Cryptocurrency is often synonymous to Bitcoin because it was what started the crypto revolution. The digital currencies’ reputation suffered too, because of unpredictable price moves that caused crypto winter. In 2017 and 2021, a lot of excitement about digital assets led to the crypto crisis meaning sell-offs, regulatory alarm, and bankruptcies.

The novelty that turned the tables and aims to instill more stability is stablecoins; a type of cryptocurrency designed to keep their value steady, by being pegged to the US dollar, the euro, or even gold. This form of digital cash has emerged as a global alternative to conventional payments infrastructure. Currently issued mostly in US dollars, stablecoin circulation has doubled over the past 18 months but still facilitates only about $30 billion of transactions daily, less than 1 percent of global money flows.

Observing current stablecoins trends can provide insights into how they are shaping financial markets, while discussions about the future of stablecoins suggest they may play a pivotal role in mainstream adoption of digital currencies.

Stablecoin timeline

2014 – Tether (Realcoin) is launched: first widely recognized stablecoin

2015–2016 – Tether adoption grows among crypto exchanges

2017 – Dai is launched: the first crypto-collateralized stablecoin

2018–2019 – Circle and Coinbase launch USD Coin (USDC) | Gemini launches GUSD | Paxos launches PAX | Facebook announces plans for Libra

2020 – Stablecoins see explosive growth during COVID-19 | USDC and Tether become top two by market cap

2021 – TerraUSD (UST) rises in popularity as algorithmic stablecoin

2022 – TerraUSD collapses & loss of confidence in algorithmic stablecoins

2023 – USDC temporarily loses its $1 peg after a banking crisis

2024 – Tokenized bank deposits and CBDC pilots begin blurring lines with stablecoins

2025 as a turning point

In 2025, tokenized cash could see significant growth, helped by weakened resistance from cryptocurrency skeptics and boosted by supportive regulations, and better security technology. This growth is reflected in stablecoins market trends 2025, which indicate increasing adoption across multiple sectors.

The future of stablecoins in corporate finance for 2025 looks especially promising, as businesses explore new ways to leverage these digital assets. Stablecoins present a second chance at reforming the financial system. However, whether they will be able to fully realize this potential depends on the stablecoin wars and whether regulators tip the scales in favor or against innovation.

Major macro trends

So what is the future of stablecoins? Stablecoin adoption is seeing a momentum at a global level and regional realities are shaping this race. According to Fireblocks, Latin America is sprinting ahead to meet demand, Asia is running a relay fueled by trade flows, North America is leaping over regulatory hurdles, and Europe is pacing itself through a marathon under a clear framework.

In previous years, stablecoins were viewed as speculative instruments used mostly by crypto traders and tech-savvy individuals. But what role do stablecoins play in the current crypto market trends? By 2025, they are already increasingly seen as practical, regulated financial tools suitable for everyday business use. Smaller businesses use stablecoins for cheaper cross-border payments, quick settlement with overseas suppliers, and access to stable currencies in inflationary environments. Meanwhile, large corporations use them for treasury management, global payroll, B2B settlements, and participation in tokenized finance ecosystems.

No matter the region or the size of the business, major stablecoins trends are emerging and revolve around the below pillars:

- regulation & compliance

- tech & infrastructure

- market demand dynamics

Stablecoin market overview

Market size and growth projections

McKinsey Insights suggests that the total value of issued stablecoins has doubled to $250 billion today from $120 billion 18 months ago. It is forecast to reach more than $400 billion by year-end and $2 trillion by 2028. At the current rate of growth, daily transaction volumes using stablecoins could reach at least $250 billion in the next three years.

In 2024, while the vast majority of volumes were related to crypto trading and decentralized finance (DeFi), an estimated 5-10% (an impressive $1.3 trillion), were genuine payments transactions in global remittances, corporate treasury, and retail in geographies including Turkey, Nigeria, and Dubai.

July was another month of milestones for the stablecoin sector. Total market capitalization surged 4.87% to $261 billion, marking 22 consecutive months of growth and setting another all-time high.

Leading players

The race for stablecoin dominance is just beginning. Stablecoins are the bridge between cryptocurrencies and traditional finance. Without them, crypto applications have to fight against volatility, and that makes financial contracts expensive.

Having introduced the first stablecoin for trading 10 years ago, Tether now dominates the market with $165 billion in USDT in circulation. Circle is Tether’s closest competitor with $65 billion in USDC.

Stakes are high – heavyweight tech and finance companies enter the stablecoin arena and intensify competition with established leaders Tether and Circle. Testament to that is PayPal’s recent push to issue its own stablecoin; JPMorgan’s JPM Coin; the Canton Network with participants including Citibank, Goldman Sachs, and UBS – or even Libra, Facebook’s ambitious digital currency project.

The stablecoin market is huge and rapidly growing – don’t get left behind. Explore how stablecoins and the future of money affect your business operations’ stability, speed, and efficiency.

Why businesses are adopting stablecoins

The foundations of global payments infrastructure were laid over 60 years ago. Until now, they’ve remained unchanged. Fast forward to today, stablecoins are becoming a key component of modern payment rails for payment providers, banks, and fintechs looking to move faster, reach new markets, and stay competitive.

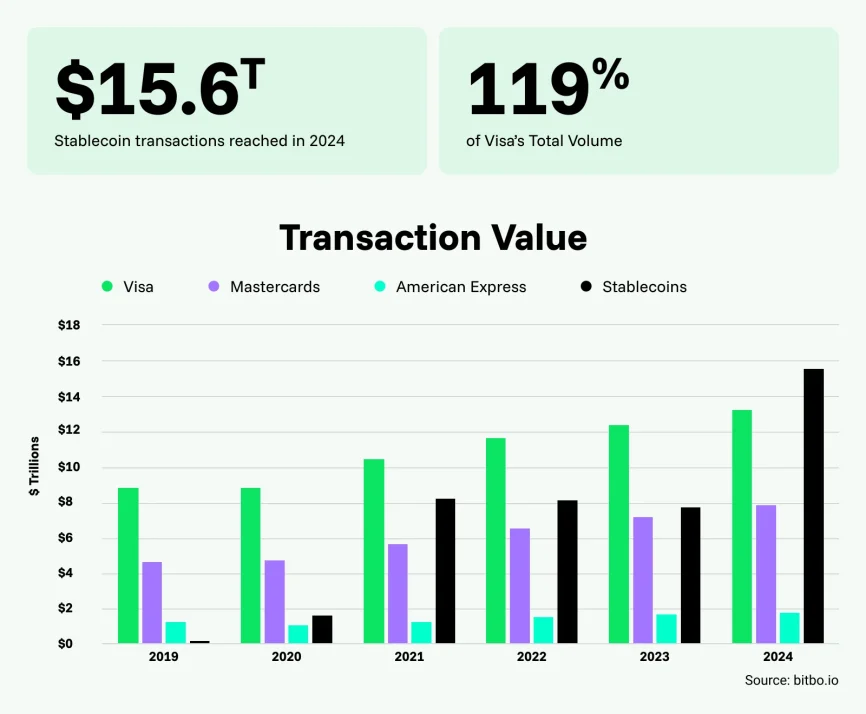

Stablecoins have the potential to rewire the global financial system. They could displace legacy payment and credit card networks such as SWIFT, Visa, and Mastercard, accelerate the unbundling of financial institutions, and expand access to dollars to countries where it is restricted.

How so? Stablecoins are an increasingly viable alternative to traditional banking and payment services, but faster, cheaper and more direct. Among their most immediate applications are remittances, B2B transactions, and internal treasury, where they achieve unmatched speed, cost-efficiency, and 24/7 uptime.

- Cross-border payments. Thanks to the institutional adoption of stablecoins, cross-border payments have become an almost real-time capability. Using a digital dollar or other collateralized stablecoins enables instant settlement across borders, with transaction costs reduced to a fraction of legacy systems. When paired with Layer 2 solutions for stablecoins and blockchain interoperability, these transfers can clear in seconds.

- Treasury operations. Treasury management with stablecoins is becoming a key part of corporate treasury crypto solutions. Businesses can park idle cash in low-volatility, high-liquidity instruments. In high-inflation markets, stablecoins offer a protective hedge and help maintain liquidity management. Many companies are experimenting with yield-bearing stablecoins and tokenized assets, while others are exploring real world asset tokenization (RWA). These instruments also find their place in sustainable finance crypto initiatives, with issuers experimenting with green blockchain initiatives to align with corporate ESG commitments.

- B2B settlements with stablecoins. Now, businesses can deploy programmable payment flows that automatically release funds. Collateralized stablecoins, supported by Layer 2 solutions for stablecoins, make it possible to settle these transactions simultaneously and with minimal reconciliation effort. The result is a faster, more transparent, and more adaptable settlement system that positions stablecoins as a core infrastructure for modern B2B commerce.

Efficiency, speed, and cost savings

Stablecoins cut settlement times to minutes or even seconds. Fees are much lower than SWIFT transfers. Automated payment systems reduce reconciliation work and shrink admin costs. Faster, cheaper, and simpler transactions for businesses means improved cash flow, more predictable treasury planning, and more market opportunities.

Access to liquidity and global currencies

Stablecoins provide businesses with 24/7 access to global currencies like USD, EUR, and SGD, bypassing traditional FX channels. They offer reliable liquidity and hedging against inflation and currency risks, especially in high-inflation countries. Cross-border remittances and trade become faster and easier, even in markets with limited dollar access.

CryptoProcessing makes crypto payments easy, fast, and worry-free for businesses of all sizes. With us, you can connect to the 650-million-strong crypto audience effortlessly.

- Transparent costs. No hidden fees. Just simple, cross-border payments with fees at 1.5% or less.

- High-speed transactions. Payments settle almost instantly on the blockchain, so your operations run smoothly.

- Free integration and support. Get started quickly with no setup costs and our expert team by your side every step of the way.

- No need to hold crypto. Enjoy automatic fiat conversion for hassle-free transactions.

- Multi-currency support. Manage 20+ digital currencies and 40+ fiat currencies, all in one convenient dashboard.

Regulation & compliance landscape

Regulatory and legislatory frameworks are now the dominant driver of adoption. They seek to ensure stable and secure operation of tokenized assets, covering reserves, disclosures, AML and KYC compliance, and proper licensing.

| Jurisdiction | Regulation / Act | Notable Details |

| European Union | Regulation on Markets in Crypto-Assets (MiCA) | Comprehensive EU-wide rules for issuance and supervision |

| United Kingdom | Financial Services and Markets Act | Integrates stablecoin regulation into existing financial services law |

| Hong Kong | Stablecoins Ordinance (Cap. 656) | Regulatory framework for licensing and oversight of stablecoin issuers |

| Japan | Payment Services Act (PSA) Amendments | Strict licensing and reserve requirements for stablecoin providers |

| Singapore | Stablecoin Issuance Service under the Payment Services Act (PS Act) | Comprehensive licensing regime to ensure stability and integrity of stablecoins within Singapore’s financial ecosystem |

| United States | (GENIUS) Act of 2025 | Passed Senate in June 2025; establishes national regulatory framework |

Security remains a top concern, especially the quality and transparency of reserves backing these digital assets. Smart contract vulnerabilities and risks from cross-chain bridge exploits pose operational threats. Robust security protocols and ongoing monitoring are needed. Due diligence is critical; businesses need to evaluate the frequency and thoroughness of issuer audits, the composition of reserves, and the overall governance framework to minimize exposure and ensure compliance with regulatory standards.

Businesses choose CryptoProcessing for crypto and stablecoin processing because we are a licensed crypto payment provider that fully complies with Know Your Business (KYB) and Anti-Money Laundering (AML) procedures. Security is a top priority, with advanced blockchain scoring, regular third-party security audits and an in-house compliance team to safeguard transactions.

Technological & infrastructure trends

- Blockchain interoperability is becoming key as businesses demand seamless movement of funds across different networks. Cross-chain stablecoins and transfer protocols help reduce liquidity silos, allowing assets to flow freely and be used where needed.

- Programmability leverages smart contracts to automate payments and financial operations. This enhances B2B settlements and treasury operations.

- ERP & treasury integration is advancing with API-driven connections that link corporate finance systems directly to blockchain networks. This enables real-time liquidity management and supports the adoption of real world asset tokenization (RWA), bringing more assets onto blockchain platforms for corporate use.

- Security technology is evolving with multi-signature wallets and institutional-grade custody solutions.

- Scalability improvements come from high-throughput blockchains and Layer 2 solutions such as rollups. These technologies lower transaction costs, increase speed, and support growing demand for cross-chain stablecoins.

- On/off ramps converting between fiat money and cryptocurrencies smoothly are essential but need to be reliable. Regulated fiat gateways ensure compliance and ease of use for businesses entering or exiting the crypto ecosystem.

This is the time for businesses to focus on infrastructure. Internal capability, from systems, pilots, to trained teams, will make the difference. The competitive advantage lies in external platforms that support liquidity, compliance, and seamless execution.

Future Outlook

What is the future of stablecoins? Major consultancies and banks argue tokenized, regulated stablecoins will materially reshape the payments stack. Incumbents are partnering to avoid disintermediation and we should expect more partnerships between card networks, banks and regulated stablecoin issuers. Other predictions include:

- Mainstream adoption across multiple industries (retail, logistics, SaaS, finance)

- Growth of region-specific stablecoins to facilitate local trade

- Merging of private stablecoins, CBDCs, and tokenized assets into one interoperable system

- Potential for stablecoins to influence global monetary flows and short-term debt markets

- Possible consolidation of issuers as regulation favors well-capitalized players

Market demand dynamics

Emerging market economies are increasingly turning to stablecoins as a practical way to access and hold USD, driven by a mix of economic instability and global trade realities.

Stablecoin innovation and adoption in financial hubs is driven by the likes of UAE and Singapore. In crypto-heavy markets such as Dubai, there is increased penetration of stablecoins as a payment method online and at point of sale, supported by Visa and Mastercard rails and on/off ramping. In Dubai alone, stablecoin transaction volumes reached about $19 billion in 2024, highlighting growing consumer use and merchant acceptance.

Racing to the top

Major payments enterprises realize that adopting stablecoins is a strategic necessity. To retain competitiveness against new crypto-savvy entrants and tap into new client bases and markets they must align with digital asset ecosystems. There is fast growth in R&D and innovation speed, as financial institutions and payment service providers rush to determine their stablecoin tactics:

- banks are issuing their own stablecoins

- stablecoin issuers like Circle launch payment networks

- major card operators like Visa and Mastercard are integrating stablecoin settlement

- e-commerce giants like Amazon and Walmart are exploring or issuing stablecoins

- PayPal expands its PYUSD stablecoin with a 3.7% yield offering and builds out its crypto trading functionality

- e-commerce platforms like Shopify and WooCommerce have developed plug-ins for seamless crypto payments

- financial technology leaders like Stripe are positioning themselves in infrastructure through strategic acquisitions

Conclusion

Stablecoins are shifting from being a simple crypto experiment to a regulated financial backbone shaping global economies. They are rewriting the rules of finance, offering speed, transparency and cost savings that legacy systems are unable to match. The disruptive impact on the traditional global financial system will be huge, impacting money transfer, payments and potentially even the core banking business model itself, bank accounts, deposits and loans.

Stablecoins’ role in wholesale and retail ecosystems is huge and can solve longstanding challenges. Despite their importance in the digital economy of the future, they are unlikely to supplant CBDCs and tokenized deposits, or replace central bank or commercial bank money.

Security, infrastructure, market forces, and institutional adoption are shaping the 2025 landscape.

“The future of money is less likely to be defined by one dominant form of currency, but by a network of instruments working together. Each will have its own role in a modern, programmable financial system and in that universe, stablecoins are poised to be the core that keeps it all moving.”

FAQ

Stablecoins are digital tokens pegged to the value of real-world assets, such as fiat currencies like the US dollar. Stablecoins and legacy cryptocurrencies like Bitcoin differ fundamentally with regards to value stability. Bitcoin’s value is highly volatile as it is driven by supply and demand, but stablecoins aim to maintain a price stability by pegging their value to less volatile assets such as fiat currencies, commodities, or other cryptocurrencies. This pegging can be direct, through reserves of the asset, or algorithmic, using financial mechanisms. To read more about this topic, see this article we published.

Yes, stablecoins can be a safe and efficient option for business transactions, especially when integrated with reputable crypto payment platforms like CryptoProcessing by CoinsPaid.

As of 2025, the most widely used stablecoins by businesses are those that offer stability, liquidity, and broad acceptance, with USDC being one of the most popular.

CoinsPaid supports 20+ leading cryptocurrencies, the most popular of which are Bitcoin, Ethereum, Litecoin, Solana, and USDC. All of these digital currencies are widely accepted and legal in most parts of the world. They offer low transaction fees, quick processing times, and are commonly used for payments, trading, and investment purposes.