCs

1) Cross-border settlements and cash management

- CBDC pilots explore new ways to settle cross-border retail and wholesale flows. Project Icebreaker linked three CBDC test systems via a hub-and-spoke model.

- Banks test tokenized deposits on shared ledgers, including the Regulated Liability Network research led by the New York Fed’s innovation center. That model tokenizes bank liabilities for programmable settlement.

2) Corporate digital currency adoption

- Policy momentum is strong. BIS’s 2024 survey shows CBDC work advancing as more jurisdictions regulate stablecoins and scale real-world asset tokenization pilots.

- CBDC experiments focus on API layers to connect public infrastructure with private apps. Your finance stack may be able to tap API-first rails for invoicing, payouts, and reconciliation.

Risks and challenges for businesses

- Issuer and reserve risk. Stablecoin strength depends on reserves, disclosures, and redemption. BIS has warned on structural risks and called for stronger policy responses. Stablecoin regulation is getting more robust in most jurisdictions.

- Operational risk. Key management, wallet security, and vendor resilience need tight controls and multi-signature management. Additional staff training and due diligence are required.

- Compliance risk. KYC and risk-scoring are important factors when accepting stablecoins. For the most part, this will be solved by working with a compliant and licensed payment service provider, such as CryptoProcessing.

- Liquidity and market structure. Today, payment flows may also include yield-bearing stablecoins and tokenized deposits. Treat yields as financial products with added risk, not as cash. CBDCs may shift risk profiles further if and as they come.

- Sustainability. CBDC planners emphasize energy efficiency and re-use of existing payments infrastructure. Businesses may need to factor environmental metrics into vendor selection in the future.

“Most businesses can add a “Pay with Crypto” button and accept stablecoins right now; that’s been solved. However, we still don’t really know what CBDC rails are going to look like in different countries. But I’m sure that when and if they come out, we’ll have that button too.”

FAQ

A CBDC is public money issued by a central bank. A stablecoin is private money backed by reserves and governed by issuer rules. CBDCs target wide acceptance and public policy goals. Stablecoins focus on programmable commerce and on‑chain finance.

CBDCs are expected to be the digital evolution of today’s fiat currency – and they aren’t on the market yet. Stablecoins gain clarity under MiCA, MAS, HKMA, and the US GENIUS Act, but you still assess the issuer, reserves, disclosures, and redemption paths. Stablecoins are on the market and readily available for corporate payments.

Merchants accept stablecoins at checkout and settle back to fiat. EU businesses can use USDC for settlement if they work with a compliant payment provider. Many firms across the globe use stablecoins for B2B payouts and faster supplier payments across time zones.

In theory, yes. BIS projects and industry pilots show blockchain integration across public and private money, including tokenized deposits and CBDCs. We are more likely to expect digital currency convergence rather than a single winner in the future.

Conclusion

The core difference between CBDC and cryptocurrency is in its issuers and goals. CBDCs standardize public digital cash with a new approach to issuing money – it’s a matter of implementation in different jurisdictions. Stablecoins already cover global rails today with deep liquidity, smart‑contract logic, and growing compliance regimes.

CryptoProcessing helps you start processing stablecoins well before CBDCs enter the market in any meaningful way. We provide a payment gateway, mass payouts, automatic exchange, and a business wallet that supports top cryptocurrencies and stablecoins.