Cryptocurrencies and Forex are increasingly connected. While Forex remains the largest financial market, crypto is used more often for payments and settlements and attracts new clients. With over 650 million crypto holders, Forex platforms have started to adopt digital assets to improve operations and meet shifting market demand.

This article explores how crypto can be used in the Forex industry and what it means for the future of both markets.

Crypto in the Forex market

Cryptocurrencies have become a functional part of the Forex industry. Many brokers now use crypto for payments, faster settlements, and to meet growing demand from crypto-savvy traders.

Forex is adopting crypto

Forex platforms are integrating digital assets to stay competitive. Over 50% of retail investors say they would switch brokers for better crypto offerings. Adoption helps brokers attract and retain clients in a shifting market.

Institutional adoption supports this trend:

- Late 2022. Deutsche Bank (10.89% market share), JP Morgan (8.67%), and Bank of America (3.73%) implement crypto transactions.

- Sept 2023. Deutsche Bank invests in Taurus and UBS (9.69% market share) launches tokenization services.

- Oct 2023. Dukascopy offers USD loans backed by crypto.

- Jan 2024. BlackRock launches a spot Bitcoin ETF.

- Mar 2024. BlackRock’s ETF hits $10B AUM in seven weeks (Nasdaq).

Forex and crypto: growing cross-market influence

Crypto and Forex are no longer isolated markets. Some crypto platforms like BitMEX, PancakeSwap, and Uniswap now offer Forex-like products, including perpetual contracts.

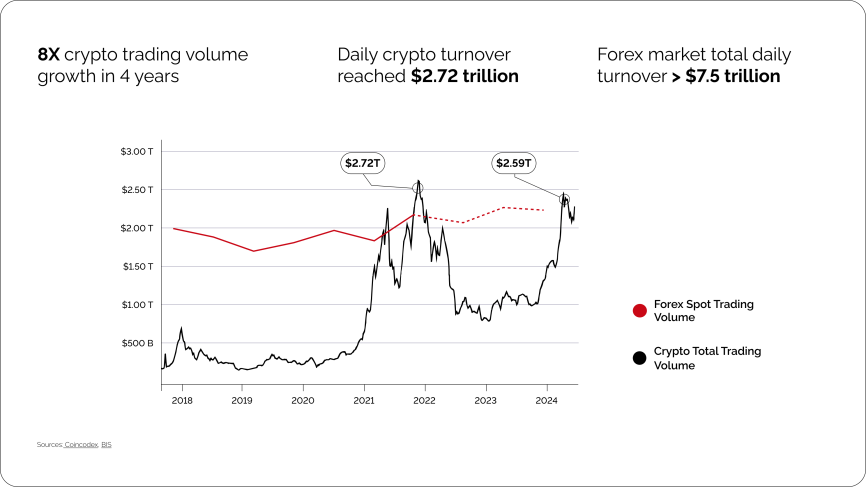

Crypto trading volume has grown 140x in five years, while Forex has expanded at a slower, steadier pace. This gap suggests that Forex brokers may need to adopt crypto tools or risk falling behind.

Sources: Crypto – CoinCodex; Forex – Bank of International Settlements

Where crypto and Forex markets intersect

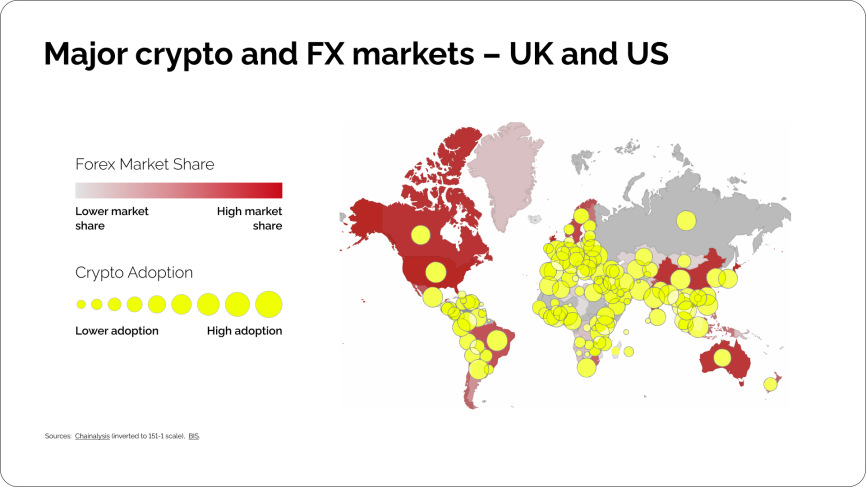

The cooperation between the two markets will likely be stronger in emerging economies, which are experiencing a simultaneous rise in both Forex participation and crypto adoption.

While developed economies like the UK and the US still dominate the Forex market, making up 57% of its trading volume (they are big in crypto, too), the world of Forex is changing.

for Forex:

Legal, Fast, Low-Cost

Emerging economies like Kenya, Nigeria, and South Africa are seeing a jump in Forex trading as well. Interestingly, the same economies are leading the charge in cryptocurrency adoption. Take Nigeria, for example. The country has become one of the big cryptocurrency economies in the Sub-Saharan region, and it continues to grow despite two major recessions.

This convergence of trends could be a game-changer for how the Forex and crypto markets work together. Forex brokers are traditionally concentrated in established financial centers. But today, they might find fertile ground for expansion by offering crypto-related services to the growing economies.

Why does Forex turn to crypto?

Forex is onboarding crypto payments for a few reasons:

- There are some inherent limitations of the traditional foreign exchange market that a new, decentralized asset class like crypto can solve.

- Certain global trends are shaping how financial markets develop. And Forex is susceptible to these trends.

Transaction speed: delays vs near-instant settlements

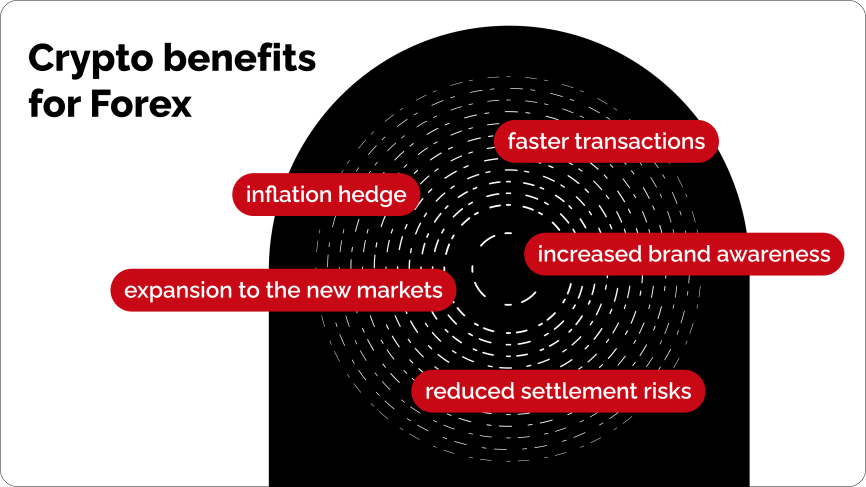

Settlement delays are a well-known issue in Forex. Trades typically take two business days or more to settle, exposing brokers and traders to risks like slippage. Cryptocurrency, by contrast, offers significantly faster settlement timelines through direct, peer-to-peer execution.

| Forex | Crypto |

|

|

While the systematic effort to improve transaction speed is underway, some brokerages recognized the advantage of onboarding crypto.

Here’s what happens when cryptocurrency comes into play as a Forex payment gateway.

Conducted directly between two parties, without any intermediaries like banks, cryptocurrency transactions become near-instant.

For example, a crypto transaction on the Tron network may take around 1 minute. The specific speed depends on the chosen network, but it rarely exceeds 10 minutes. And when popular blockchains get congested, there are several to choose from.

Some crypto processing services, such as CryptoProcessing, freeze the exchange rate until the transaction is completed to prevent losses.

Settlement risk: intermediary exposure vs blockchain finality

Settlement risk arises when one party fulfills its side of the trade, while the other delays or fails. In traditional Forex, it is often caused by asynchronous banking systems. Blockchain-based crypto payments reduce this exposure by design.

| Forex | Crypto |

|

|

Keeping in mind that the average daily volume in the global Forex market is estimated at around $2 trillion, that’s a considerable impact on financial stability.

Market entry: long setup vs instant reach

Expanding into new markets for Forex brokers may be slowed by banking requirements and local integration hurdles. Crypto provides an alternative entry path, enabling immediate access in regions with high crypto usage.

| Forex | Crypto |

|

|

Realistically, securing a local bank account may take up to two weeks, followed by an additional four to eight weeks needed to integrate a local Forex payment gateway.

Sources: Crypto Market – Chainalysis 2023 Geography of Cryptocurrency Report, the index was inverted to 151-1 scale, a higher number indicates higher crypto adoption, where 151 is the highest adoption; Forex Market – first 52 countries were ranked from 151-100 based on BIS data, other countries were attributed with the base rank of 80 and ranked based on trading taxes.

You will still have to comply with local AML and KYC procedures. However, partnering with a reputable crypto payment provider can help reduce the compliance burden, as they likely already have established procedures in place.

The demand is already here. If Forex businesses want to stay competitive, integrating crypto payments is the logical next step.

Market correlation: dependency vs diversified movement

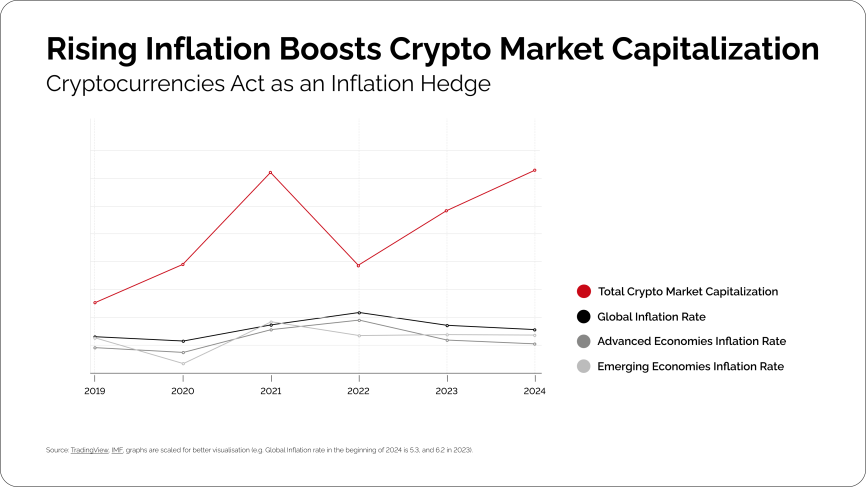

Studies have found that nearly all assets experienced increased volatility during COVID-19 and the Russian invasion of Ukraine. Except for Bitcoin. However, there are some differences:

| Forex | Crypto |

|

|

Source: TradingView, IMF, graphs are scaled for better visualisation (e.g. Global Inflation rate in the beginning of 2024 is 5.3, and 6.2 in 2023).

Source: TradingView, IMF, graphs are scaled for better visualisation (e.g. Global Inflation rate in the beginning of 2024 is 5.3, and 6.2 in 2023).

Forex businesses:

Liquidity retention: established scale vs growing attraction

The Forex market is larger and more liquid than the cryptocurrency market. But even though the cryptocurrency industry is smaller, it is growing fast and may compete for liquidity.

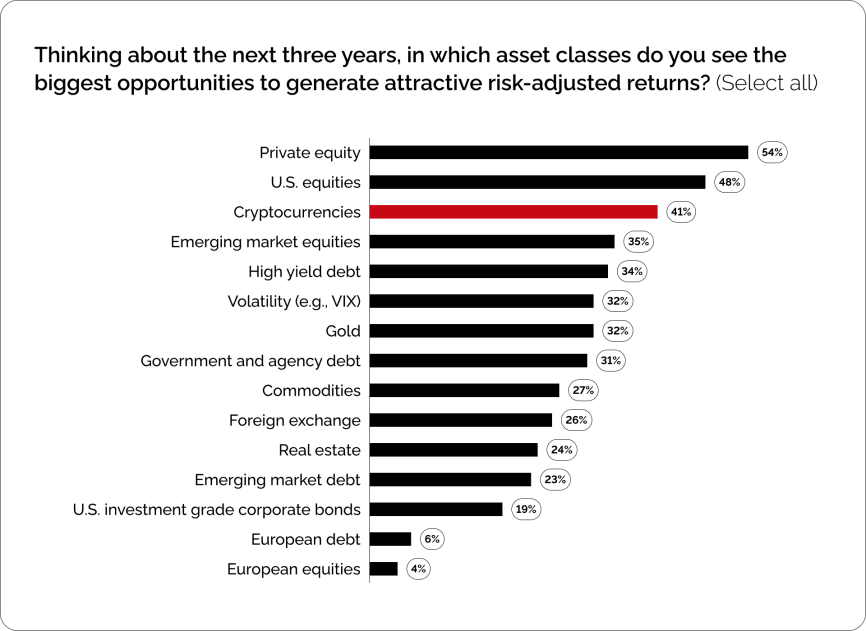

In 2023, cryptocurrency already ranked third among good sources of risk-adjusted returns. A high-performing asset class, it may encourage crypto holders to diversify their portfolios and pull funds from traditional Forex markets.

| Forex | Crypto |

|

|

Transparency: OTC limits vs public ledger clarity

Traditionally, most Forex trades have been conducted over-the-counter (OTC). But here’s an interesting twist: CME’s listed Forex futures and options market has seen a noticeable rise in daily trading volume, jumping to an average of $85 billion from $76 billion in 2021. This could mean that crypto holders’ preferences are changing toward more transparency.

| Forex | Crypto |

|

|

Regulatory landscape of Forex and crypto

Previously, a lack of regulatory clarity kept many Forex institutions from adopting crypto. That’s changing.

Thus, MiCA provides clear rules for issuing, trading, and storing crypto assets across the EU. It also harmonizes regulations within the EU, potentially allowing a crypto-asset service provider licensed in one EU country to operate in others. This might nudge more TradFi institutions to dip their toes in crypto.

How to accept crypto payments as a Forex business?

Say, you have been convinced that crypto payments are a worthy addition to your traditional payment gateways. Let’s see what you should do next to start accepting crypto.

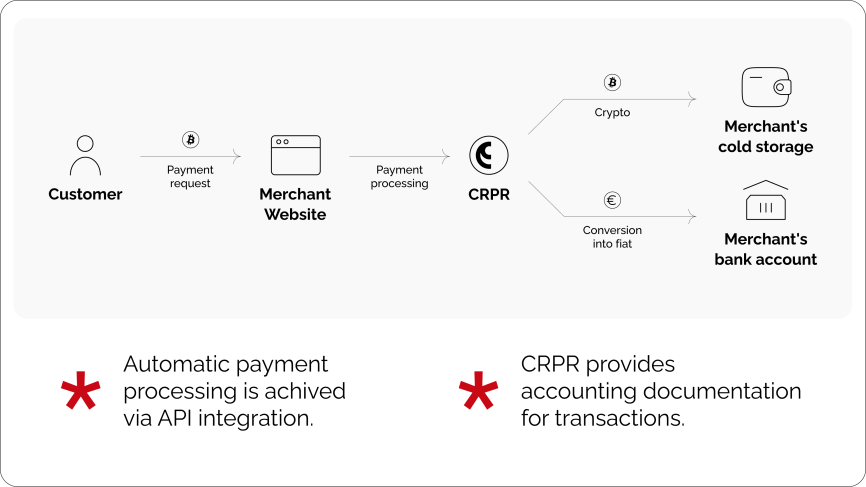

CryptoProcessing – a reliable Forex Payment Gateway

First and foremost, you need to partner with a legal, reputable crypto payments provider.

That’s where CryptoProcessing comes into play. With over 10 years of experience in the crypto industry, it has established itself as one of the prominent leaders in crypto payments technologies.

- We are servicing hundreds of merchant accounts

- We are processing over 900K transactions a month

- We are processing over €700M worth of crypto monthly

- We are registered and licensed in Estonia

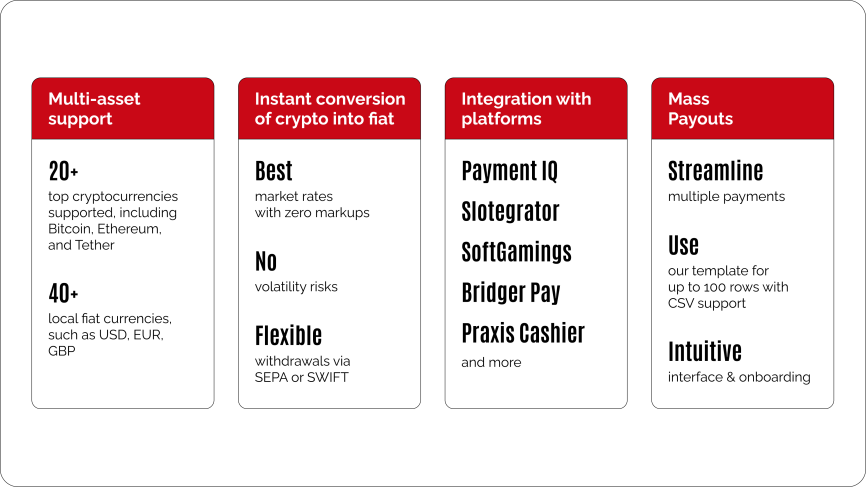

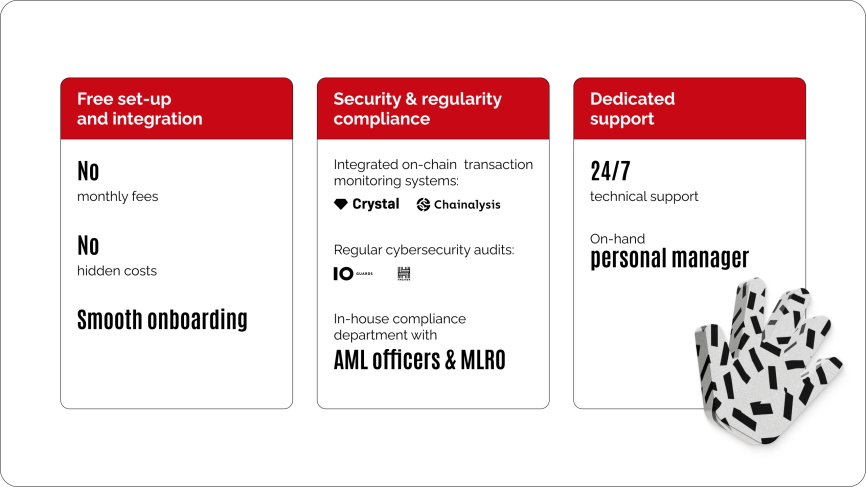

Our core product, the crypto payments processor, is the right fit for the Forex industry. Here is what we offer:

Business wallet by CryptoProcessing: manage your crypto

In addition to our crypto processing engine, we offer a Business Wallet that Forex brokers can use to accept and store crypto as a hedge. The API integration is not required. It complements your Forex crypto offering and delivers the same benefits as a payment gateway!

We are ready for crypto. Are you?

Is it worth using Forex and crypto together?

Cryptocurrencies, once seen as a fringe asset class, are becoming a part of the Forex market. The trend is driven by a unique market dynamic: foreign exchange and cryptocurrencies are competing for liquidity, often targeting a very similar customer base.

At the same time, the old challenges of Forex are resurfacing. Higher transaction costs and inherent risks associated with slower processing times may encourage crypto holders to seek profits elsewhere.

In response, more Forex brokerages are integrating cryptocurrency as a Forex payment gateway and as trading assets. Interestingly, some crypto services are adopting Forex perpetual and venturing into Forex trading.

Looking ahead, we expect even greater convergence of both markets, both developed economies, like the UK and US, and in emerging economies where Forex and crypto are on the rise.

So, the bottom line is: if Forex businesses want to stay ahead of the curve, they have to start considering crypto now!

Summary

The Forex market remains the largest financial marketplace, but cryptocurrencies are rapidly becoming a functional part of its operations. Faster settlements, reduced intermediary risks, and broader market access make crypto a strategic addition for brokers. Recent trends indicate that integration of crypto capabilities is becoming more common among Forex brokers, reflecting changing market dynamics and client expectations.

- Blockchain-based settlements, which often occur within 1-10 minutes, may help mitigate certain delays associated with the traditional T+2 Forex cycle.

- Crypto payments are meant to reduce exposure to settlement risk by removing banking intermediaries and enabling payment-versus-payment transactions.

- Markets such as Nigeria and Kenya have seen an increase in interest in crypto adoption, as it opens new entry points for Forex brokers without the need for local banking setups.

- Public blockchain ledgers provide transparency that OTC Forex transactions lack, which appeals to compliance-focused institutions.

- Multi-asset platforms offering both Forex and crypto products may attract younger, diversified traders and increase competition for liquidity.

As client preferences shift toward faster and more transparent payment methods, early adopters of crypto solutions may be better positioned to align with evolving market expectations.

business with crypto payments?