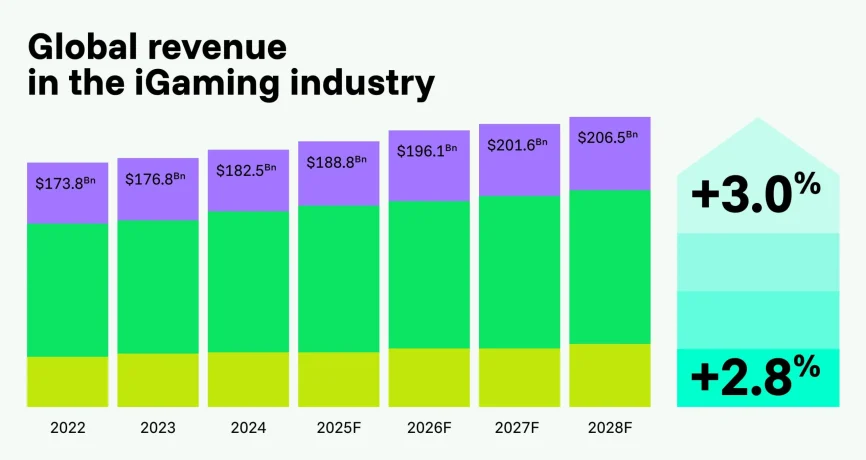

The iGaming industry keeps growing fast. Forecasts suggest the global market could reach $188.8 billion in 2025. For iGaming companies, one of the fundamentals of that growth is a reliable payment infrastructure.

Global revenue in the iGaming industry with projected growth (source: Newzoo Global Games Market Report 2025)

iGaming payment solutions handle the core of every platform:

- Deposits let players top up their accounts.

- Withdrawals deliver winnings back to players.

- Secure processing builds trust on both sides.

Smooth transactions serve to strengthen player confidence. Delays or errors can damage a brand’s reputation and drive users to other platforms. At the same time, operators must work through strict compliance rules, fraud prevention, and high costs imposed by traditional payment providers.

The challenge for operators is finding the right balance between these demands.

This article will outline the current landscape of iGaming payments in 2025. We will look at possible payment solutions, compliance requirements, and the main features a reliable payment solution for iGaming should possess.

The iGaming payments landscape in 2025

Demand for payment solutions grows alongside the industry. Platforms must process millions of transactions quickly and securely.

Let’s have a look at the figures.

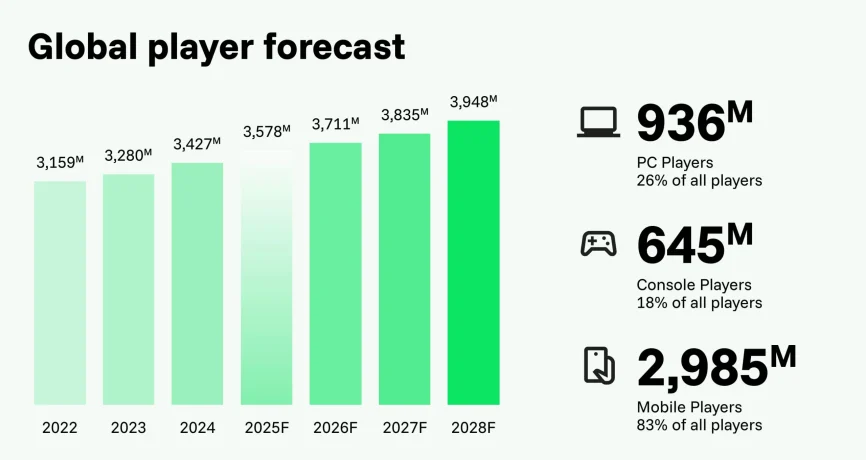

By 2025, the global player base is expected to reach 3.6 billion, or 61.5% of the online population. Players access platforms through PCs (936 million), consoles (645 million), and mobile devices (3 billion).

It means platforms must provide smooth deposits and real-time withdrawals on any device to keep players engaged and satisfied.

Provided that players now expect choice and flexibility, iGaming providers offer diverse payment solutions:

- Cards are widely used but less popular among younger, tech-savvy players.

- E-wallets are fast, familiar, and essential for mobile-first users.

- Instant bank transfers are popular in Europe and Asia for speed and reliability.

- Cryptocurrencies are accepted in emerging and tech-forward markets.

- Local payment solutions build regional trust and acceptance.

iGaming platforms try to combine these options with instant payouts, fraud detection, and secure processing, ensuring transactions meet modern player expectations.

Geographical differences and regulatory regimes may affect payments

iGaming operators navigate a patchwork of regulations that shape payment requirements. Licensing, AML checks, identity verification, and responsible gaming measures are standard in most markets. Payment systems must adapt to local laws while maintaining smooth operations for players.

| Region | Licensing and regulation | Payment implications | Notes |

| Europe | National authorities | AML, identity verification, audits | Severe fines for non-compliance |

| North America | State-level + federal laws | Cross-state restrictions | Patchwork regulations complicate operations |

| Latin America | Emerging frameworks | Licensed banking/payment channels required | Increasing regulation, market growth |

| Asia & Middle East | Mixed | Limited or regulated payment options |

Below is an overview of how some regions approach licensing and payment regulation:

Europe

- Malta. Transparent licensing, AML checks, and clear payment compliance.

- Italy. Strict licensing and monitored payments.

- Germany. New authority, strong advertising and payment rules.

- UK. UK Gambling Commission enforces AML, responsible gaming, audits, and heavy fines for violations.

North America

- USA. State-level licenses (New Jersey, Pennsylvania, Michigan) and federal laws limit cross-state payments.

- Canada. Provinces regulate independently and payment systems follow local rules.

Latin America

- Colombia, Mexico, Brazil. Licensed banking/payment channels required.

- Other countries. Legal frameworks are still evolving.

Asia and middle east

- Philippines. Licensed operators under PAGCOR, regulated payment processing.

- India and Japan. State-specific rules, some payment restrictions.

iGaming companies must opt for flexible, secure, and device-compatible payment systems that comply with local regulations while meeting modern player expectations. Mobile-first, crypto-ready, and locally trusted solutions define the competitive standard in 2025.

The licensing and payment regulations are relevant as of September 202 and may vary over time.

Key features and requirements for payment solutions for iGaming

Selecting the right payment solution is critical for iGaming operators. Players expect secure, fast, and seamless transactions. The following features define high-quality payment systems.

Security

Security must be a top priority. iGaming platforms handle sensitive data and large volumes of transactions.

Key security measures include:

- Encryption. Protects data during transmission to prevent unauthorized access.

- Fraud detection tools. AI and machine learning identify and block suspicious activity.

- SSL certificates. Ensure all data transfers remain secure.

- Two-factor authentication (2FA). Adds an extra layer of protection during transactions.

Speed

Fast deposits and withdrawals directly affect player satisfaction. Real-time payment processing ensures instant transactions. Providers should support high transaction volumes simultaneously without delays.

That’s why many iGaming companies opt for a crypto-friendly payment gateway, as it is designed to provide players with fast withdrawals. Efficient processing improves retention and encourages repeat activity.

“More and more online users want to pay with crypto. If your platform doesn’t support it yet, you’re probably missing out.”

Payment diversity

Players expect freedom of choice, and payment systems must deliver:

- Multiple methods. Cards, e-wallets, bank transfers, cryptocurrencies, and trusted local options.

- Multi-currency support. The ability to handle payments in different currencies across regions.

- Fund conversion. Fast and easy processing of fiat-to-fiat, crypto-to-crypto, fiat-to-crypto, and crypto-to-fiat transactions.

User experience and checkout flow

A smooth payment process directly impacts satisfaction. Consider:

- Fast processing times. Minimize waiting for deposits or withdrawals.

- User-friendly interfaces. Intuitive layouts reduce transaction errors.

- Convenient checkout. Support saving payment details, offer multiple options, and provide your users with mobile-friendly checkout.

- Reliable service providers. Partnering with trusted processors prevents downtime or errors.

Compliance and regulatory requirements

Payment solutions must meet local and international rules. Operators should ensure compliance with:

- AML regulations. Prevent money laundering and fraudulent activity.

- KYC requirements. Verify identities accurately and securely.

- PCI DSS standards. Protect cardholder data during payments.

Non-compliance can result in fines and reputational damage. Payment providers should understand regulations across all regions where the platform operates.

By combining security, speed, diversity, seamless UX, and full compliance, iGaming operators can deliver a reliable and player-focused payment experience.

Challenges in iGaming payments

There’s another side to the coin. Significant growth in iGaming brings complexity, especially in payments. Operators face multiple challenges that can impact revenue, trust, and even player retention.

Let’s dive deep into the main challenges.

Fraud and security risks

According to the 2024 iGaming Fraud Report by Sumsub, fraud in the online gaming industry grew by 64% between 2022 and 2024. And it’s clear why. iGaming platforms handle high transaction volumes and sensitive financial data.

This environment makes iGaming platforms prime targets for fraud, such as:

- Account takeovers.

- Chargebacks and bonus abuse.

- Money laundering schemes.

Solutions: Real-time fraud detection, proactive security measures, and built-in AML compliance help reduce risk. Operators must implement encryption, 2FA, and continuous monitoring to maintain a secure environment for players.

Cross-border payments complexity

Global expansion introduces new difficulties. Managing multiple currencies, fragmented payment systems, and regional preferences can slow transactions and reduce conversion.

Common pain points include:

- Costly currency conversion fees.

- Slow or failed settlements.

- Limited local payment options.

Solutions: Multi-currency support, localized payment methods, and centralized payment platforms provide fast and clear cross-border operations. Understanding local trends and player preferences improves adoption and conversion.

Managing player expectations

Modern players demand fast payouts, multiple payment options, and frictionless experiences. Poor payment flows can drive churn. As BusinessWire highlights, one-third of bettors report abandoning a platform if deposits take too long.

Key issues include:

- Slow or delayed withdrawals.

- Limited local payment methods.

- Clunky or confusing checkout processes.

Solutions: Instant payout systems, customized payment flows, and intuitive user interfaces enhance satisfaction. Real-time solutions such as push-to-debit reduce friction and increase retention.

Scalability and growth

Legacy payment systems struggle with today’s iGaming scale.

Growing platforms often face risks such as:

- Downtime during traffic spikes.

- Poor API performance or integration delays.

- Difficulty supporting new markets or payment innovations.

Traditional banking blocks on gambling-related transactions have historically lowered approval rates. Modern payment systems with flexible APIs, high reliability, and multi-channel support can improve transaction success rates from single digits to over 90%, directly supporting growth and player retention.

Solutions: Adopt scalable, API-driven platforms with high uptime and flexible integrations. Ensure the system can handle traffic surges, integrate new methods quickly, and support global expansion.

By addressing these challenges with modern, secure, and flexible payment solutions, iGaming operators can maintain trust, improve conversion, and meet the demands of a global, tech-savvy player base.

How to choose the right iGaming payment solution provider

The choice of a payment partner can define the success of an iGaming platform.

A strong payment solution should offer:

- Encryption, fraud detection, SSL, and 2FA.

- Real-time deposits and withdrawals with minimal downtime.

- Mobile-optimized checkout.

- Scalable infrastructure for high traffic and market expansion.

- Compliance with AML, KYC, and local requirements.

- Transparent reporting with clear dashboards.

- Multi-currency support.

Operators must manage three priorities: transaction costs, regulatory obligations, and player satisfaction. Ignoring any of these weakens performance.

Final thoughts on payment solutions for iGaming

The iGaming industry in 2025 is global and player-focused. Payment solutions play a central role in platform performance and trust.

Operators face challenges such as fraud, complex cross-border transactions, evolving player expectations, and scaling systems for growth. Payment systems that combine security, speed, multi-currency support, diverse methods, and regulatory compliance meet these demands.

To operate efficiently, modern platforms enable:

- Protection against fraud through encryption, 2FA, and real-time monitoring.

- Instant deposits and withdrawals across devices.

- Global operations with localized payment options and currency conversion.

- Integration with a crypto wallet for business, supporting crypto payments and settlements efficiently.

In 2025, reliable, transparent, and flexible payment solutions define the competitive standard, underpinning player confidence and platform stability.

FAQ

What are the most reliable payment solutions providers for iGaming?

Top providers are recognized for security, speed, and multi-currency support. They must support diverse payment methods, high transaction volumes, and offer robust fraud detection systems. The crypto payment gateway by CryptoProcessing can become a good choice for iGaming companies that appreciate speed in combination with security.

How do iGaming payment compliance solutions work?

Compliance systems monitor transactions to prevent fraud, money laundering, and other illegal activity. They typically include AML checks and KYC verification. These tools often integrate with payment gateways, automatically flagging suspicious activity while maintaining transactions for legitimate users.

Which payment methods should an iGaming operator offer?

Operators typically provide a mix of cards, e-wallets, bank transfers, crypto payment gateways, and local solutions.

How long do withdrawals usually take with top providers?

Withdrawal times vary by method. E-wallets and crypto payments can settle in minutes or a few hours. Cards and bank transfers may take 1-3 business days, depending on the region and processing rules.