Cryptocurrency has numerous benefits — speed, security, and low fees, to name a few. However, like any technology, cryptocurrency has its own challenges.

In this blogpost, we’ll explore the drawbacks you should consider before adopting cryptocurrency as a payment method.

1. Price volatility

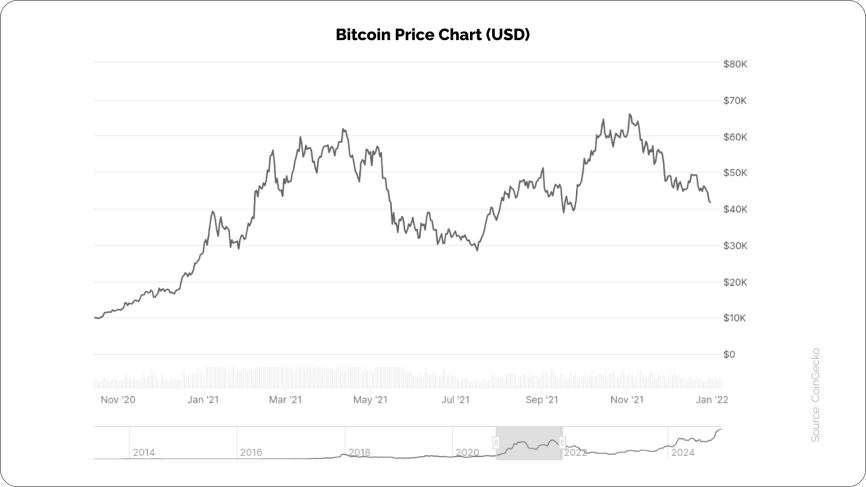

Cryptocurrencies are highly volatile. Their prices can fluctuate wildly within days, hours, and even minutes. For example, Bitcoin’s value has fluctuated by over 10% in a single day multiple times, including a 30% drop in May 2021 during a market sell-off.

This variability creates a layer of unpredictability that is often challenging for both businesses and consumers.

Impact on consumers and businesses

For consumers, price volatility means the value of a transaction can change between its initiation and confirmation. This makes it difficult for consumers to plan their spending or trust the consistency of prices.

For businesses, dealing with such volatility can involve even more significant risks.

- Revenue loss: A business accepting cryptocurrency risks losing value if the market drops sharply after a transaction is initiated.

- Inconsistent pricing: Pricing products or services in volatile cryptocurrencies requires constant adjustments to reflect market rates.

- Complicated accounting: Volatility requires frequent conversions to fiat currencies and constant monitoring of exchange rates. Businesses may need to introduce additional accounting systems to track crypto transactions and ensure compliance with tax regulations.

That said, there are effective ways to manage crypto volatility.

Volatility is the single biggest mental hurdle for most businesses considering crypto payments. But in reality, it’s not something they need to face alone. With the right partner, you can shield your revenue from market swings, settle in fiat instantly, and still offer crypto as a payment method to your customers.

First, many businesses are now transacting in stablecoins — cryptocurrencies pegged to fiat currencies like USD or EUR, which provide more stability and reduce risk.

Second, most crypto payment processors lock in the exchange rate at the moment a transaction is initiated, ensuring businesses don’t lose profits due to market fluctuations.

2. Regulatory uncertainty

Cryptocurrency’s evolving regulatory landscape poses risks. While some countries are embracing crypto, others have imposed strict bans that can limit transactions. This inconsistency makes it harder to navigate compliance and slows the adoption of cryptocurrencies on a global scale.

For instance, China implemented a strict cryptocurrency trading ban and later extended it to mining activities. Conversely, Japan has taken a progressive approach by recognising cryptocurrencies as a legitimate property under the Payment Services Act in 2017.

Europe’s regulatory stance has been more cohesive with the Markets in Crypto-Assets (MiCA) regulation. MiCA established a comprehensive framework for crypto-assets across all EU member states.

The U.S. regulatory environment, in turn, has been rather fragmented, with agencies such as the SEC and the CFTC overseeing different aspects of the crypto market. However, Donald Trump’s return to the White House and his appointment of Paul Atkins as the new SEC Chair could mark a shift in U.S. cryptocurrency regulations towards a more innovation-friendly environment.

3. Security risks

Cryptocurrency’s decentralised framework, while revolutionary, comes with inherent risks.

Notably, exchanges and wallets have been frequent targets of high-profile hacking incidents, which caused financial losses for users. For example, the infamous Mt. Gox hack resulted in the theft of up to 950,000 Bitcoins.

However, advancements in security standards and practices have significantly reduced risks for the average user. In fact, according to Chainalysis, on-chain illicit activity decreased by nearly 20% between January and August 2024. According to other sources, the number of crypto heists dropped by more than 40% since 2023, though the total volume of stolen crypto assets remains high.

4. Lack of consumer protection

Unlike traditional methods like credit cards or bank transfers, which allow transaction reversals in cases of errors or disputes, cryptocurrency transactions are final once confirmed.

The inability to reverse transactions can be a challenge for consumers. If you send a payment to the wrong wallet address, getting it back is almost impossible unless the recipient agrees to return it.

For businesses, on the other hand, the immutability of crypto offers a solution against chargeback fraud. According to Juniper Research, global merchant losses to online payment fraud are projected to exceed $343 billion between 2023 and 2027. Additionally, Mastercard estimates that merchants will face over $100 billion in chargebacks in 2024, with chargeback abuse accounting for 61% of these losses.

5. Limited acceptance

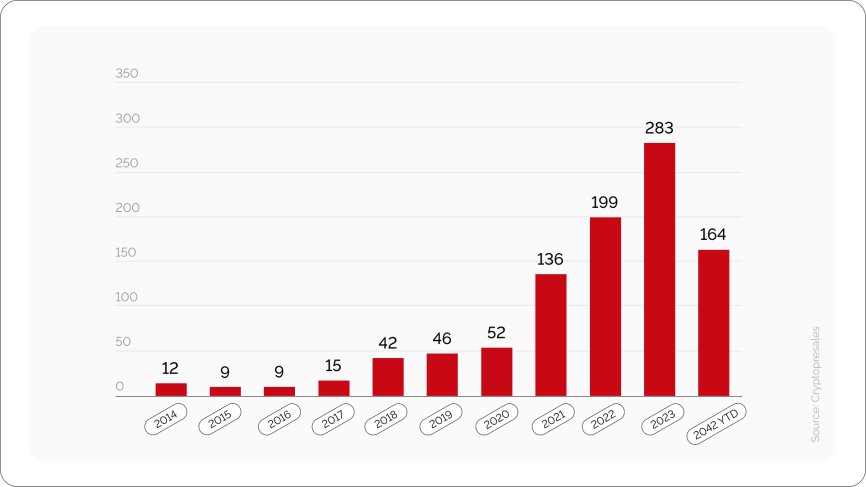

Despite its growing popularity, the adoption of cryptocurrency among merchants and service providers is still a work in progress. According to Crypto.com, around 15,000 businesses worldwide currently accept cryptocurrency payments. Many are still cautious, citing concerns about volatility, regulatory uncertainty, and technical challenges.

This hesitation limits the everyday utility of cryptocurrencies and slows their integration into traditional financial systems. So, terms like “mainstream” and “widespread” may still be a bit optimistic when describing the current state of cryptocurrency adoption.

6. Technical barriers

Cryptocurrencies often come with a learning curve that can deter widespread adoption, especially among those less familiar with technology.

Managing digital wallets, handling cryptographic keys, and understanding blockchain transactions require skills that can feel daunting to newcomers.

Usability challenges for new users

- Understanding the basics: The concepts of public and private keys, blockchain technology, and decentralised systems can be overwhelming for first-time users.

- Avoiding scams: New users are particularly vulnerable to phishing attacks and fraudulent schemes.

- Lack of centralized support: Unlike traditional financial systems, cryptocurrencies lack centralised customer support. Instead, users must often rely on forums, online guides, or community-driven assistance.

7. Transaction speed and scalability issues

Among skeptics, cryptocurrencies are often criticised for being slower than traditional payment methods. While this can be true during periods of peak network congestion — when transaction delays and higher fees are common — it’s not the full picture.

For domestic transactions, payment systems like Visa and MasterCard do execute transactions within seconds. However, they primarily handle payment authorization, not the actual settlement of funds, which can take days. International transfers through SWIFT typically require up to three business days to clear, depending on the banks and countries involved.

In contrast, cryptocurrencies transfer value directly and settle almost instantly on the blockchain. Even during network congestion, settlement typically occurs within minutes.

Comparison with traditional systems

| Parameter | Cryptocurrency | Traditional methods |

|---|---|---|

| Processing speed | Varies by blockchain:

|

Varies by method:

|

| Stability | Can be volatile due to market speculation and lack of centralised control. However, stablecoins pegged to fiat currencies help combat price swings. | Stable and predictable, backed by central banks. Currencies like USD and EUR maintain consistent value. |

| Reliability | Dependent on network uptime, susceptible to delays during high network activity, but solutions like layer-2 networks improve performance. | Reliable, with established infrastructure and consistent service. |

To sum it up

Cryptocurrencies do come with challenges like price volatility, regulatory uncertainty, and technical barriers. However, the benefits of cryptocurrencies are too significant to ignore — and there’s no need to.

Advancements like layer-2 solutions, stablecoins, and growing educational resources are making cryptocurrencies more reliable and accessible. The regulatory landscape is becoming clearer, too, making it easier to navigate.

And for businesses looking to embrace the benefits of cryptocurrencies without having to worry about the risks, partnering with a trustworthy crypto payment processor could be the perfect solution.

Trusted processors, like us, handle everything from managing volatility to ensuring security to navigating regulatory environments, so you can enjoy lower fees, protection from chargeback fraud, and faster international settlements.

experience

Unlock faster transactions with our highly secure crypto payment gateway