Chances are, even those unfamiliar with crypto have heard of Bitcoin and Ethereum. You might have even read a blog post or two saying that “Bitcoin (BTC) and Ethereum (ETH) are the leading cryptocurrencies” — a statement that’s almost true.

Designed as an alternative to traditional currencies, Bitcoin (BTC) is the original cryptocurrency. It functions mainly as a medium of exchange and a store of value and operates on a blockchain of the same name.

Ethereum, on the other hand, is a software platform for decentralised apps. Its native currency is Ether. And it is Ether (ETH) that gets compared to Bitcoin and runs second in the cryptocurrency race.

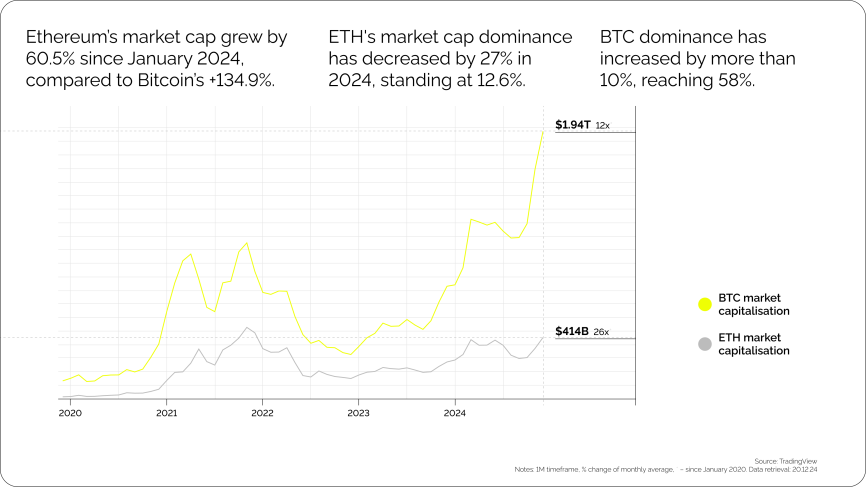

Indeed, Bitcoin and Ether make up more than 69.7% of the entire cryptocurrency market. Their dominance naturally raises a question: who is the winner in the Ether vs. Bitcoin (or, if we are speaking in the broader notion of blockchains, Ethereum vs. Bitcoin) debacle?

Below, we will be breaking down the difference between the two blockchains and their native tokens.

Image 1. Source: CoinMarketCap, dominance is the ratio between the market capitalisation of one crypto to the total market cap of the entire cryptocurrency market.

Ethereum vs. Bitcoin: The Basics

Before we delve into the differences between Bitcoin and Ethereum, let’s explore how both blockchains and their tokens came into existence. As the pioneer, Bitcoin takes the stage first.

What is Bitcoin?

The 2008 financial crisis shuttered trust in traditional finance and inspired the search for alternatives. That’s when an anonymous entity Satoshi Nakamoto introduced Bitcoin. Essentially, it is a digital token that holds value just like your standard dollar bill.

The difference is that unlike physical currencies issued and controlled by governments, Bitcoin is digital and decentralized. All Bitcoin transactions are recorded on a public ledger secured by cryptography, which makes them secure, tamper-proof and free from intervention. Just what’s needed in times of crisis.

While not the first digital currency, Bitcoin’s design captured the attention of investors — far beyond the great recession. Today it is used as:

- A store of value: Similar to commodities like gold or silver, Bitcoin can be held as a long-term investment.

- An investment asset: Bitcoin’s price fluctuations allow making profits through trading.

- A means of payment: Over 15,000 of businesses accept Bitcoin payments for goods and services worldwide.

Useful terms:

- Blockchain — a public, distributed ledger that records all Bitcoin transactions. Each new transaction is cryptographically linked to the previous one, making a secure, tamper-proof chain.

- Mining — the process of verifying and adding new transactions to the blockchain. Miners use computers to solve mathematical problems and get rewarded with new Bitcoins. That’s how new Bitcoins are created.

What is Ethereum?

Ethereum is a decentralised, open-source software platform running on the blockchain technology. It allows developers to build decentralised applications, say, exchange protocols or marketplaces, and run smart contracts.

The token native to the platform is Ether (ETH). Developers use it to pay fees for running transactions and deploying applications on the Ethereum network. Beyond its uses on the blockchain, Ether also has market value. Just like Bitcoin, it can be used as a long- or short-term investment and means of payment.

Useful terms:

- Decentralised application (dApp) — any application that is built on a decentralised network. Unlike traditional apps, decentralised applications operate without a single central authority.

- Smart contract — self-executing contracts stored on the Ethereum blockchain. Such contracts execute automatically once predetermined conditions are met.

- Hard fork — the split that took place in 2015 after a group of participants gained control over the smart contracts of the DAO project and stole more than $50 million worth of Ether. This split marked the division into Ethereum, a blockchain with a revised history, and Ethereum Classic, the original version of the Ethereum blockchain.

Legal, cheap, secure

Ethereum / Ether vs. Bitcoin: Key Features and Differences

| Bitcoin | Ethereum/Ether | |

| Foundation year | 2009 | 2015 |

| Unique proposition | Store of value, decentralised asset | Smart contracts, decentralised applications (dApps) platform, crypto ecosystem |

| Founder | Satoshi Nakamoto (pseudonymous) | Vitalik Buterin |

| Governance | Decentralised | Hybrid |

| Market cap (Dec 2024) | $2.1 trillion | $485.7 billion |

| Price | $105,730 | $4,027 |

| Unique active wallets | 777,34k | 504,68k |

Source: TradingView, the number of unique addresses that were active either as a sender or receiver

Purpose

The creators of Bitcoin and Ethereum had different motivations.

- Motivation behind Bitcoin: For Satoshi Nakamoto, the goal was to break away from the traditional financial system and establish a new payment environment — fair, secure, and resistant to broader market influence.

- Motivation behind Ethereum: For Vitalik Buterin, the author of the Ethereum whitepaper, the aim was to address the limitations of the existing cryptocurrency ecosystem (think: the incompatibility between different protocols and a plethora of different cryptocurrencies.) His vision was to create a platform for building applications that could seamlessly interact with each other.

When it comes to the native currencies of the blockchains, both Bitcoin and Ethereum use their tokens to reward network participants for the work done. Beyond their roles on the blockchains, both Bitcoin and Ether have become attractive investment assets.

Supply

| Blockchain | Total supply | Circulating supply |

| Bitcoin | 21 million | 19.79 million* |

| Ethereum | Unlimited | 120.44 million |

*Bitcoin’s supply cap, paired with human error, resulted in a share of coins being lost. These are referred to as presumably lost coins. Different sources agree that 17-23% of the total Bitcoin supply might be lost, so the circulating supply might be lower.

Bitcoin

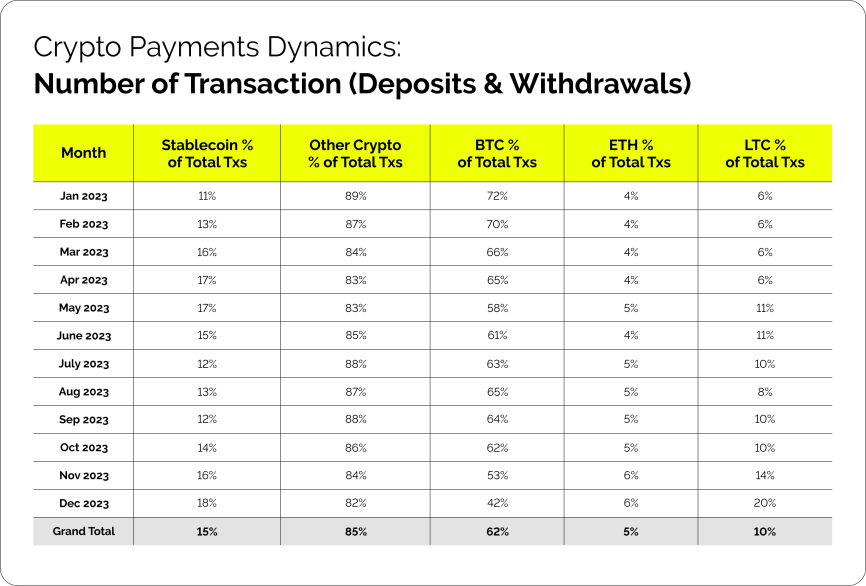

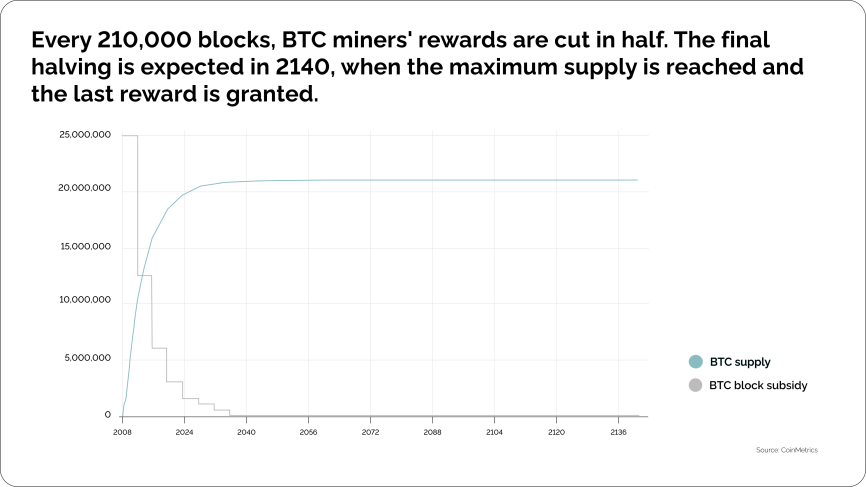

Bitcoin’s total supply is limited to 21 million coins. To understand the origins of this limitation, let’s take a look at how Bitcoins are mined.

New Bitcoins are created as a reward for miners. Each time a miner solves a mathematical problem, they get a certain number of new Bitcoins. The tricky thing is that this number gets split in half every 210,00 blocks (roughly four years) — the process known as halving. So far, there have been four halving events. The most recent halving took place on April 19, 2024, when the reward for mining went down to 3.125 BTC.

Image 2. Source: https://www.fidelitydigitalassets.com/research-and-insights/understanding-bitcoin-and-ethereum-supply

Halvings directly reduce the rate at which new Bitcoins enter circulation. Halvings, coupled with a capped supply, create scarcity, which makes Bitcoin more resistant to inflation.

Ether

Ether’s total supply is, in theory, infinite. But the reality is more nuanced.

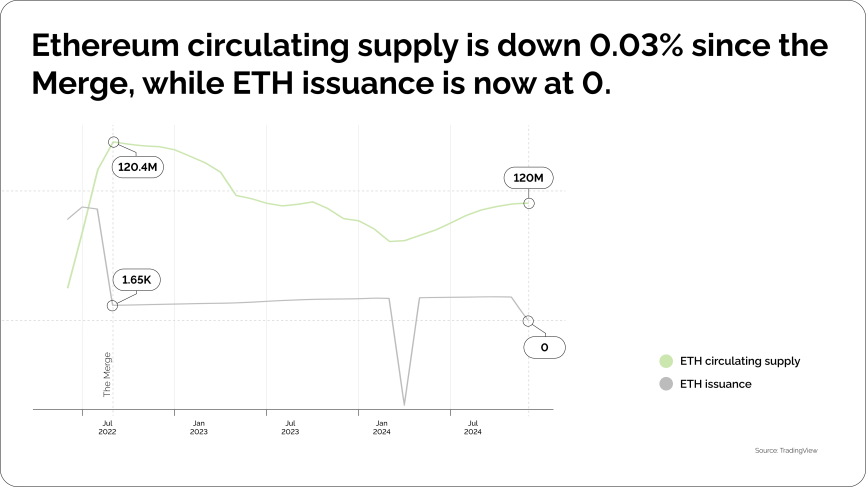

While Bitcoin has gone through four halvings, more significant changes have taken place on the Ethereum protocol that impacted its supply.

The first one took place in 2021. Ethereum introduced a burn mechanism that caused gas, the network fee, to be removed from the circulating supply. Today, whenever you pay a transaction fee, a share of it is sent to a dedicated ETH address that no one can access. This, together with the rising transaction fees when the demand is high, allows to “burn excess coins” and shrinks the circulating supply.

Another upgrade that impacted Ether’s supply is the transition from proof-of-work to proof-of-stake, known as the Merge. This upgrade lowered Ethereum’s energy consumption, cut the block time down to 12 seconds, and — what’s of interest to us — slowed down the rate at which Ether is created.

The two updates have caused Ether’s supply to slowly decrease over time. As of March 11, 2025, the circulating supply of Ether is 120.6 million tokens.

Adoption and usage

Measuring the adoption of both tokens is no easy feat. Sure, there are metrics like active addresses and transaction volumes. Informative to an extent, they don’t paint a full picture. The thing is both Bitcoin and Ether have use cases beyond their respective blockchains. These are a bit more difficult to record. Still, here’s what is known.

Bitcoin vs Ethereum: on-chain metrics (approximated)

| Bitcoin | Ethereum | |

| Active addresses | 851,000 | 512,000 |

| Daily transaction volume | 300,000 | 1,300,000 |

| Average transaction value (past month) | $10,000 | $3,000 |

Bitcoin vs Ethereum: off-chain metrics

Number of wallets

- Bitcoin — 200 million

- Ether — 200 million

Number of businesses that accept BTC and ETH

Institutional adoption

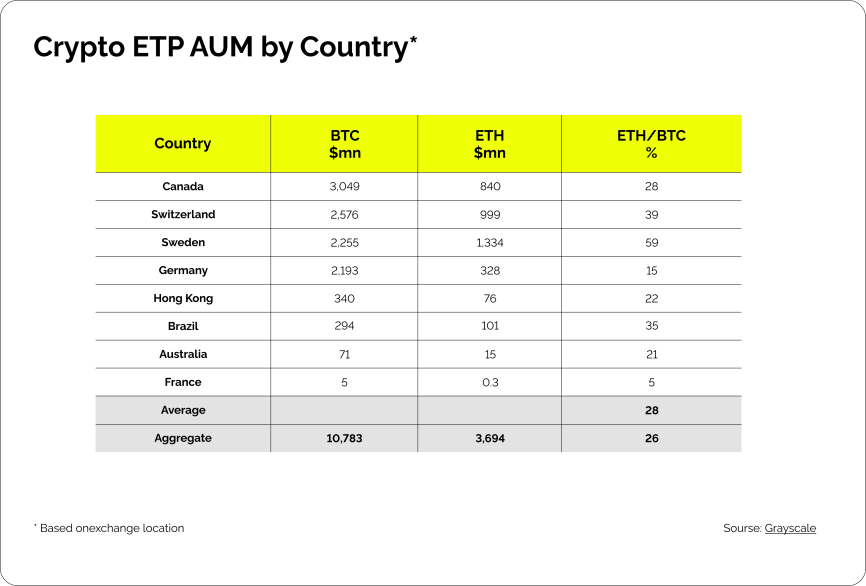

Today, Bitcoin seems to hold more sway with institutions, as proven by the larger AUM (Assets Under Management) of Bitcoin ETFs:

Image 4. Source: Grayscale

However, ETFs, while designed to attract institutions, can also be held by retail investors. So, a high AUM doesn’t automatically translate to a purely institutional investor base.

What these figures tell us

In the Bitcoin vs Ethereum battle, Biton holds a clear brand edge. It is leading across most adoption metrics. The first household name in crypto, it attracts both retail and institutional investors seeking a familiar store of value.

However, Ether is posing a challenge to Bitcoin’s leadership. Ethereum attracts investors seeking a stable and versatile platform. Institutions might be gradually shifting to Ethereum as well. Ether’s deflationary supply, the declining number of Ether tokens held on exchanges, and the rise in staking activity may be at play.

Don’t miss out on a large and growing demographic of crypto holders

Price and volatility

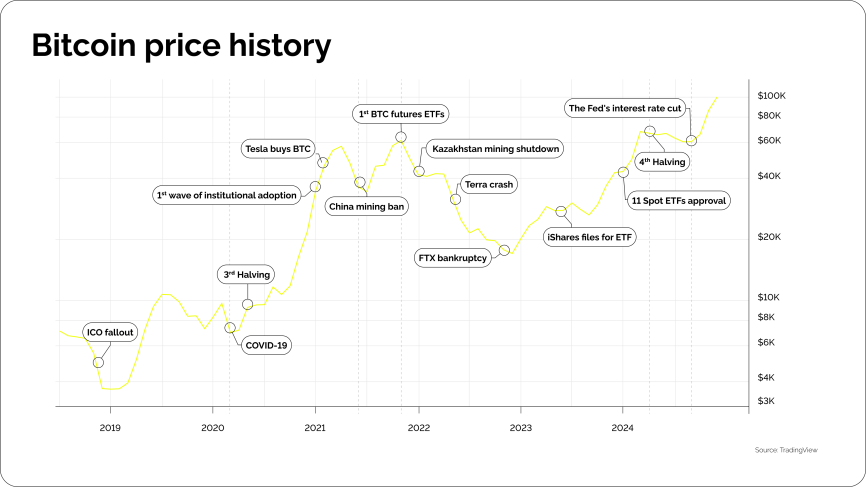

When it comes to volatility, Bitcoin has had its fair share of rallies and crashes:

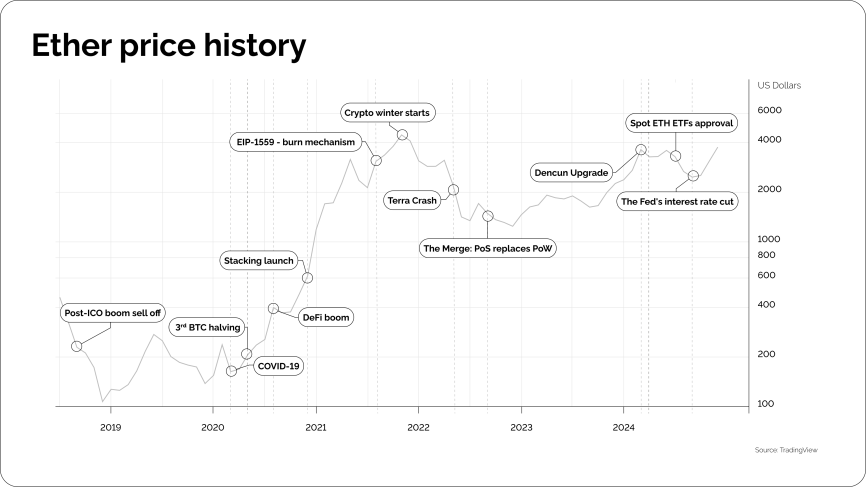

Ether’s price trajectory hasn’t been a steady one either:

The erratic trajectories above show that both Bitcoin and Ether are quite volatile. However, traditionally the latter showed a higher volatility index: 64.79 against Bitcoin’s 53.62. Interestingly, in 2024, Bitcoin’s volatility surpassed that of Ether — possibly because of its fourth halving event.

Overall, such factors as market sentiment, supply and demand, media attention, regulatory changes, competition, and technical updates — all are at play when it comes to both currencies’ price swings.

Technical aspects

| Bitcoin (BTC) | Ether (ETH) | |

| Consensus mechanism | Proof-of-Work | Proof-of-Stake (PoW till 2022) |

| Mean block time | 10 minutes | 12 seconds |

| Average transaction confirmation time | ~40 minutes | ~3 minutes |

| Trading volume (24h) | $96 billion | $51 billion |

| Average transaction fee | $3.508 | $1.485 |

Source: Tradingview, Circle

Consensus mechanism

One of the biggest technical differences between Bitcoin and Ethereum is the consensus mechanism.

A consensus mechanism is a set of rules that determines how transactions are validated and added to a blockchain.

Bitcoin uses the Proof-of-Work protocol. Miners compete to find a hash that is small enough to be accepted by the network, and the winner gets to seal the transaction and earn a reward. This process secures the network and introduces new Bitcoins into the system. It’s secure, but it can be slow and very energy-intensive. Indeed, researchers say that a single Bitcoin transaction could cost as much water as a backyard swimming pool.

Ethereum started as a Proof-of-Work network but transitioned to Proof-of-Stake in September 2022. PoS uses validators who stake their cryptocurrency holdings to validate transactions. It is faster and more energy-efficient.

To draw the line, Ethereum has switched to a more energy-efficient approach, which can give it an edge in the future. However, Bitcoin supporters argue that the environmental impact of Proof-of-Work can be mitigated if miners use renewable energy sources.

Block & transaction confirmation time

Bitcoin’s network takes roughly 10 minutes to create a new block and 60 minutes to confirm a transaction. The final time, however, depends on such factors as network activity, hash rate, and transaction fees.

On the Ethereum network, a block is created in a much shorter 12 second period, while the average transaction confirmation time averages around 3 minutes. But just like with Bitcoin, the times may vary depending on how congested the network is. Gas fee paid by the sender also impacts the speed of confirmation — the more you pay the faster your transaction is processed.

Transaction fees

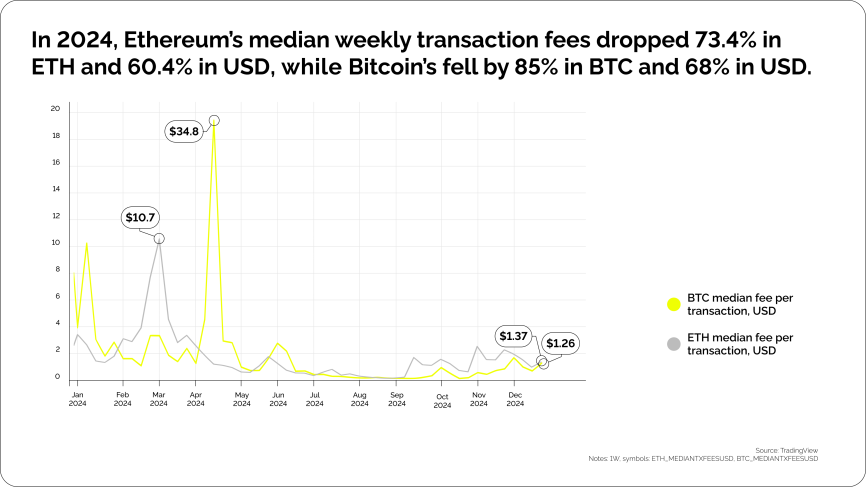

Sending Bitcoin comes with a variable cost. The more people are trying to send Bitcoin at the same time, the higher the fees. Your wallet will usually show an estimated fee based on the current network traffic.

Want your Bitcoin to arrive quickly? Be prepared to pay more. Bitcoin transactions are grouped into “blocks”, and each block has limited space. Miners prioritise transactions with higher fees, processing them first.

Ethereum fees work much like Bitcoin’s. When the network is busy, fees go up. Also, just like with Bitcoin, you can speed up your transaction by paying a higher fee, essentially tipping the validator to prioritise it over other transactions.

Since January 2024, both Bitcoin’s and Ethereum’s transaction fees have been trending downwards, median weekly fees in USD decreased by 68% and 60.4% respectively.

Security

Both Bitcoin and Ethereum are highly secure. But they use different approaches to security.

Bitcoin is a Proof-of-Work network. This mechanism does not only validate transactions, but also deters potential attackers. It requires immense computational power and energy, which makes it very difficult and expensive for attackers to gain control of the network.

On the Ethereum blockchain, participants vouch for the network’s integrity by putting up their own Ethereum coins as collateral. If someone tries to tamper with the system, they risk losing the staked funds. That’s a hefty penalty that discourages potential attackers.

Ethereum vs. Bitcoin: Adoption by Merchants

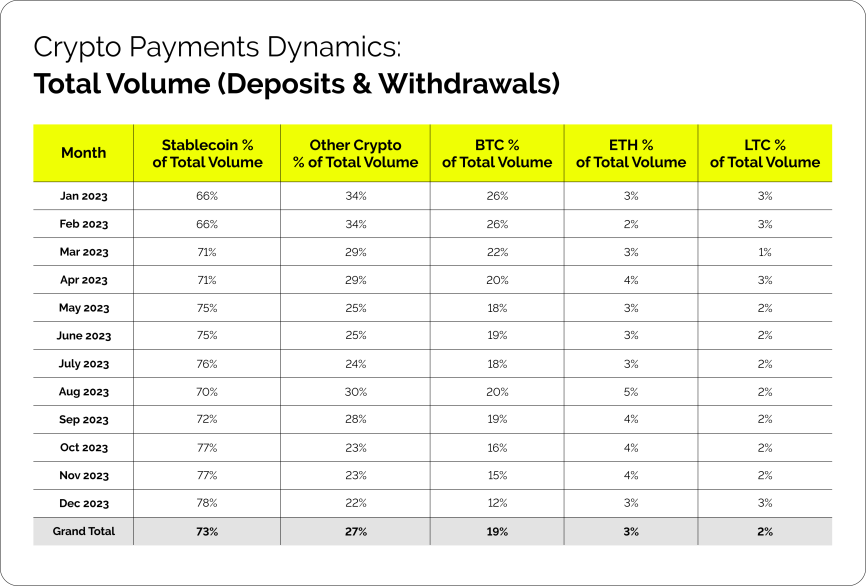

We are here to highlight how cryptocurrency might be gaining traction with merchants. We looked at transaction data from CryptoProcessing to see how Bitcoin and Ether fared throughout 2023.

- In January 2023, Bitcoin accounted for 72% of the total transaction number — compared to only 4% for Ether.

- However, Bitcoin’s popularity dipped steadily throughout the year, reaching 42% by December.

- Transaction volume for Bitcoin also decreased, starting at 26% and dropping to 12% by the end of the year.

- When it comes to Ether, although its transaction volume remained relatively flat (around 3% throughout the year), its share of transactions grew steadily. By December, ETH transactions reached 6%, suggesting a potential rise in its use.

These trends might suggest a possible shift in merchant preferences. While Bitcoin still holds the larger share of transactions, its popularity seems to be declining. Ethereum, though starting with a smaller base, is showing a positive growth trend.

It is interesting to see how this “power struggle” plays out. Bitcoin has a strong brand edge. However, Ethereum’s recent developments (like the switch to proof-of-stake) and the growing popularity of stablecoins might change the landscape.

Given everything said above, if you’re considering entering the crypto space, diversifying your holdings and payment options might be a wise strategy. Our gateway supports both Bitcoin and Ether, along with over 20+ other tokens, including stablecoins.

And if you have any unanswered questions about Bitcoin, Ethereum, or anything crypto-related, don’t hesitate to reach out.

Summary

Bitcoin and Ethereum lead the cryptocurrency market with a combined dominance of almost 70%. Bitcoin is widely recognized for its capped supply and historical role in the early development of the crypto market. Ethereum, however, continues to close the gap through its versatile platform, deflationary supply trend, and faster network performance. The difference between the two is determined by technical upgrades, supply mechanics, and shifting adoption patterns among users and merchants.

Let’s have a look at the main figures:

- Bitcoin market cap is $2.1 trillion. Ethereum market cap is $485.7 billion (December 2024).

- Bitcoin price is $105,730. Ether price is $4,027.

- Circulating supply of Bitcoin is 19.79M (max 21M), Ether – 120.6M (not fixed).

- Daily on-chain transactions of Ethereum are 1.3M, Bitcoin – 300k.

- The average transaction fee of Bitcoin is $3.51, and Ethereum $1.49.

- BTC is accepted by around 15,000 businesses, and ETH by around 5,000 companies.

This head-to-head dynamic shows two distinct paths: Bitcoin’s scarcity-driven model versus Ethereum’s adaptable ecosystem. While Bitcoin benefits from first-mover recognition and strong brand presence, Ethereum’s proof-of-stake model and broader application ecosystem have contributed to its increasing adoption among developers and users.

Market dynamics between Bitcoin and Ethereum may continue to evolve, influenced by ongoing technological, regulatory, and adoption-related developments.