In 2025, crypto is fast becoming the go-to method for global transactions.

Traditional banks and money transfer services still dominate, but they’re slow, costly, and limited by business hours and middlemen.

International crypto payments are rising to these challenges:

- They’re near-instant and available 24/7, including weekends;

- Transaction fees are often dramatically lower;

- There are no intermediaries, meaning less friction and fewer delays.

Whether it’s a business paying overseas suppliers, a startup sending payroll in crypto, or a migrant sending money home, more people are turning to crypto for cross border payments thanks to speed, cost, and accessibility.

Why choose crypto for international payments?

Cost savings

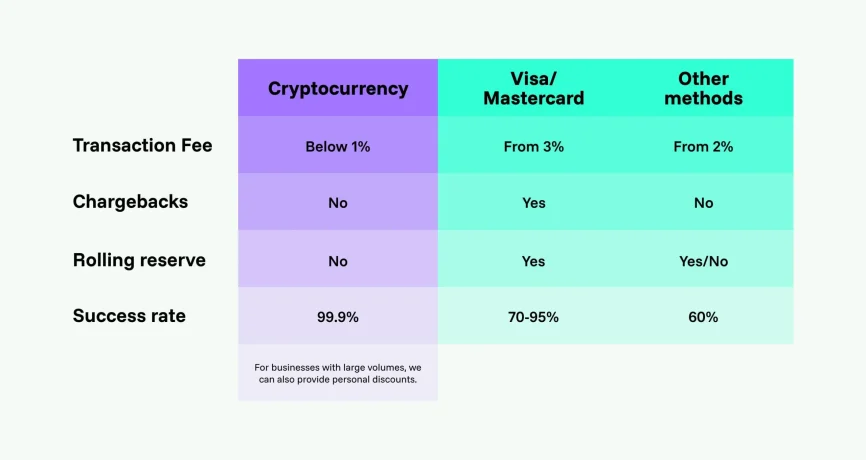

One of the biggest advantages of using crypto for international transactions is the cost. Banks and traditional money transfer services often charge between 5-10% in fees and exchange markups. That’s also before accounting for delays or hidden charges.

By removing intermediaries and relying on blockchain payments, users can drastically cut costs.

Stablecoins and other digital currencies have been shown to reduce cross-border payment expenses by up to 80%. For companies managing frequent international transactions, that level of savings can transform their bottom line.

Speed and efficiency

Waiting three business days for a bank transfer is not efficient business wise.

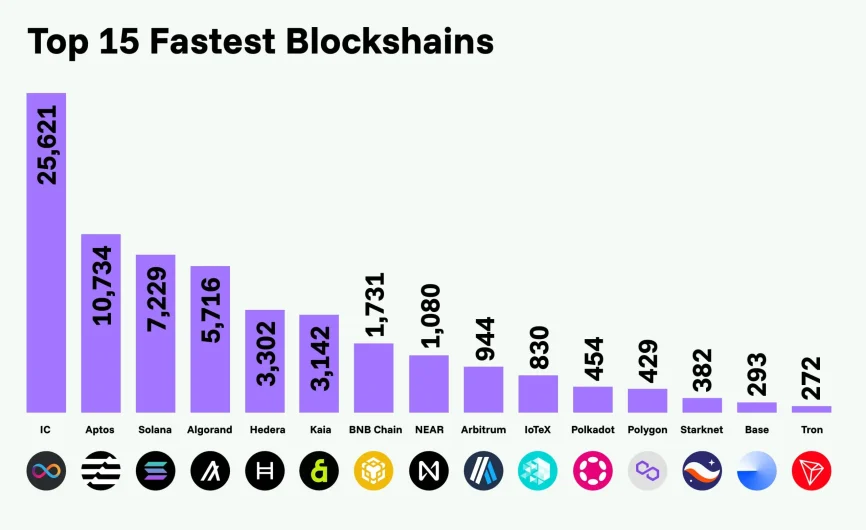

Crypto enables real-time or near-instant settlement, regardless of where the sender or recipient is located. Most major blockchains finalize payments within minutes or even seconds and remain active through weekends and holidays.

This kind of 24/7 availability gives businesses better control over liquidity management, reduces downtime, and improves the predictability of cash flow.

Crypto means accessibility for cross border payments

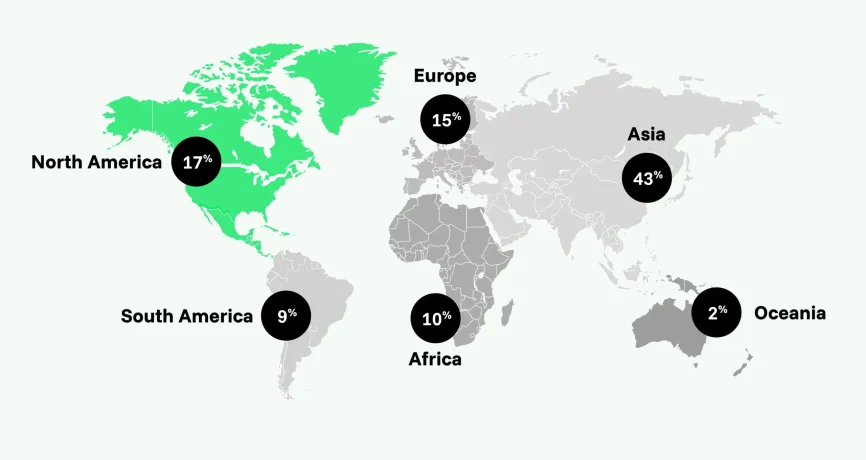

Anyone with an internet connection can participate in decentralised finance. There’s no need for a bank account, just a crypto wallet and a device. This opens up financial access to unbanked and underbanked populations, particularly in regions where banking infrastructure is limited or unreliable.

For businesses, it also makes it easier to reach customers and partners in emerging markets, helping to expand their global footprint without being limited by banking constraints.

Transparency and security

Crypto transactions are recorded on public blockchains. Every payment leaves a traceable record, reducing disputes and enabling both parties to verify receipt and timing.

Security is also core to the system. Transactions are protected by strong encryption and decentralized validation, making them highly resistant to fraud. Of course, when crypto payments are routed through regulated platforms, users can benefit from KYC/AML protections while maintaining efficiency.

This combination of fraud prevention, transparency, and bank-level security is appealing to enterprises seeking trust and compliance in digital payments.

“Crypto lets global businesses settle payments securely in minutes instead of days, freeing up cash flow and boosting growth.”

Real-world use cases

Blockchain international payments

For migrant workers and expatriates, crypto offers a faster and cheaper way to send money home. Instead of paying high remittance fees (often around 6.4%), senders can use stablecoin remittances to deliver funds instantly and at a much lower cost. There’s no waiting in line, no paperwork, and no delay.

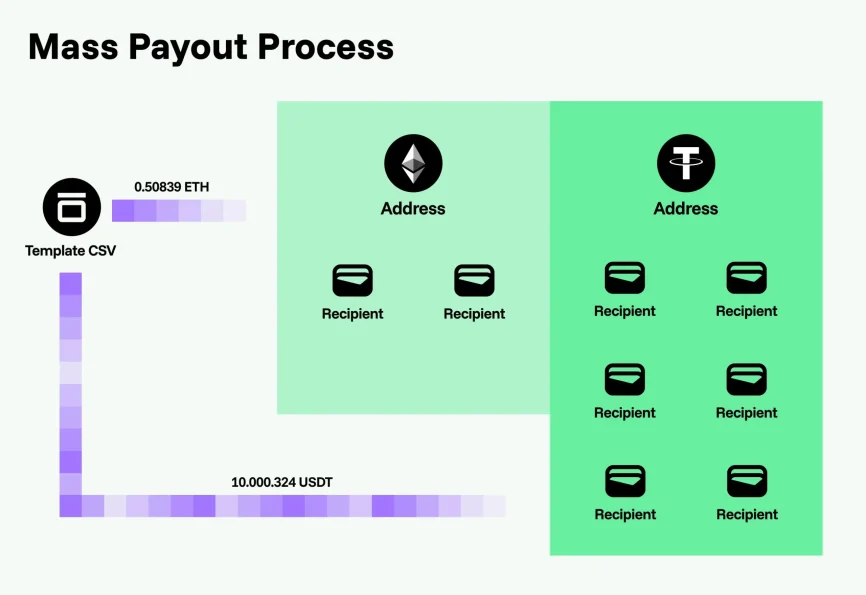

Business payments and payroll

Companies are turning to crypto for international payroll and supplier payments. Using the best crypto for cross border payments, such as USDC, employers can pay remote teams using mass payouts in real time, while suppliers receive funds the same day. This is especially useful in countries where banking services are slow or unpredictable.

Cross-border e-commerce

Online merchants are integrating crypto payments to serve global customers without the friction of foreign transaction fees or chargebacks.

Customers pay in crypto, and merchants can instantly convert it to local fiat or hold it as part of their strategy. For digital-native businesses, this model improves speed, cuts processing fees, and offers a better customer experience.

Step-by-step guide to making international crypto payments

Adopting crypto for cross border payments is practical, fast, and standard for global commerce in 2025. Here’s how to do it right.

1. Choose the right Crypto asset

The first decision is which cryptocurrency to use. While Bitcoin is what most people think of when it comes to cryptocurrencies, it’s rarely ideal for cross-border transactions due to price volatility. If the value drops mid-transfer, the recipient could receive less than expected.

For international crypto payments, stablecoins are the smart choice:

- Pegged to fiat (like USD), so there’s no value fluctuation during the transfer;

- Widely accepted and fast to settle;

- Popular options include USDC.

Stablecoin remittances ensure that the amount sent is the amount received, critical for both personal and business payments.

2. Set up a wallet or platform

You’ll need a secure way to store and send your crypto. This can be:

- A mobile wallet app for personal use;

- A hardware wallet for enhanced security;

- Or a crypto payment platform for business-level functionality.

If you’re a business handling international transactions, a crypto payment gateway simplifies the process by managing wallets, conversions, and even compliance. Just make sure to:

- Choose a trusted provider with robust KYC/AML procedures;

- Enable two-factor authentication and access management;

- Use strong passwords and follow best practices for security.

For companies managing supplier payments or payroll in crypto, this setup ensures both speed and regulatory alignment.

3. Send the payment and settle

Once the setup is complete, all that’s left is to send the funds:

- Double-check the recipient’s crypto wallet address. This one is critical, as blockchain payments are irreversible;

- Submit the transaction from your wallet or platform;

- The blockchain will confirm the transaction, often in under a minute.

The recipient can then:

- Hold the funds in crypto (common in regions with rising crypto adoption);

- Or instantly convert to local fiat currency using an exchange or built-in auto-conversion.

Either way, the process is significantly faster than a traditional bank wire, and with lower fees.

Real-world examples and trends

Stablecoins going mainstream

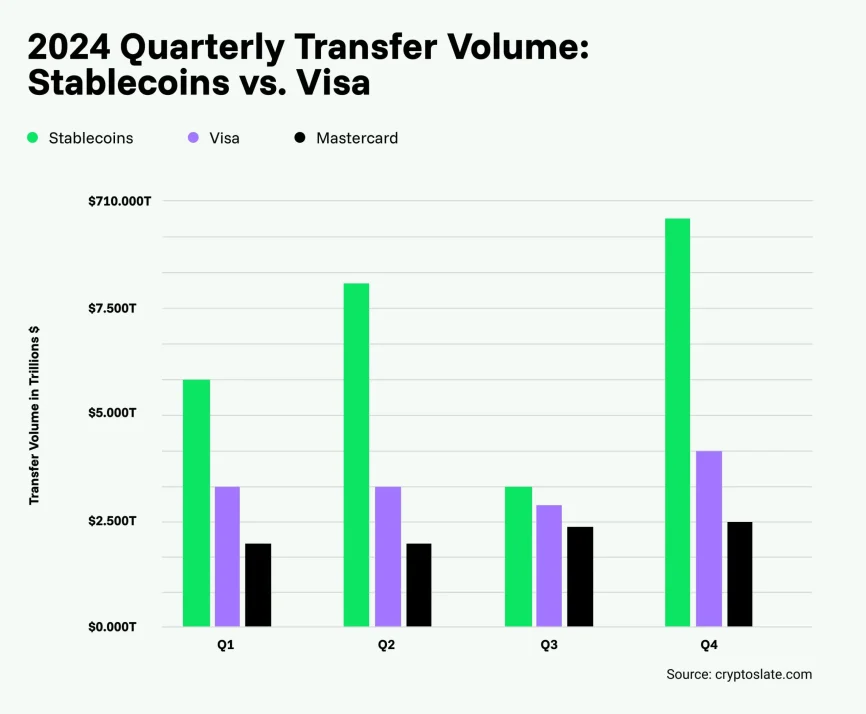

Stablecoins have become the backbone of blockchain international payments. Major companies, including Visa, are now using USDC (a digital dollar) for global settlements.

- Transfers cost up to 80% less than bank alternatives;

- Transactions settle in near real-time.

Fintech startups are also riding the wave, using stablecoins to offer faster, cheaper remittances in regions underserved by banks.

CBDCs and regulation

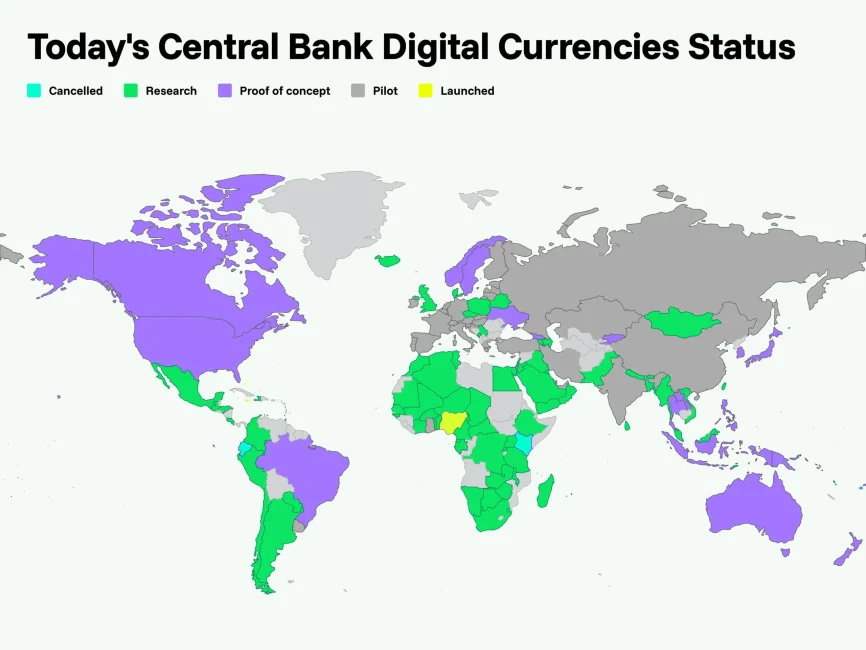

The growth of Central Bank Digital Currencies (CBDCs) is switching things up. In 2025, numerous central banks across the globe are piloting or launching digital versions of their fiat currencies to modernize payments.

Meanwhile, regulators are introducing clearer guidelines around crypto transfers, smart contracts, and digital payments. That helps legitimize the role of crypto in mainstream finance while enhancing fraud prevention and bank security.

It’s looking good for international crypto payments

In just a few years, crypto for international payments has become a necessity. Individuals and businesses can now:

- Move money globally in minutes;

- Avoid intermediary costs;

- Benefit from 24/7 availability;

- And stay compliant thanks to evolving regulation and better infrastructure.

Whether it’s paying remote staff, sending stablecoin remittances, or handling international e-commerce, crypto transfers offer a faster, smarter, and more affordable way to connect financially across borders.