Cryptocurrency markets never sleep – and while that 24/7 accessibility opens up new opportunities, it also introduces extreme price swings.

Take May 2025, for a recent example: Bitcoin hit a record high of $111,970, only to tumble to around $104,000 within a few days – a nearly 7% drop.

This kind of cryptocurrency volatility can make day-to-day business operations a nightmare. Managing payroll, settling supplier payments, issuing invoices, or forecasting revenue becomes much harder when the value of your assets can change dramatically by the hour.

That’s where stablecoins come in. These stable value crypto assets are digital currencies pegged to more predictable references – usually fiat currencies like the U.S. dollar. They combine the speed and global reach of crypto with a much-needed layer of volatility protection.

For businesses, this means predictable cash flow, faster cross-border transactions, and no reliance on bank intermediaries.

What’s causing cryptocurrency volatility?

Before diving deeper into how stablecoins help, it’s worth understanding what drives such wild swings in the crypto space.

1. Thin liquidity and speculation

Most cryptocurrencies aren’t traded in high volumes, which means that even moderately large trades can shift prices dramatically.

Add to that a heavy dose of speculative trading – driven more by emotion than fundamentals – and you get markets prone to sudden spikes and crashes.

2. Leverage and margin trading

Many crypto traders borrow funds to increase their exposure. When prices move the wrong way, liquidations are triggered automatically, accelerating the sell-off and creating cascading price drops across the board.

3. Regulatory news shocks

Crypto is highly sensitive to headlines. A sudden regulatory announcement – such as a crackdown or ban – can wipe out billions in market value overnight, spooking investors and freezing business operations.

4. Lack of intrinsic value anchors

Unlike traditional financial assets, many cryptocurrencies don’t produce cash flows or represent ownership in real-world assets. This absence of intrinsic value makes them particularly vulnerable to market sentiment and herd behavior.

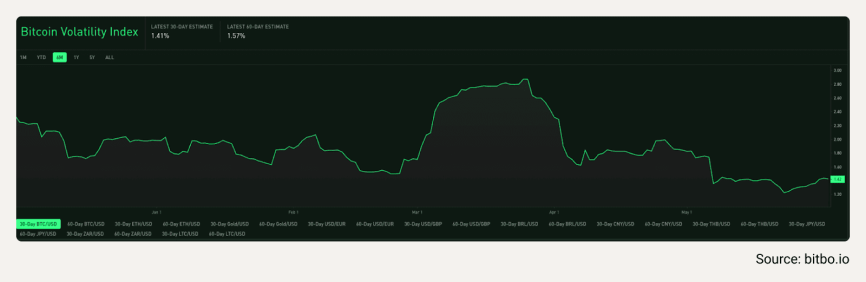

Cryptocurrency volatility chart

One popular way to visualize and track cryptocurrency volatility risk is through tools like the Cryptocurrency Volatility Index (CVI) or Bitcoin Volatility Index (BVI), which chart market instability over time.

But what do they tell us? Generally speaking, crypto remains a highly volatile asset class. Sharp price swings of 5-10% in a single day are not unusual, even for currencies with deeper liquidity.

Business risks from crypto volatility

Cryptocurrency and volatility go hand in hand – and that’s a problem for companies trying to build financial systems around it. Here are just a few challenges:

- Invoice risk: When clients pay in volatile crypto, the value may drop significantly between the time of invoicing and the time of settlement – impacting revenue accuracy.

- Complex treasury management: Treasury teams face added burdens when they constantly have to mark-to-market and adjust for price swings.

- Payment failures from slippage: Rapid price movement during a transaction can result in payment mismatches or rejections – particularly if the network doesn’t auto-adjust for crypto payment integration.

Stablecoins – a practical solution to cryptocurrency volatility

Stablecoins are designed to sidestep these problems. They maintain a stable value by pegging to external references – such as fiat currencies, commodities, or even other cryptocurrencies – and they offer fast, secure payments without exposure to wild market shifts.

Main types of stablecoins

| Type of Stablecoin | Backing Mechanism | Examples | Key Benefits |

|---|---|---|---|

| Fiat-Backed | 1:1 with fiat currency (e.g., USD) | USDT, USDC | High stability, widely used in business payments |

| Commodity-Backed | Pegged to physical assets (e.g., gold) | PAXG, CACHE Gold | Hedge against inflation, real-asset exposure |

| Crypto-Backed | Collateralized with volatile crypto (e.g., ETH) | DAI | Decentralized, smart contract-based stability |

| Algorithmic | Stabilized via on-chain supply algorithms | (Previously UST) | No collateral required, highly scalable |

Why businesses are turning to stablecoins

For companies toughing it out in a volatile crypto landscape, stablecoins offer clear advantages:

- Predictable Cash Flow: Enables accurate budgeting and financial forecasting.

- Instant Settlements: Transactions settle within seconds – ideal for payroll, supplier payments, and recurring bills.

- Low Transaction Fees: Avoid costly banking intermediaries, wire delays, and cross-border markup fees.

- Smart Contract Payments: Automate invoicing and recurring payouts via on-chain logic – perfect for platforms using crypto invoicing or DeFi integrations.

- 24/7 Availability: Never wait for bank hours again. Settle transactions across time zones in real time.

- Reduced FX Risk: Especially powerful for global businesses, stablecoins allow currency-agnostic transactions that eliminate conversion delays and slippage.

Open a business crypto account with stablecoin support at LINK and experience instant settlements, low fees, and predictable payments with enterprise-grade security.

Stablecoins vs. traditional cryptocurrencies – what sets them apart?

Stablecoins and traditional cryptocurrencies like Bitcoin and Ethereum play very different roles in the digital economy.

While assets like BTC and ETH are known for high price volatility and are often used for speculative investment, stablecoins are designed for one thing: stability.

That makes them much more suitable for business payments, day-to-day transactions, and efficient treasury operations.

| Feature | Bitcoin / Ethereum | Stablecoins (e.g., USDC) |

|---|---|---|

| Price Volatility | High (10–20% weekly) | Low (≤1%) |

| Settlement Time | 10–15 minutes (BTC), faster on ETH | Near-instant |

| Transaction Fees | Variable, often high | Low and predictable |

| Usability for Payroll | Risky due to price swings | Ideal for consistent payments |

| Accounting Simplicity | Complex, frequent revaluation | Transparent, easy to reconcile |

How businesses use stablecoins in the real world

Stablecoins are becoming a go-to tool for businesses looking to move faster, reduce friction, and improve financial resilience.

1. Cross-border supplier payments

International wire transfers are notoriously slow, expensive, and bogged down by banking intermediaries. Stablecoins offer a faster, cheaper alternative for global settlements – cutting transfer times from days to minutes.

2. Stablecoin payroll for global teams

Paying freelancers or remote employees in multiple currencies usually requires dealing with FX conversions, delays, and high fees. Stablecoins let businesses send consistent-value payments – instantly and globally.

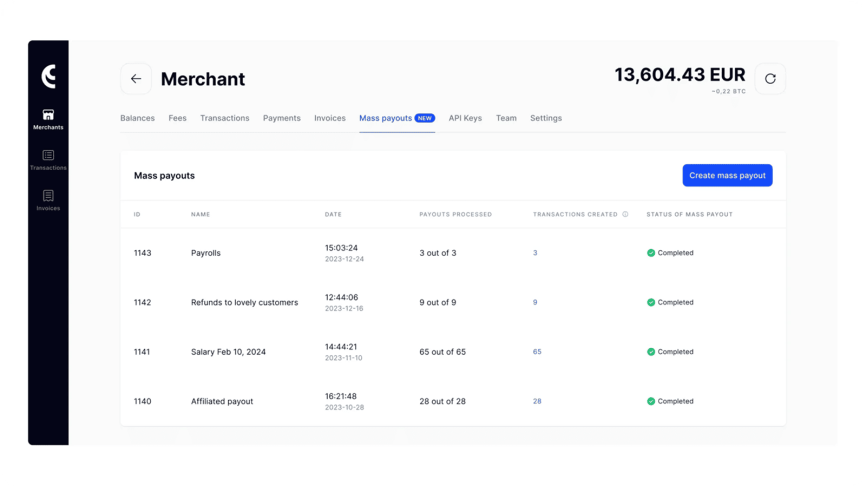

Cryptoprocessing.com, for instance, offers mass payout tools that automate stablecoin salaries for hundreds of contractors or employees.

3. Treasury diversification and cash parking

Some businesses use stablecoins to park digital cash reserves – especially in regions facing currency devaluation, capital controls, or inflation. Fiat-pegged stablecoins like USDC offer a liquid and stable store of value, ideal for short-term crypto risk management.

4. Instant crypto invoicing

Stablecoins simplify crypto invoicing by reducing value disputes and delays. Businesses can issue invoices in stablecoins and receive payment in seconds.

At Cryptoprocessing.com, businesses benefit from built-in invoicing tools with real-time conversion and tracking.

5. Smart contract-based B2B automation

For companies using blockchain for supply chain or logistics, stablecoins enable smart contract payments that trigger automatically when conditions are met – perfect for milestone-based B2B agreements.

“At CryptoProcessing.com, we’ve seen a major shift toward stablecoins in business operations. Predictable value and instant settlements make them an ideal payment layer for forward-looking companies.”

Looking ahead – stablecoins and cryptocurrency volatility

As regulation, technology, and use cases mature in 2025, the role of stablecoins is only growing.

Regulatory Clarity Is Fueling Adoption

In the EU, the MiCA framework now requires stablecoin issuers to hold full reserves and meet transparency standards – encouraging institutional use of euro-backed stablecoins like Circle’s EURC.

Meanwhile, in the U.S., laws like the GENIUS Act and STABLE Act aim to give fiat-backed stablecoins a clear legal foundation, requiring 1:1 reserve backing and stronger disclosures.

Layer 2 Integration Boosts Efficiency

The integration of USDC into Layer 2 networks like Arbitrum and Optimism is slashing costs and boosting stablecoin transaction speed, enabling real-time payments at scale.

This tech stack is especially useful for instant settlements, stablecoin liquidity, and B2B automation.

Expanding Beyond Fiat Pegs

The future of stablecoins includes tokenized real-world assets (RWAs) – such as stablecoins backed by U.S. Treasuries or commodities.

These offer additional volatility protection and improved options for treasury management in uncertain economic climates.

Complementing CBDCs

With central banks exploring CBDCs, stablecoins may serve as the connective tissue – powering CBDC-compatible platforms that enable full B2B ecosystems. Think: stablecoin payroll, crypto invoicing, and even automated audit trails, all executed without banking delays.

Cryptocurrency and volatility – a panacea?

Cryptocurrency market volatility remains a key barrier for many companies looking to adopt digital currency for business use.

Stablecoins bridge that gap. They offer:

- The instant settlements and global reach of crypto;

- The predictable cash flow and pricing stability of fiat;

- And a future-proof infrastructure that integrates with smart contracts, CBDCs, and tokenized assets.

So, whether you’re paying global freelancers, streamlining supplier payments, or diversifying your treasury, stablecoins are the fastest route to secure, modern business payments.

Open a CryptoProcessing.com account and build stability into your crypto strategy.