Stablecoins are cryptocurrencies pegged to stable assets (like the US dollar) to minimize price swings. They combine blockchain benefits (24/7 instant settlement) with fiat stability, making them popular for international payments and treasury management. Companies from SpaceX to PayPal use stablecoins for cross-border transactions and corporate payments.

As usage grows, crypto tax compliance becomes critical to avoid audits or penalties. This guide answers the following questions.

What you’ll learn in this article

- Are stablecoin transactions taxable?

- Which events (trades, payments, payroll) trigger tax?

- How to report crypto income and gains across jurisdictions?

- When are taxes due on crypto transactions (US, EU, Asia)?

- Special cases: cross-border transfers, invoicing, payroll, remittances.

- Strategies to reduce crypto tax bills.

Need help navigating crypto tax rules? Consult СryptoProcessing’s tax experts or download our free compliance checklist for businesses.

Understanding stablecoin taxes

Stablecoins are taxed like other cryptocurrencies. Tax authorities treat them as digital assets/property. The IRS, for example, explicitly includes stablecoins in its definition of digital assets and requires all crypto transactions (including stablecoins) to be reported on tax returns.

In other words, any sale, exchange, or use of stablecoin is a taxable event.

In fact, the US offers one of the clearest frameworks for stablecoin taxation, so we’ll begin by examining how reporting works there before turning to regulations in Europe and Asia.

Key taxable events:

- Exchanging crypto for stablecoin (or vice versa): Converting Bitcoin, Ethereum or any other crypto into a stablecoin (e.g. USDT, USDC) is a disposal of property, triggering capital gain or loss on the difference between cost basis and market value. Likewise, trading one stablecoin for another or into fiat triggers gain/loss. (Since stablecoins are pegged to USD, gains are often small, but still reportable.)

- Selling or spending stablecoins: Using stablecoins to buy goods/services or settling invoices is also a disposal. For example, if you convert $200 worth of stablecoin into a $300 purchase, you report a $100 gain. Each disposal (spending or sale) must be recorded and reported.

- Receiving stablecoins as income or payment: If your business receives stablecoin as payment for goods or services, the fair-market value in local currency at receipt is ordinary income. (For example, paying a contractor 1,000 USDC when the USD price is $1 each means $1,000 of income.) This applies to sales revenue, consulting fees, and any stablecoin awarded (e.g. staking or rewards).

- Paying wages or suppliers in stablecoin: Paying employees or vendors in stablecoins creates a taxable event. For employees, the stablecoin amount (at FMV) is treated as wages subject to withholding and reported on Form W-2. For suppliers, using stablecoin means you exchanged an asset for a service – this triggers a capital gain or loss on any change in value irs.gov. (If your supplier is a US business, they also record income.) In all cases, record the USD value at the transaction date.

Stablecoins vs. other crypto

Because stablecoins are tied to fiat, they exhibit minimal volatility. This usually means insignificant capital gains/losses on trades. For instance, trading $10,000 USDC for other crypto might yield almost zero gain.

However, tax treatment remains the same as volatile crypto. Every exchange, trade or purchase with a stablecoin is reportable. The IRS and most tax agencies do not exempt stablecoins, despite their stable value. (Some VAT/GST rules may treat stablecoin payments differently, but income and gains taxes follow general crypto rules.)

In practice, stablecoins simplify accounting by avoiding large fluctuations, but businesses must still track and report every transaction.

How to report cryptocurrency taxes

Accurate records are key. Businesses typically use specialized crypto accounting or tax software to import transactions and generate reports.

Tools like CoinLedger, TaxBit, Koinly, CoinTracking and CoinsPaid’s own crypto accounting platform can sync with exchanges and wallets via API or CSV.

These platforms consolidate trades, automatically compute gains/losses (FIFO, LIFO, etc.), and produce tax forms (e.g. Form 8949 in the US). Some ERP/accounting systems (e.g. Netsuite with crypto modules) also support crypto.

Avoid these pitfalls to prevent an audit:

- Incomplete transaction records: Failing to record every crypto transfer, trade or fee can understate taxable gains. Self-custodied trades, DeFi swaps, airdrops, and mining/staking rewards must be tracked. Compare exchange/ broker 1099s to your ledgers and ensure all reportable events are included.

- Incorrect cost basis: Miscomputing purchase price (e.g. ignoring fees) leads to errors. Include transaction fees in the basis – this lowers reported gains.

- Mixing personal and business: Use separate wallets/accounts for business transactions. This prevents confusion over which trades belong to the company.

- Forgetting forms: In the US, businesses should use Form 8949/Schedule D for capital gains and Schedule C (or 1120 for corporations) for crypto revenue. Missing required forms (like IRS’s new 1099-DA for brokers) triggers IRS notice.

- Not updating exchanges: Some businesses treat crypto like cash and spend it without logging each use. This leads to complications when filing – it’s crucial to reconcile spending transactions at year-end.

Protect your business from audit risks. Schedule a crypto tax review today or use our recommended software to automate reporting.

What does the reporting process look like?

The basic steps are:

- Collect records: gather exchange statements, wallet exports, payroll/expense receipts in crypto.

- Calculate gains/losses: use software or a ledger to match sales/exchanges and compute profit or loss (include fees as adjustments).

- Report income: list any crypto payments received as business revenue.

- Complete tax forms: incorporate numbers into your tax returns (e.g. Form 1040, 1120, VAT returns, etc.).

- File and pay: submit by the deadline in each jurisdiction.

When do businesses pay taxes on crypto?

Crypto taxes follow your regular tax calendar.

In the United States, businesses report crypto gains and income on annual returns (corporations by April 15, partnerships/S-corps by March 15). However, any crypto income or gain is taxable in the year it occurred, even if not realized in cash. For example, a January 2024 sale of crypto for USD is included on the 2024 return due in 2025.

Note that the IRS has added a question on Form 1040 asking if the taxpayer “received, sold, exchanged, or otherwise disposed of any digital asset” during the year. This applies to businesses and individuals alike. In 2025, brokers will issue Form 1099-DA for crypto sales, so taxpayers must reconcile their filings with these reports.

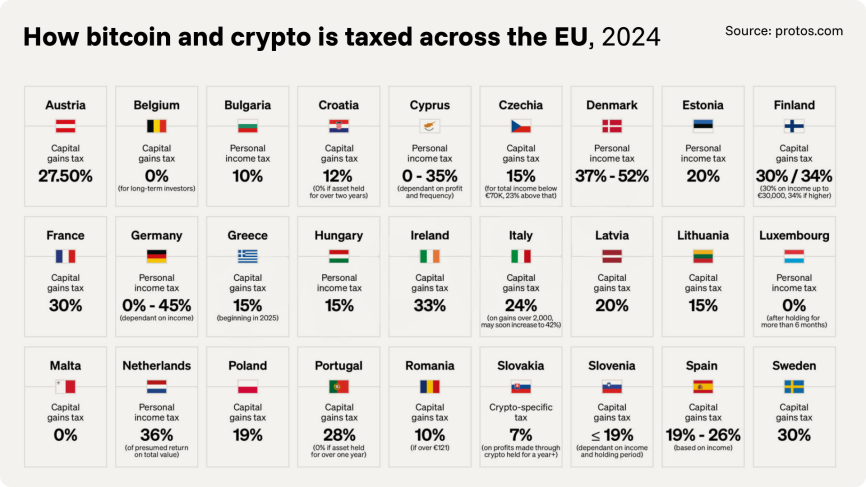

In the European Union, each country sets its deadlines, but filings typically occur once per year. Crypto gains are generally treated as capital or business income. Notably, starting from 2026, EU DAC8 rules will require automatic exchange of crypto tax information between member states, making timely reporting mandatory. Also, EU’s MiCA regulation (effective 2024) will require stablecoin issuers to publish audited reserve reports, increasing transparency (though not a tax rule per se).

In Asia, deadlines vary by country:

- For example, Japan’s tax year is calendar (Jan–Dec) and crypto transactions are reported by March 15 of the following year;

- India treats crypto as a flat 30% tax on gains (due by July 31, etc.);

- Singapore has no capital gains tax on crypto for individuals, but businesses must report crypto revenue as ordinary income.

Always align crypto reporting with your country’s corporate or income tax filings.

Tax triggers and events: A recap

Taxes are triggered when crypto changes hands or generates income. Key events requiring reporting include:

- Trades and sales: Selling crypto for fiat or swapping one crypto for another is taxable (capital gain/loss).

- Goods/services payments: Accepting or making payments in crypto (including stablecoins) is taxable as income or disposal respectively.

- Payroll: Paying employees in crypto requires payroll tax withholding on the USD-equivalent wage.

- Airdrops, forks, staking: Receiving tokens or rewards is taxable as income in many jurisdictions.

- Cross-border transfers: Moving crypto across countries might trigger reporting under transfer pricing or information-sharing laws (e.g. OECD CARF). Large cross-border stablecoin payments can be reportable under FATF/AML rules and soon under DAC8/CARF.

In short, any crypto-related transaction that results in gain or income should be reported in the tax year it occurs. (Crypto transfers between your own company wallets only are generally not taxable events, but you must track basis.)

Special cases for businesses

B2B transactions

When two businesses transact in stablecoins, the payer should record the expense at the stablecoin’s USD value, and the payee recognizes the same amount as revenue. VAT/sales tax is due on the underlying sale amount (in USD). For instance, if you invoice a supplier 5,000 USDC for services, you record a $5,000 expense (and possibly gain/loss if your own USDC basis differs), and pay the applicable VAT on $5,000 if required. In the EU, crypto-to-fiat exchanges are VAT-exempt (treating crypto as currency), but the sale itself still carries VAT as usual.

International payments/remittances

Using stablecoins for cross-border B2B or remittances speeds up settlement, but each leg has tax implications. The receiving country may treat incoming crypto as foreign income, requiring conversion to local currency for tax purposes. New global reporting frameworks mean such transfers are increasingly scrutinized. The OECD’s Crypto-Asset Reporting Framework (CARF) and EU’s DAC8 (effective 2026) will compel crypto firms to share transaction data across borders. Businesses should keep records of cross-border stablecoin transfers to support proper tax reporting.

Invoicing in stablecoins and sales tax

Companies may invoice customers in stablecoins. It’s critical to state the invoice in a legal currency equivalent (e.g. USD) and calculate sales/VAT based on that value. The stablecoin itself is treated as payment, but taxes are levied on the goods/services. For example, an invoice for €10,000 (paid in EURT stablecoin) still has €10,000 subject to VAT/GST. Be sure to comply with local sales tax laws: many jurisdictions require VAT on the product/service, not on the crypto payment.

Crypto payroll taxes

Paying staff in stablecoins triggers payroll taxes. The stablecoin’s USD value at payment becomes the employee’s taxable wage. Employers must withhold income tax and FICA, just as with fiat wages. Employers can deduct these wages as a business expense at the FMV. (From an employee’s view, receiving $1,500 USDC is $1,500 income on the W-2.) Failure to withhold properly can incur penalties, so treat crypto payroll like cash payroll for tax purposes.

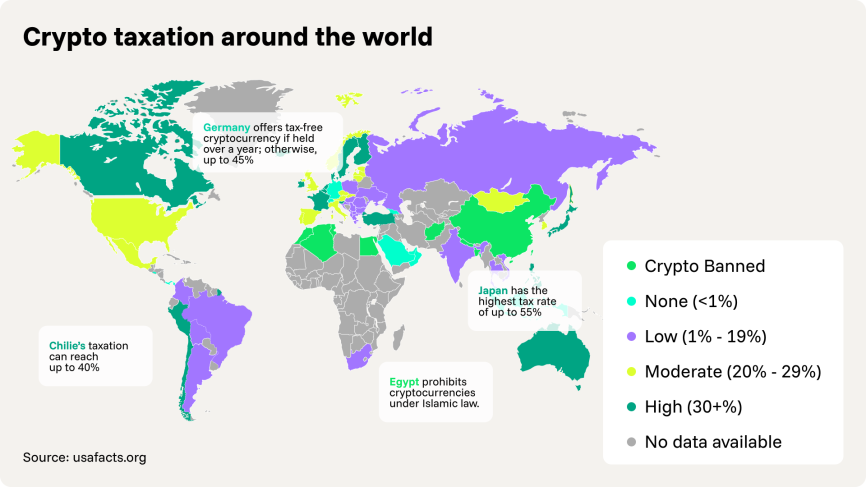

Crypto taxation around the world

Tax rules vary widely. For instance, Japan taxes crypto income up to 55%, while Germany imposes no tax on crypto gains held over one year.

The map above highlights this diversity: countries in blue impose low or no crypto taxes, whereas purple tones denote higher rates.

Cross-border stablecoin use means you must map local tax laws carefully. If you send or receive crypto internationally, know that one jurisdiction’s tax-free treatment might not apply elsewhere.

In Asia, for example, India taxes all crypto gains at 30%, but Singapore exempts most crypto gains. Stay aware of these cross-border rules to ensure compliance.

How to minimize crypto tax liability

Structuring transactions

Plan timing of disposals to take advantage of tax rules. Remember, in Germany, holding crypto over 1 year can eliminate tax on gains.

Though most countries don’t offer such breaks, maintaining long-term holds can reduce reporting frequency. Consider also the corporate structure: some jurisdictions (like Hong Kong) have tax holidays or exemptions for crypto trading by funds. Use these incentives legally to lower effective rates.

Deductible expenses

Business expenses paid in crypto are deductible. Keep receipts for all crypto-related costs (equipment, software subscriptions, consulting).

Network and exchange fees incurred on trades can be added to cost basis, thereby lowering taxable gains. Also, if your business mines crypto or engages in staking, you can deduct mining hardware depreciation and electricity costs as business expenses against that income.

Accurate recordkeeping

The best way to minimize penalties is meticulous records. Keep a comprehensive ledger of all crypto inflows and outflows, including dates, values, and purpose.

Use blockchain explorers or accounting apps to verify wallet transfers. If audited, clear records of cost basis, transaction history and FMV of each transaction will substantiate your tax positions.

Good software or professional accountants can automate much of this.

Tax-loss harvesting

If laws permit, sell underperforming crypto assets at a loss to offset gains elsewhere, reducing overall tax. Note that many jurisdictions (like India) don’t allow offsetting crypto losses against other income, so check local rules.

Professional advice and audits

Finally, consider periodic tax audits or reviews by crypto-specialist CPAs. This can catch errors early and prevent big fines later. Given the IRS’s growing scrutiny in the US, an ounce of prevention is worth a pound of cure.

Future of Stablecoin Taxation (2025)

As of 2025, the regulatory landscape for crypto remains in a state of flux.

In early 2025, the White House issued an Executive Order prioritizing stablecoin regulation. This signals that Congress and regulators will enact clear rules for stablecoin issuers and users.

Meanwhile, the IRS has expanded reporting: the final 2025 Form 1099-DA requires brokers and even “DeFi” platforms to report crypto sales.

New regulations (TD 10021) broaden the definition of broker to include crypto exchanges, stablecoin issuers and decentralized finance protocols. In practice, this means all stablecoin transactions on major platforms will soon be reported to the IRS.

Businesses should expect tighter enforcement (more audits, information-matching) and plan accordingly.

International coordination should also be considered. After all, in 2025, global tax authorities are increasing crypto cooperation.

The OECD’s Crypto-Asset Reporting Framework (CARF), for example, is being adopted by dozens of countries. Also, once more, EU’s DAC8 (effective 2026) will force crypto firms to report user transactions to tax agencies.

These rules cover stablecoins as well as other crypto. The goal is to automatically share data on cross-border crypto flows. For businesses, this means a decrease in reporting arbitrage – if a transaction is reported in one country, it will be visible elsewhere.

Next, many jurisdictions are enacting stablecoin legislation.

The EU MiCA law (Dec 2024) will require stablecoin issuers to hold 100% reserves and publish audits – this enhances transparency but may not directly change taxes.

Meanwhile, Hong Kong is making stablecoin activity more attractive with tax breaks for crypto fund managers.

On the flip side, some countries may start taxing payments differently if stablecoins become widespread (e.g. treating large crypto transfers as remittances).

Lastly, one should expect more emphasis on compliance. Tax agencies around the world (IRS, HMRC, EU tax authorities, ATO, etc.) are ramping up crypto audits. Schemes such as Form 1099-DA and blockchain surveillance tools mean businesses should be audit-ready.

Stay ahead of changing rules. Subscribe to CoinsPaid updates or contact our tax experts to ensure your stablecoin transactions comply with 2025’s regulations.

Stablecoin taxation and your next steps

Stablecoins offer businesses efficiency and stability, but tax compliance is non-negotiable. To recap:

- Stablecoin transactions are taxable events, just like other crypto.

- Report each sale, swap, payment or receipt accurately in your tax filings (US, EU, Asia have their own rules).

- Use crypto tax software and maintain clear records to avoid mistakes.

- Pay attention to deadlines and new forms (e.g. IRS 1099-DA, EU DAC8).

- In special cases (cross-border, payroll, invoicing) follow both local tax law and international guidelines.

- Plan transactions to optimize tax outcomes, claim all business deductions, and prepare for audits.

In light of the above, it may be time to audit your current crypto accounting:

- Ensure your books reflect each stablecoin transaction with FMV at time of event;

- Consult a specialist if needed;

- Use tools, like those on offer at СryptoProcessing, or professional services to automate crypto tax compliance.

With these practices, your business can reap stablecoin benefits while minimizing tax risk.

Take action now. Reach out to СryptoProcessing to safeguard your compliance and focus on growth.

Summary

The use of stablecoins for payments, payroll, and cross-border transactions is subject to the same tax rules as other cryptocurrencies. Under current regulatory frameworks, many jurisdictions treat each crypto-related transaction, such as payments, exchanges, or receipts, as potentially taxable, depending on local tax laws. For example, payroll or supplier payments in stablecoins may be treated as disposal events or require wage reporting based on the fair market value at the time of payment.

With new reporting rules in the US, EU, and other regions, businesses face stricter oversight. Clear valuations at the time of each transaction, full recordkeeping, and accurate cost basis calculations are critical for compliance.

- Conversions between crypto, stablecoins, and fiat must be reported, with gains or losses calculated for each transaction.

- Payroll and supplier payments in stablecoins trigger wage reporting or disposal events at the fair market value on the payment date.

- International transfers may be subject to mandatory disclosure under frameworks like DAC8 (from 2026) and CARF.

- With evolving reporting regulations such as the upcoming IRS Form 1099-DA, aligning internal records with third-party reporting obligations is increasingly important.

- Network fees and business expenses paid in crypto can lower taxable amounts when properly documented.

By combining disciplined record-keeping with compliance-focused tools, businesses can support the efficient management of stablecoin transactions and help them meet applicable regulatory obligations.